On My Radar - The Big Bad Bill

June 6, 2025

By Steve Blumenthal

“When the interest payments on debt rise faster than income and expenses remain unchecked, a country enters a classic debt spiral. These rarely end without pain.”

— Ray Dalio, Principles for Navigating Big Debt Crises

My intention this week was to share my reflections on what I learned at the SIC2025 Investment Conference. However, the Big Beautiful Bill has taken center stage. Candidly, it is not so beautiful. Let’s touch on it today and consider what this means in terms of future debt levels, interest rates, and inflation.

As I’m sure you are aware, there is venom in the air between President Trump and the world’s wealthiest person, Elon Musk. Musk argues that the spending cuts are not substantial enough. He tweeted on X, Kill the Bill. Trump responded to Musk in a manner that was, well, not-so-presidential.

The U.S. has a spending and debt problem. It must be fixed. Big Beautiful is a move in the right direction but is not nearly enough.

Treasury Secretary Scott Bessent’s plan, which he calls “3-3-3,” seeks to achieve a 3% GDP growth rate, reduce the budget deficit to 3% of GDP (currently around 7%), and increase U.S. energy production by 3 million barrels per day by the end of the President’s term. That’s an excellent objective. The spending and tax cuts require legislative approval, and that’s where the rubber meets the road. A road that legislators seem unwilling to travel down.

If the "One Big Beautiful Bill Act of 2025" is now in the Senate. If it does not pass, several tax provisions from the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire at the end of 2025, resulting in significant changes to the tax code. Higher taxes are likely to slow the economy, potentially impacting the 3% GDP goal. However, what I want to delve deeper into today is the spending aspect of Bessent’s 3-3-3 and the source of Musk’s remarks.

Let’s look at the math. U.S. GDP is approximately $28.3 trillion according to the U.S. Bureau of Economic Analysis (BEA). To decrease the budget deficit spending from 7% of GDP to 3% means we need to cut spending by $1.13 trillion (which is 4% of $28.3 trillion). That takes legislative courage. Courage that I don’t believe exists. Not yet, anyway.

Back of the napkin, so far, DOGE has found approximately $150 billion. The Big Beautiful Bill is estimated to achieve approximately $1.6 trillion in mandatory spending cuts over the 2025–2034 budget window, as claimed by House Republican leadership, the White House, and the Office of Management and Budget (OMB).

Let’s crunch the numbers.

$1.6 trillion over ten years is $160 billion per year.

We need to cut spending by $1.13 trillion per year to achieve a 3% deficit-to-GDP level.

$1.13 trillion minus $150 billion in annual DOGE savings, minus $160 billion in proposed spending cuts in the House-passed Big Bill, equals approximately $800 billion that needs to be cut annually.

How do we find $800 trillion in additional spending cuts?

We are not getting that in the proposed bill.

I understand why Trump wants to extend the tax legislation that is due to expire at the end of 2025. Higher taxes may help address the budget deficit problem, but they will also impact growth, making the 3% GDP goal harder to achieve. We do need growth.

The bill currently sits in the Senate. Will they find additional cuts? I’m not holding my breath.

Estimating the exact odds of the bill passing the Senate is challenging due to the dynamic nature of legislative negotiations. Here’s the breakdown:

Republicans hold a 53-seat majority in the Senate, meaning they can afford to lose up to three votes and still pass the bill with a tie-breaking vote from Vice President JD Vance, as the bill is being considered under the budget reconciliation process, which requires only a simple majority (51 votes) rather than the usual 60 to overcome a filibuster.

Posts on X suggest that at least three republican senators (Johnson, Paul, and Scott) are firm "no" votes, and others like Collins, Murkowski, and Hawley have indicated opposition, potentially leading to a 50-50 vote requiring Vance’s tiebreaker.

If Collins, Murkowski, or Hawley defects, the bill could fail without significant changes.

I don’t believe most Americans understand how the government spends and how it funds itself. I will explain that today. Sadly, what is clear is that there is little political will or courage to make the necessary spending cuts. I hope I’m wrong, I fear I’m right… It will likely take a crisis to put our financial house in order.

Bond Vigilanties

We caught our first whiff of bond vigilantes in the recent Treasury auction. When U.S. Treasury bondholders revolt en masse (sell), the crisis begins. If the U.S. continues to spend close to $2 trillion per year more than it is taking in, it must issue bonds to cover the expense. More debt, fewer bond buyers, higher interest rates, and high inflation. It is the train ride we are on. As Dalio said, “These rarely end without pain.”

Grab a coffee and find your favorite chair. We often assume everyone understands how the government funds itself. However, it’s worth taking the time to walk through the basics of how the government spends and who pays for it. Once you understand how the system works, it becomes easier to recognize its unsustainable nature.

On My Radar:

How the Government Spends—and Who Pays for It

Watch the 10-year and 30-year Treasury Yields, as Well as the Dollar

Trade Signals: Update - June 5, 2025

Personal Note: The Hard Hat Way: How George Boiardi Still Leads Cornell Lacrosse

See Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion purposes only.

If you like what you are reading, you can subscribe for free.

How the Government Spends—and Who Pays for It

To pay for everything—government salaries, defense contracts, interest on existing debt, and much more —the federal government needs cash. And, since it consistently spends more than it brings in through tax revenues, it makes up the shortfall by issuing Treasury bonds (IOUs).

Here’s how it works:

The U.S. Treasury holds regular bond auctions. Investors- including individuals, banks, large institutions, and foreign governments- purchase the bonds and wire money to the federal government. That money lands in the government’s account, and the government uses it to pay its bills.

But here’s the kicker: this process never stops. The Treasury must continuously issue new debt to fund ongoing spending and refinance maturing bonds. The more we spend, the more we have to borrow. The more we borrow, the more we owe in interest.

When demand for Treasuries is strong, things move smoothly. However, when demand weakens, as seen in the recent $16 billion bond auction, interest rates rise, and the Treasury was forced to step in and purchase $10 billion of the offering. That is a giant red flag that the bond vigilantes are beginning to revolt.

It was not a large auction; few buyers showed up. In simple terms, not enough people raised their hands to buy what the government was selling. When that happens, there’s only one way to attract buyers: raise interest rates. That creates a dangerous feedback loop.

As Ray Dalio and others have pointed out, this can morph into what is known as a debt death spiral. The U.S. has already passed the point where debt service (interest payments) is one of the largest line items in the federal budget. The more we spend and borrow, the higher our interest burden becomes. The higher that burden, the more debt we must issue to pay the interest payments on the debt.

It’s unsustainable.

The current trajectory is clear: deficits are rising, spending remains unchecked, and interest costs are rising. That "Big Bad Bill" winding its way through Congress? It increases the debt ceiling (the amount of debt the U.S. Treasury is allowed to issue) by $4 to $5 trillion.

At some point, the bond market will say, "enough!" That’s when the crisis begins.

From Ray Dalio:

The Government Debt Spiral, in Five Steps

The government spends more than it takes in.

➝ It issues bonds to cover the gap.Interest payments rise as debt grows.

➝ This increases the deficit even more.More bonds are issued to pay the rising interest.

➝ Demand for bonds weakens unless yields rise.The cost of borrowing climbs.

➝ Higher interest means even faster debt growth.Eventually, confidence erodes.

➝ Investors demand a risk premium (higher yields), or stop buying altogether.

Here is a look at where we are:

Scott Bessent’s 3-3-3 plan is an ambitious framework aiming for 3% real GDP growth, a 3% budget deficit (as a percentage of GDP), and an additional 3 million barrels of oil per day by 2028. It seeks to stabilize the national debt at around 100% of GDP through deregulation, tax cuts, spending reductions, and increased energy production. While the plan has garnered market optimism and aligns with Trump’s economic vision, it faces significant challenges: structural economic limits, policy contradictions (e.g., tax cuts vs. deficit reduction, tariffs vs. growth), and political hurdles in Congress.

Can we get “Net Interest Outlays” down from 7% of GDP (approximate current level) to 3%? There is nothing in the bill that gets us close. Disappointment is an understatement.

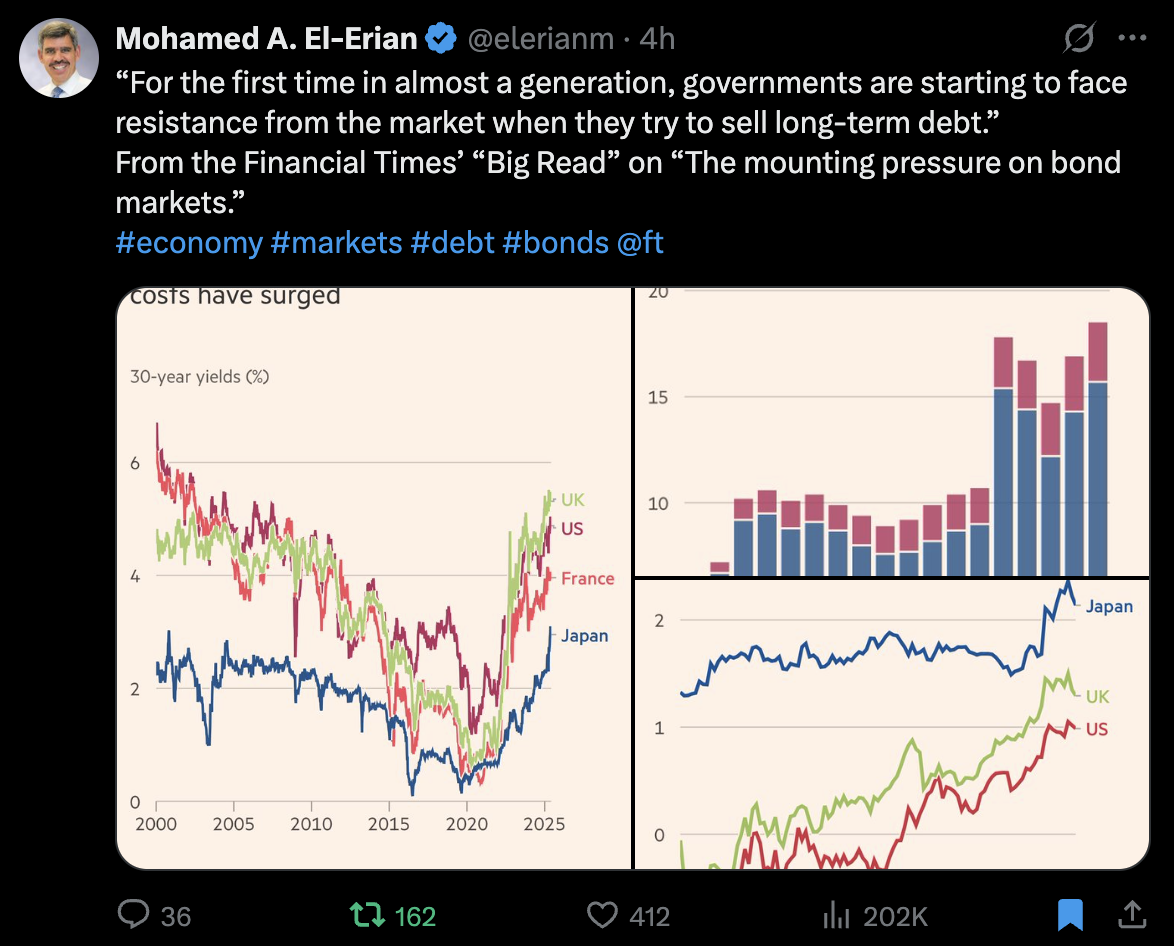

A Debt Death Spiral - We are in the early innings.

Source: @elerianm 6-6-25, X

The U.S. Treasury just bought back $10 billion of its own debt. According to @Barchart, it is the largest buyback in history.

The Debt Spiral, Explained

Once demand for Treasuries weakens, as witnessed in underwhelming auctions, yields must rise to attract buyers. This increases the government's borrowing costs, which then fuel even larger deficits, necessitating further borrowing. It’s a self-reinforcing loop:

Spending exceeds revenue, so the Treasury issues bonds.

Interest payments grow as debt accumulates.

Bond supply increases to pay off interest—demand must grow too.

Interest rates climb to entice investors.

Higher costs drive further deficits, as borrowing becomes more expensive.

Investor confidence falters, potentially triggering a crisis.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Views are those of Howard Marks and not necessarily Steve Blumenthal’s nor CMG’s.The information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Watch the 10-year and 30-year Treasury yields, As Well as the Dollar.

The key indicators to watch are the direction of yields in Treasury bonds and the direction of the dollar.

When rates rise, the dollar generally rises as foreign capital flows into U.S. bonds (and other U.S. assets). That is not what happened in the latest Treasury auction, as evidenced by the recent decline in the U.S. dollar price.

To understand the direction, I favor the Weekly MACD trend indicator. Directional arrows are in the bottom section, with the most recent signal on the bottom right-hand side.

The 10-year Treasury Yield

The red arrows are signaling rising interest rates. Green arrows indicate declining interest rates. The current signal is red.

Source: Stockcharts,com, CMG

They 30-year Treasury Yield

A break above 5% is a critical area to watch (indicated by the thin red line). Currently, the Weekly MACD trend indicator is signaling a potential shift to higher interest rates. The current signal is red.

Source: Stockcharts.com

The U.S. Dollar

Rising interest rates generally lead to a rising dollar. That trend temporarily broke around the recent Treasury bond auction.

A declining dollar is inflationary. Printing money devalues the currency. The U.S. continues to print money to finance its excess spending.

Source: StockCharts.com, CMG

Knowing where we stand in the long-term debt cycle and how the game has historically unfolded provides us with a roadmap of sorts. The current behavior is similar to that observed at the end of previous long-term debt accumulation cycles.

Conclusion

The Big Beautiful Bill is not so beautiful. I’m calling it the Big Bad Bill. Not in support of Musk. Just my opinion. We are not yet over the edge of the cliff, but we are on the path to it.

Probabilities favor rising interest rates, inflation, and a declining U.S. dollar. In a word, “Stagflation.” I continue to advise clients to expect a rollercoaster ride in equities, currencies, and fixed income.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Views are those of Howard Marks and not necessarily Steve Blumenthal’s nor CMG’s.The information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: Update - June 5, 2025

“Stay on top of the current market trends with Trade Signals.”

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.”

– Charlie Munger

Market Commentary:

No meaningful changes this week. Occasionally, I share the following chart with you. It compares the percentage of total household financial assets invested in the equity market to the subsequent 10-year total return on the S&P 500 (inverted). When households are heavily invested in equity, the subsequent 10-year returns are low or even negative, while the subsequent 10-year returns are high when household equity holdings are low. Note the high correlation between household equity allocation and the subsequent inverted 10-year return.

Bottom line: Projecting a minus 3% 10-year Total Return.

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets. It is free for CMG clients.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: The Hard Hat Way: How George Boiardi Still Leads Cornell Lacrosse

“Live as if you were to die tomorrow; learn as if you were to live forever.”

- Mahatma Gandhi.

My favorite coach, my wife, Susan, played soccer at Cornell and shared an excellent book written by Jon Gordon, called The Hard Hat, a true story.

One of her best friends, Lauren Gallagher, co-wrote a children’s version of the book titled The Hard Hat for Kids: A Story About 10 Ways to Be a Great Teammate (Jon Gordon).

Earlier this month, I watched Cornell’s lacrosse team beat my Penn State Nittany Lions in the semi-final match. Two days later, I watched Cornell win the National Championship. It was a thrill to watch. With great delight, I share the following with you from The Daily Coach. Please share it with your children.

From The Daily Coach,

“Standards, when held over time, become identity.

It wasn’t the final goal, the dogpile at midfield, or even the program’s first national title in 48 years that defined Cornell’s championship on Memorial Day. It was the way they got there.

It was the empty-net goal CJ Kirst scored with 50 seconds left, not to celebrate early, but to finish the job. It was the 21-rep lifts in the weight room. The quiet reflections at 1:21 p.m. during class or film sessions. It was the hard hat with George Boiardi’s number that traveled with the team all season.

At Cornell, winning is important, but legacy is sacred.

On March 17, 2004, George Boiardi—Cornell’s senior captain, No. 21, and the embodiment of selfless leadership—died after taking a shot to the chest during a game. He staggered to the sideline and collapsed. Since then, Boiardi’s memory has shaped the program’s DNA. And last Monday, when Cornell beat Maryland 13–10 in the national championship game, it was a culmination of a dominant 18–1 season, yes, but also proof that standards, when held over time, become identity.

Here are three lessons especially relevant to us as coaches, executives, and leaders.

Lesson 1: Great leaders don’t just raise the bar. They hold it, every day.

Boiardi wasn’t loud. He didn’t command the room. He led by showing up early, staying late, and doing the invisible work: the mop, the ride home, the last sprint. Cornell players today still read Jon Gordon’s The Hard Hat, a book about his life. They do 21 reps. They ask what George would do.

“He taught us not to complain,” one of his best friends, Ian Rosenberger, told The Athletic. “He just picked up the mop, and then five other guys would do it. Classic leadership by example.”

During one-mile team runs, he’d finish first, then circle back to run with the last man. He greeted his coach with the same 100-watt smile he gave to dining hall workers. He made it a point to sit with new teammates each week, uplift walk-ons, and check in on those having rough days. Many former players still wear a bracelet honoring him every day and run on the treadmill for exactly 21 minutes.

Another former player added: “George instilled in all of us that nothing is more important than our togetherness.”

Lesson 2: Culture doesn’t forget. It’s built on quiet moments repeated with care.

The most lasting team cultures aren’t forged through slogans or speeches. They’re built through small, consistent actions repeated with care.

Cornell coach Connor Buczek, a program alum, knows this firsthand. “This place changes you,” he said. “Not because it’s easy. It asks a lot. But you learn to appreciate every moment.”

David Coors, one of his teammates, used to rise at 5:30 a.m. before work to hit the beach, squeezing the most out of life. When asked to go out to eat with friends, he always says yes. “Life is so precious,” Coors told The Athletic. “It’s exhausting at times. But you’ve got to cherish these moments we have. There’s too many instances in the world where you never get that moment again.”

In great cultures, those values don’t fade. They’re passed down, moment by moment.

Lesson 3: Legacy isn’t something we speak about after someone’s gone. It’s the way we choose to carry them forward.

George’s locker remains untouched. His jersey hangs as a reminder: You don’t play for him. You play like him. And that’s what Kirst and the 2025 Big Red did on the field, in the locker room, and at dinner the night before the final, when Kirst reminded his team to link arms for the national anthem and “embrace the moment.”

The next day, they created one more.

In leadership, we often talk about culture. But culture isn’t built in huddles or highlight reels. It’s built in who stays to sweep the floor, in the effort we give when no one’s watching, and in whether we hold fast to what we say we value, even when it’s hard.

Last Monday, Cornell lifted a trophy. But what they’ve upheld for 21 years means far more.” Source: The Daily Coach

Have a wonderful week!

Kind regards,

Steve

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201, Malvern, PA 19355

Private Wealth Client Website

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.