On My Radar - What’s Messing with Copper?

August 1, 2025

By Steve Blumenthal

“The market tells you when to buy things. And when things are really cheap, on a Graham and Dodd valuation basis, you should like them more. And when they’re really expensive, you should like them less.”

— Seth Klarman, CEO, Baupost Group

When Seth was four years old, he redecorated his room to match a retail store, putting price tags on all of his belongings, and he gave an oral presentation to his fifth-grade class about the logistics of buying a stock.

As he grew older, he had a variety of small-time business ventures, including a paper route, a snow cone stand, a snow shoveling business, and selling stamp-coin collections on the weekends. When he was 10 years old, he purchased his first stock, one share of Johnson & Johnson (the stock split three-for-one and over time tripled his initial investment).

His reasoning behind buying a share of Johnson & Johnson was that he had used a lot of Band-Aids in his youth. At age 12, he was regularly calling his broker to get stock quotes. Source: Wikipedia

For some people, skill is just in them. Seth Klarman is a value investor - one of the greats. He closely follows the investment philosophy of Benjamin Graham and is known for buying unpopular assets while they are undervalued, seeking a margin of safety, and profiting from any price rise. Since his fund's $27 million inception in 1982, he has realized a 20% compounded return on investment. He now manages $30 billion in assets.

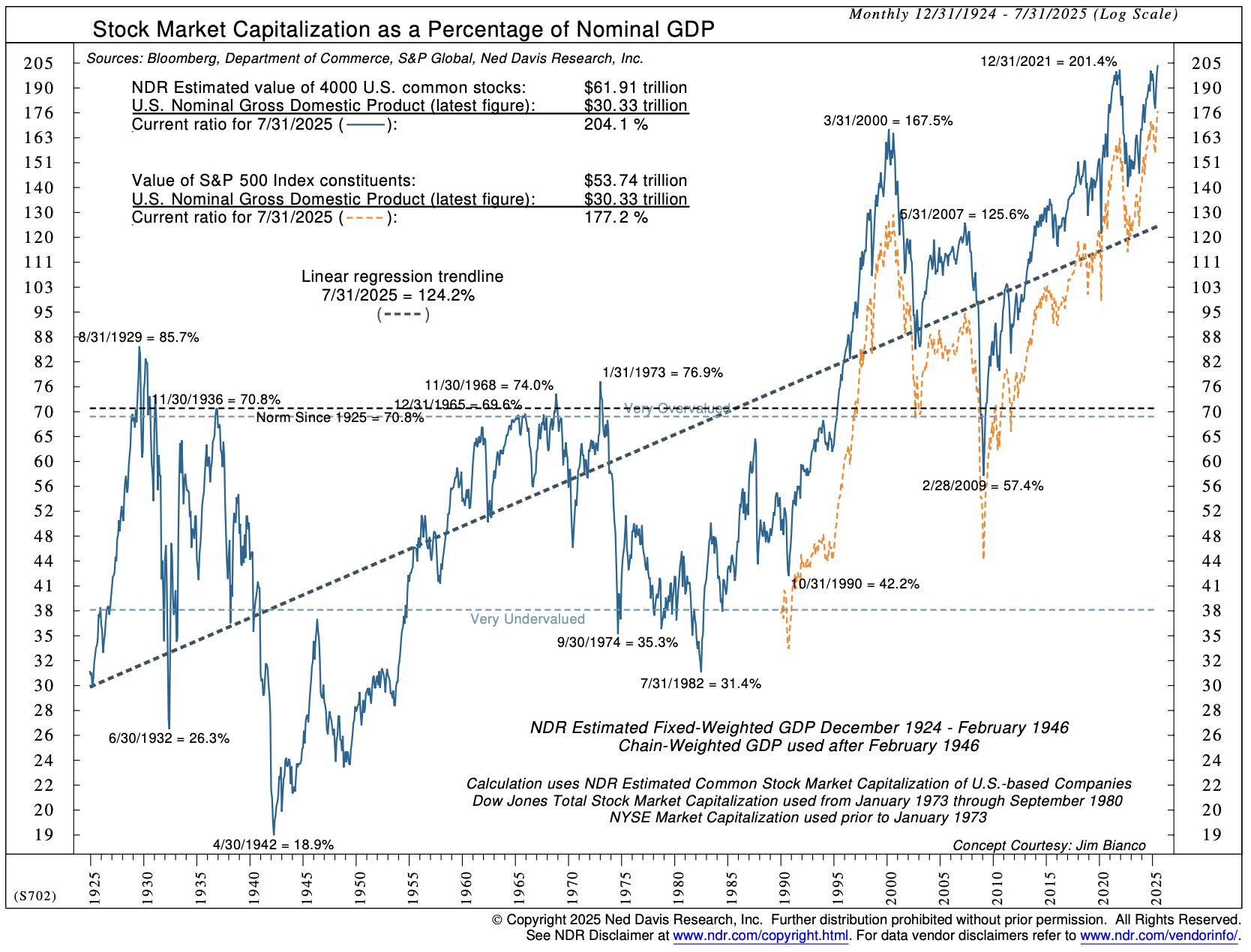

Each week, I look for a quote to tie into what I’m writing about. As I reviewed the July month-end valuations this morning, I noticed Warren Buffett’s favorite valuation indicator at a record high. I share it with you below. It should give us all pause.

It will for some, it won’t for most: no trips, no scratches, no falls. No Band-Aid. The overbought, overvalued, and overly optimistic conditions remain.

And, as you’ll see, overvalued is an understatement. We have breached the highest level dating back to 1924 - a record high.

The following chart, courtesy of Ned Davis Research, plots two ratios; the blue line is the Stock Market Capitalization of 4000 US common stocks compared to US Nominal Gross Domestic Product (nominal means before inflation is factored in).

The July 31 ratio is 204.1 (blue line - upper right-hand side in chart)

The prior record high was 201.4% on December 31, 2021

Recall the challenging 2022 year for the markets

Also, note the dotted upward-sloping trend line in the chart.

We are here: 204.1%. We’d be better off here: 125%.

The orange line plots the Value of the S&P 500 index relative to the US Nominal Gross Domestic Product.

Source: NDR

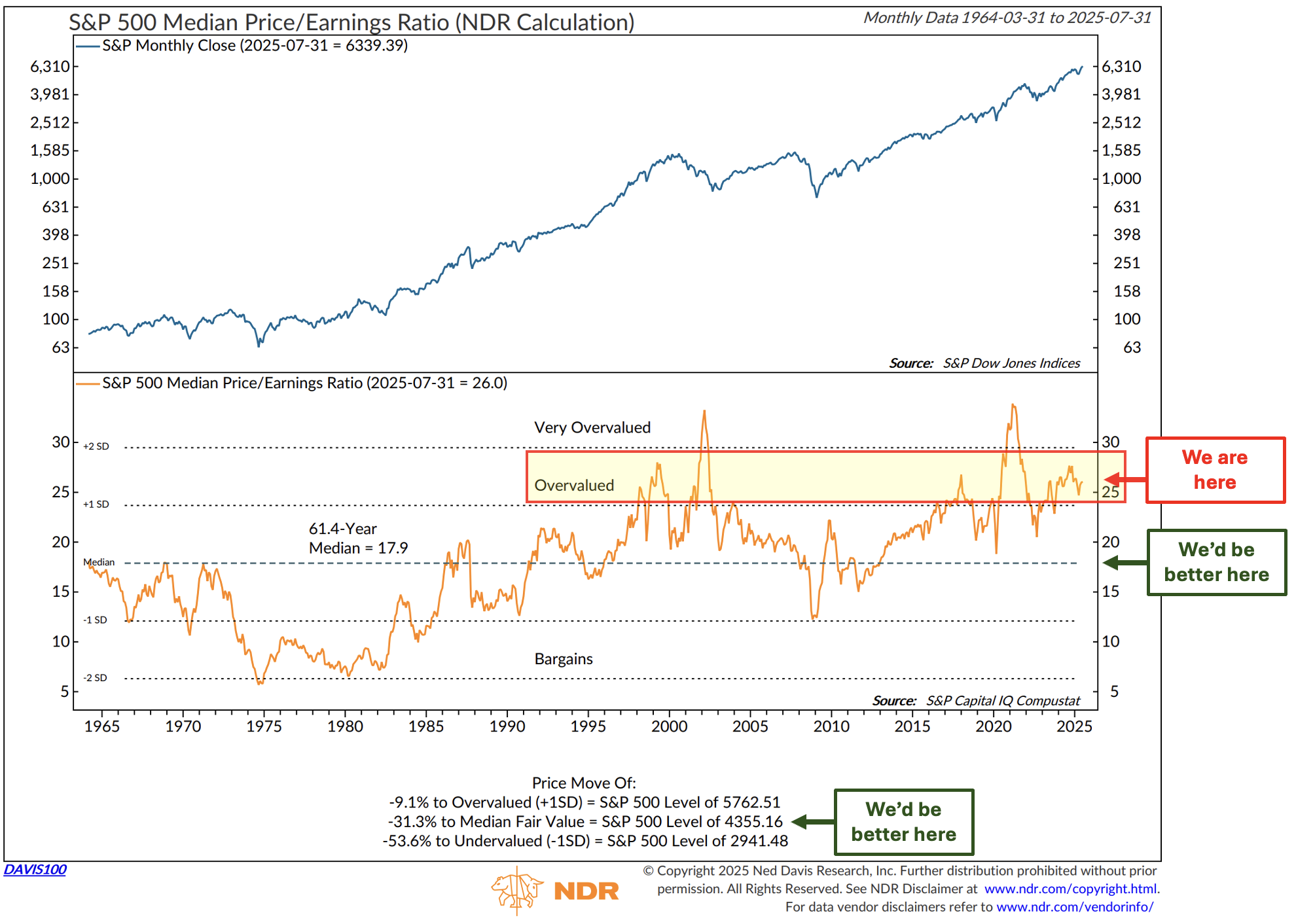

One of my favorite valuation metrics is Median PE. I’ve shared the chart with you frequently over the years. Median PE is the PE of the stock in the middle of the data set. As of yesterday’s close, the S&P 500 index's Median PE was at 26. The 61.4-year average is 17.9.

Seth says, “There is nothing esoteric about value investing. It is simply the process of determining the value underlying a security and then buying it at a considerable discount from that value. It is really that simple.”

Channeling our inner Seth Klarman, the better value entry point is around 4,355.16. The considerable discount from that value is somewhere between 3,000 and 4,000.

Source: NDR, with CMG comments

Not easy. Even for the pros, even for Klarman, even for Buffett. Required is great patience and an iron stomach to take action amidst the fear. I’m waiting for the next Band-Aid moment.

Hold the presses, this just in: After a weaker-than-expected jobs report, President Trump fired the commissioner of labor statistics. My good friend Barry Habib had a different take. He said, “Finally, a does of reality from the BLS.” Truth, finally truth. The Dow closed down over 500 points today on the weaker jobs report. Yields are dropping. Odds of a September rate cut have gone up.

I reached out to Barry asking if I could share his client update with you. Click here or on the photo for a fast, fun economic update (a big hat tip to Barry and team).

Grab a coffee and find your favorite chair. The balance of this week’s OMR reads fast. I touch on a few additional areas that I found interesting this week - the massive sell-off in copper, Jamie Dimon on CNBC, and I highlight Seth Klarman’s Top Ten.

On My Radar:

What’s Messing With Copper?

Jamie Dimon on CNBC

Seth Klarman’s Top Ten

Trade Signals: Update - July 31, 2025

Personal Note: Early August, Time to Relax

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

What’s Messing With Copper

Copper Cracks

A record one-day collapse in copper futures on July 30 reveals how fast a policy twist can unravel a crowded trade. What looked like a bullish setup for protectionism turned into a case study in market fragility. I break it down below.

First, the chart shows just how dramatic the move was (red price line, upper section, far right).

Source: Stockcharts

July 30, 2025: Copper Futures Plunge Over 20% as Tariff Pivot Sparks Arbitrage Unravel

The copper market’s historic meltdown underscores how a single, unexpected policy reversal can topple a fragile financial narrative. Traders, anticipating a 50% tariff across all copper imports, had flooded U.S. warehouses with refined copper, fueled by a soaring COMEX premium over LME (London Metal Exchange). But, when the Trump administration suddenly limited the tariff to semi‑finished products and exempted refined forms (cathodes, scrap, ore), that speculation evaporated overnight.

COMEX copper futures tanked by 19–22% in one trading session, marking the steepest intraday collapse since the contract’s 1988 inception (Source). Positions built on arbitrage and hedge flows unwound in a frenzy, and inventory became a liability, not an asset.

What unfolded wasn’t a natural correction, but the rapid deflation of a policy‑driven price distortion. Arbitrage traders and leveraged funds lost their risk edge when the expected tariff failed to materialize on refined metal. What had seemed like a boosting trade turned into a trap.

Beyond copper alone, this episode delivers a critical warning: inconsistent tariffs erode confidence in U.S. industrial policy. When carve‑outs emerge last‑minute, they inject chaos into modeling and supply‑chain planning, undermining price signals across metals. That volatility doesn’t just disrupt markets; it threatens long‑term credibility.

For the broader narrative: copper is foundational to electrification, EV production, data centers, power grids, and the energy transition writ large. Boom‑and‑bust pricing cycles triggered by unpredictable industrial policy risk are chilling investment in mining and refining capacity. The very strategy intended to bolster domestic production has instead destabilized the price base of one of its most vital inputs.

In short: what happened on July 30 wasn’t just a price crash, it was a systemic recalibration. A stark reminder that geopolitical opacity and financial leverage amplify each other, and that markets built on assumed policy paths can unravel in hours.

Is this a Band-Aid moment for Copper? Maybe. There is a bullish case to be made.

Copper is essential for electrification:

Electric vehicles use 2–4x more copper than gas cars.

EV charging infrastructure, renewable energy systems (solar, wind), and upgraded power grids all depend heavily on copper.

AI and data center expansion also increase power needs, boosting copper-intensive transmission lines.

The IEA projects copper demand will double by 2040 under global net-zero scenarios.

Constrained Supply and Long Lead Times

New copper mines take 7 to 10 or more years to permit, build, and bring online.

Grade quality is declining globally as mines are extracting less copper per ton of ore.

Major projects in Chile, Peru, and Africa face political and environmental hurdles.

Inventory levels on the LME and COMEX are near historic lows.

This combination of rising demand and tight supply has many analysts calling for a structural copper deficit in the coming years.

Inflation Hedge + Commodity Cycle Tailwinds

Copper, as a hard asset, may benefit from persistent inflation or currency devaluation.

I believe we are in the early stages of a new commodity supercycle, driven by underinvestment in supply capacity across energy and metals.

This may be a time to start building a position. NOTE - CMG and its clients may have exposure to copper.

Not a recommendation to buy or sell any security. See CMG Disclosures at the bottom of this page.

Jamie Dimon on CNBC

Recently on CNBC, Jamie Dimon expressed cautious optimism; he expects the Fed to begin rate cuts soon, given mixed growth data and moderating inflation, and reaffirmed the importance of Fed independence in maintaining lower interest rates.

Dimon flagged concerns around high asset prices, tight credit spreads, and persistent global deficit spending ($10 trillion over five years) as key contributors to market distortions. On trade, he noted that tariffs have moderated and now impact the U.S. economy by about $300 billion annually- a manageable figure in a $30 trillion economy.

Dimon also addressed AI, crypto, and private credit markets. He sees artificial intelligence as a transformative force, advancing faster than the internet or electricity, with broad potential for productivity and scientific breakthroughs, though not without risks to the job market. On digital assets, he remains skeptical of Bitcoin but supports stablecoins and blockchain innovation, especially as regulatory frameworks like the Genius Act aim to reinforce the dollar’s dominance.

JPMorgan continues to expand into digital finance and private credit, offering more choice while keeping an eye on emerging risks.

Click on the photo to watch the full interview. You may have to be a CNBC Pro subscriber.

See CMG Disclosures at the bottom of this page.

Seth Klarman’s Top Ten

Seth Andrew Klarman (born May 21, 1957) s an American billionaire investor, hedge fund manager, and author. He is a proponent of value investing. He is the chief executive and portfolio manager of the Baupost Group, a Boston-based private investment partnership he founded in 1982.

Top Ten

Patience Pays: Consistency and patience are crucial. Most investors are their own worst enemies. Endurance enables compounding.”

Cash Is A Position: “Holding cash in the absence of opportunity makes sense.”

Expect The Unexpected: “Unprecedented events occur with some regularity, so be prepared.”

Listen To The Market: “The market tells you when to buy things. And when things are really cheap, on a Graham and Dodd valuation basis, you should like them more. And when they’re really expensive, you should like them less.”

Choose Your Poison “Investors need to pick their poison: Either make more money when times are good and have a really ugly year every so often, or protect on the downside and don’t be at the party so long when things are good.”

Guard Against Catastrophe “We try to protect against tail risk: the risk of unlikely but possible events that could be catastrophic.”

Peace Of Mind “All investors need to learn how to be at peace with their decisions.”

Be Unemotional “Successful investors tend to be unemotional, allowing the greed and fear of others to play into their hands.”

Beware The Hype “The value of a company selling a trendy product, such as television shopping, depends on the profitability of the product, the product life cycle, competitive barriers, and the ability of the company to replicate its current success.”

Simple, Not Easy “There is nothing esoteric about value investing. It is simply the process of determining the value underlying a security and then buying it at a considerable discount from that value. It is really that simple.”

Source: @qcompounding

Trade Signals: Update - July 31, 2025

“Stay on top of the current market trends with Trade Signals.”

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.”

– Charlie Munger

Trade Signals basics:

The Market Commentary - general comments.

The Notable Changes in key indicators - investor sentiment, market breadth, stocks, treasury yields, the dollar, and gold.

The Dashboard of Indicators provides a detailed view of all Trade Signals indicators.

Market Commentary:

Updated 8-1-25. The Fed left interest rates unchanged, and Powell highlighted inflation. Interest rates moved higher during his post-Fed meeting presser, but have moved lower this week. The stock market opened down today, and the 10-year yield is trading at 4.24%. It was 4.44% two days ago. Here’s an updated look:

Source: StockCharts.com, CMG Capital Management Group, Inc.

Notable Changes This Week:

The Weekly MACD for the S&P 500 Index remains bullish. The Daily MACD turned bearish, indicating initial weakness.

The Weekly MACD for the 10-year Treasury Yield turned bullish, signaling lower interest rates.

The Weekly MACD for Gold remains bearish.

Key Macro Indicators - Investor Sentiment, Market Breadth, The S&P 500 Index (Stocks), The 10-year Treasury Yield (Bonds), and the Dollar:

The S&P 500 Index (Stock Market)

Investor Sentiment (looking for Extreme Optimism or Extreme Pessimism): The current reading is Extreme Optimism, which is short-term bearish for equities. Since we are in a secular bull market, we are looking for near-peak level scores (not yet there).

Market Breadth (looking for direction): The current reading is bullish.

S&P 500 Index Weekly MACD: The current reading is bullish

Investor sentiment is signaling Extreme Optimism, which is short-term bearish for equities. Market Breadth remains positive as measured by the CMG-NDR Long Flat Indicator.

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: Early August, Time to Relax

Susan and I are taking a little time off next week. I still plan to write On My Radar next Friday. Odd as it may sound, the process is something I find relaxing. It’s a welcome counterbalance to my addiction to all things macro. Next week’s post will be a game-day decision.

Summer soccer has wrapped up this week. Camps and league games are in the rearview. It’s hard to put into words how much energy and heart Susan pours into the high school program. But in the midst of the long days and hard work, there are those small, one-on-one moments... and then the big team breakthroughs. That’s where the joy lives. That is where the dividends are earned.

For new readers, my wife, Susan (Coach Sue), is the head coach of a boys’ high school soccer team. The boys grow. She grows. I do, too. One of my greatest joys is watching how much sports teach young people about life, and how much they teach us, too. Another joy for me is watching Coach Sue.

Two-a-days begin the third week of August, and the season follows shortly thereafter. I’ll be there on the sidelines with Coach, clipboard in hand, and eyes on the opposition. The team looks to be the best yet. Hopes are high. As I have in years past, I’ll keep you updated on the team’s progress. This is the year, this is the year, this is the year!

And to all my football rabid fans, a new season is almost upon us - best of luck to your favorite teams.

Let’s go Nittany Lions, Let’s go Birds!

With kind regards,

Steve

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201, Malvern, PA 19355

Private Wealth Client Website

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.