On My Radar: Bubble, Bubble, Avoid the Trouble

December 5, 2025

By Steve Blumenthal

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?.”

— Scott McNealy, the co-founder and CEO of Sun Microsystems (2002)

The quote comes from a 2002 Bloomberg interview, in which McNealy reflected on the irrational valuations during the dot-com bubble's peak in 2000, when Sun’s stock hit $64 per share, trading at 10 times revenue. He criticized the absurdity of such multiples, pointing out unrealistic assumptions like zero costs, expenses, taxes, and R&D while maintaining revenue growth.

I searched X for the history of Sun Microsystems' market cap (total value of the company).

The absolute peak market cap occurred in early September 2000 at ~$200–210 billion (briefly making Sun one of the most valuable companies in the world).

After the dot-com crash, it lost more than 90% of its value in less than 2 years.

Oracle acquired Sun Microsystems for $7.4 billion in total enterprise value. Sources: Reuters, Wikipedia, Link: Technology Business Valuations, and Link: Sun Microsystems Stock Price History.

Valuations matter!

Quantitative Tightening just ended, and the next chapter is likely to be a slow turn toward easing. I don’t think it will come in one big wave. More likely, it will arrive in fits and starts; periods of monetary and fiscal support, punctuated by stronger responses when crises hit.

The 40-year tailwind of falling interest rates is behind us. With government debt and deficit levels where they are, and with money creation a recurring tool, I believe rates on the long-end of the interest rate curve will trend higher over time, along with several waves of inflation (similar to the 1970s). I wrote in Trade Signals (below) this week that some form of interest rate control on the short end of the curve (Treasury Bills) is likely. The Fed can control short-term rates; the market controls long-term rates.

In the near term, several variables can meaningfully influence the economy and the markets. The Supreme Court’s pending decision on emergency-power tariffs, the Fed’s choices on rates and its balance sheet (QE), and similar policy moves in Europe, China, Japan, and elsewhere should all sit on our radars.

Big picture: liquidity indicators may look reasonably supportive over the next year. But liquidity alone doesn’t overcome valuation. And on that front, many assets, particularly in the U.S., are expensive.

Valuations shape forward returns, and they define the balance between risk and reward.

In this environment, it’s hard for broad indices like the S&P 500 or for 4.05% yielding 10-year Treasury bonds to deliver attractive returns, especially after adjusting for inflation (your real purchasing power).

Selecting the right investment assets is critical. It’s the difference between a “lost decade,” of returns like 2000–2010 in the U.S. or Japan since 1990, and a decade of attractive returns. I continue to believe that all roads lead to inflation. There is value out there. The key will be proper positioning.

Grab that coffee and find your favorite chair. You’ll find a fascinating historical valuation chart that may hit you as hard as it hit me. More on valuations from two legends, along with an explanation of today’s intro quote. I share a podcast discussion on AI (I’m a big David Friedberg fan), and we’ll conclude this week’s OMR with an incredible story about teachers. It’s a one-coffee read. Let’s go!

On My Radar: Bubble, Bubble, Avoid The Trouble

Valuations - Record High

Doug Kass and Howard Marks

David Friedberg on AI, The Future of Biology, Business, and Creativity

Trade Signals: December 4, 2025 Update

Personal Note: San Diego, LA, West Palm Beach, and Teachers

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

Valuations - Record High

I am not going to share the complete set of valuation charts I share with you quarterly; let’s save that for early January when we have the year-end marks.

Instead, let’s look at just one I came across. I’ll walk you through it.

S&P 500 Index - Trend Channel

Here’s how to read the chart:

The channel is obvious. The blue line plots the S&P 500 Index (from 1928 to November 28, 2025, the last trading day of the month)

Technicians look for prices to move within their trend channels—overbought near the upper line and oversold near the lower. As the chart shows, valuation extremes tend to occur when the S&P 500 approaches either boundary.

As indicated in the chart, valuation extremes have been evident when the S&P 500 has approached the top or bottom of the channel line.

Now, this is where valuations come into play:

The data box in the lower right-hand side shows specific dates that correspond with the dates with arrows in the channel line section. The data shows the three valuation metrics: P/B (price-to-book ratio), P/D (price-to-dividend ratio), and P/E (price-to-earnings ratio). NDR also includes the T-Bill and T-Bond yields.

Take a look and compare the valuation numbers in the lower right-hand corner data box to the current numbers, which are as of November 28, 2025:

P/B = 5.3

P/D = 87.3

P/E = 26.9

Finally, the data box in the upper left shows the historical Average High, Average Low, and, interestingly, the Average Lows (Disinflationary) cycles and Average Lows (Inflationary) cycles.

Bottom line: we are at the top of the channel and have the highest P/B, P/D, and P/E ratios of any of the identified market peaks (upper channel dates with arrows).

Not one of the three valuation numbers is higher.

And yes, the S&P 500 may continue higher, but this is a game of risk and reward, and, as you’ll see in the Howard Marks short video below, returns for passive cap-weighted index funds over the next 10 years are unlikely to be good.

Source: Ned Davis Research

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. See important CMG and NDR disclosures below.

Doug Kass and Howard Marks

Doug Kass, Seabreeze Capital

The motivation for today’s intro quote came from Doug Kass’s: Bubble, Bubble Toil and Trouble? Click the photo.

Howard Marks, Oakmark Capital

“When you buy the S&P 500 at a 23x P/E, your 10-yr annualized return has always fallen between +2% and –2%, IN EVERY CASE, EVERY CASE.” - Marks

Worth the watch (1 minute, 23 seconds)

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

David Friedberg on AI, The Future of Biology, Business, and Creativity

Put your headphones on and head out for a walk or hit play on your next car ride. I had my earbuds in last weekend while putting away the porch furniture (always a bit of a downer of a day). It was made much more enjoyable to listen to this excellent, visionary discussion on AI and biotech, AI and business, and AI and creativity.

In this episode, Jason chats with David Friedberg—CEO of Ohalo Genetics and co-host of the All-In Podcast—about how AI is transforming agriculture and startups. David introduces Ohalo’s "Boosted Breeding" technology, which enables plants to inherit 100% of genes from both parents, potentially doubling crop yields. They also discuss building AI-first companies, genome language models, and the future of creativity in an AI-driven world. Click on the photo below to watch, or you can jump to various points in the show:

Timestamps:

(0:00) David Friedberg joins Jason to discuss AI Basics.

(1:44) How AI leveled up hiring and operations at startups

(5:46) AI and economic opportunities, complex problem-solving, and leadership's role

(11:48) How to build an AI-first company culture

(16:48) AI's transformative impact on biology and DNA sequencing

(21:36) The “GLM” - GPT for DNA Is already in production

(23:17) Biology meets AI: designing perfect plants with CRISPR and genome models

(32:08) Is the “Age of Abundance” around the corner?

(35:56) Democratization of creativity through AI: personalized Star Wars musicals & the future of media

If you like what you are reading, click on the following link.

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: December 4, 2025 Update

Trade Signals is Organized in the Following Sections:

*Trade Signals basics: The Market Commentary section summarizes notable changes in the core key indicators: Investor sentiment, market breadth, stocks, treasury yields, the dollar, and gold. The Dashboard of Indicators provides a detailed view of all Trade Signals indicators.

Market Commentary

Natural gas made a notable move—touching $5 today. Data centers? Perhaps. My firm and I continue to hold a fundamentally bullish view on oil and natural gas. Of course, this is not a recommendation to buy or sell any security.

Zweig Bond Model

The model has moved back to +1, signaling declining interest rates—a bullish backdrop for bonds.

Two Fridays ago, NY Fed President John Williams shifted the tone of the markets. His comments suggested the Fed will cut the Fed Funds rate by 25 bps at the December 9 meeting. Stocks rose, the 10-year yield fell, and the market quickly priced in that expectation.

On the personnel front, based on recent reporting and prediction market odds, Kevin Hassett remains the clear frontrunner for the top economic post. Hassett, currently Director of the National Economic Council and a long-time Trump economic advisor, has consistently advocated for tax cuts, tariffs, and lower rates.

Let me say this plainly: “interest rate control” is likely in our future. Look at the Interest on Debt (Net) number in the chart above—now approaching 20% of total U.S. tax revenues. The math is becoming impossible to ignore.

Federal spending is running near $7 trillion, with roughly $5.2 trillion in revenue, and total debt has reached $38.4 trillion—up nearly $1.5 trillion since the passage of the OBBB just months ago.

To meet ongoing cash needs, Treasury continues to lean heavily on short-term financing. Bill issuance has surged relative to notes and bonds—especially after the July 2025 budget reconciliation that added $5 trillion to the debt ceiling. Recent auction data shows that about 79% of new marketable debt issued in the week ending November 14, 2025, came in the form of T-bills.

Can you see the problem? We’re moving toward a system that relies on more money creation—financed by the Fed and funneled through short-term Treasury bills. The Fed controls the short end of the curve, and that’s the trap: the government must keep short-term financing rates low to sustain the current path. That’s why interest-rate control is coming.

Money creation is the force that ultimately drives inflation, and right now I don’t see anything that would meaningfully change the trajectory we’re on.

Bottom line: the Fed can anchor short-term rates, but it can’t control the long end. That’s a setup in which higher inflation, lower short-term rates, and higher long-term yields are the probable outcomes.

This is where I see the probabilities today. Could we find some form of fiscal religion? Yes. I sure hope so.

Below is an updated look at the Zweig Bond Model, which has now shifted from bear to bull—signaling declining intermediate- and long-term interest rates. As the next major round of fiscal stimulus takes effect, tracking interest-rate trends will be essential.

Not a recommendation to buy or sell any security. Used for risk management purposes. Consult your advisor.

You’ll find a detailed description of how it works in Trade Signals.

Key Macro Indicators - Investor Sentiment, Market Breadth, The S&P 500 Index (Stocks), The 10-year Treasury Yield (Bonds), and the Dollar

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

“Extreme patience combined with extreme decisiveness. You may call that our investment process.

Yes, it’s that simple.”

– Charlie Munger

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: San Diego, LA, West Palm Beach and Teachers

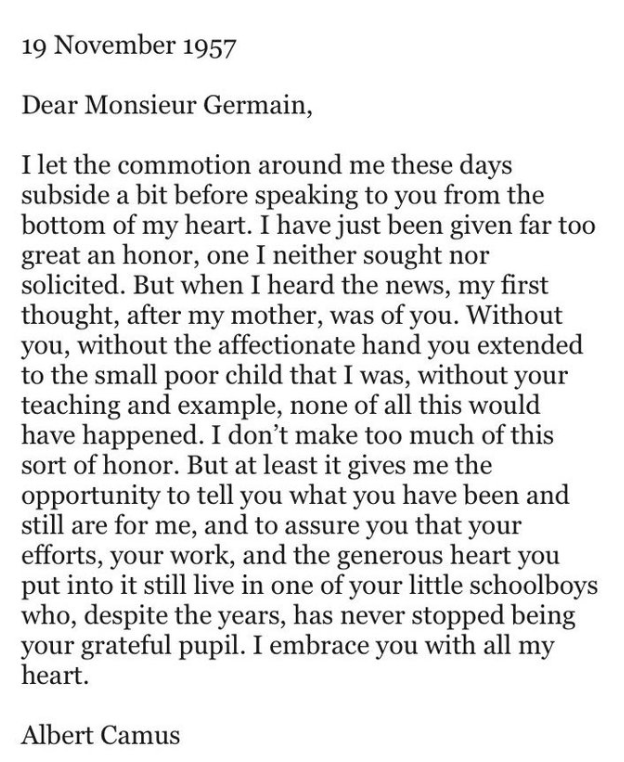

“After he won the Nobel Prize in Literature in 1957, Albert Camus wrote a letter of thanks to his favorite childhood teacher, whom he'd never forgotten. It's beautiful.”

Joseph Fasano, @Joseph_Fasano_

The greatest abundance is the kind that fills the heart. The pocket matters too, of course; everyone needs a little cushion, but real wealth is found in the people who shape us. Teachers carry an enormous responsibility and are often vastly underpaid for it. They give, and give, and give. I imagine there are days they wonder if the work is worth it.

A note of gratitude, like the one Camus sent to Monsieur Germain, can change everything. Great teachers are extraordinary. We need them. And they need to hear it.

Here’s Camus’s letter:

Source: Joseph Fasano (Hat tip to Doug Kass via X)

San Diego, LA, and Florida

I’m flying to California for business meetings and, yes, some golf. I’ll be with my favorite bio-ag scientist on Saturday, and golf on Sunday with good friends Mike, Adin, and Kyle. Then we drive up to LA. Work on Monday before heading to SoFi Stadium for the Eagles-Chargers game on Monday night. Then a red eye home. I hate red eyes but love golf, good friends, and my struggling Eagles!

West Palm Beach - December 15

I am presenting at a YPO event on Monday, December 15, and then hosting a dinner for clients and readers in West Palm Beach, FL, that same evening.

We’ll discuss wealth-mitigation strategies, the state of the real estate market, and broader macro trends.

Please reach out to Amy at Amy@cmgwealth.com if you are interested in attending. Space is very limited.

Call your favorite teacher and say thank you. And if they’ve passed, send them some love from your heart. The richest among us… It's not all about money. Though they should be paid far more!

Have a great week.

Warm regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201,

Malvern, PA 19355

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.

See CMG Disclosures at the bottom of this page.

For more information about NDR, please visit at www.ndr.com.

NDR, Inc. (NDR), d.b.a. Ned Davis Research Group (NDRG), any NDRG affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDRG publication. The data and analysis contained herein are provided "as is." NDRG disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. NDRG's past recommendations and model results are not a guarantee of future results. This communication reflects our analysts' opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDRG or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. For NDRG's important additional disclaimers, refer to www.ndr.com/invest/public/copyright.html. Further distribution prohibited without prior permission. Copyright 2025 © NDR, Inc. All rights reserved.