On My Radar: The Canary in the Coal Mine is Japan

February 13, 2026

By Steve Blumenthal

“All the ingredients are in place for some kind of a blowoff.”

- Paul Tudor Jones

The macro investment game is about assessing degrees of risk and potential opportunity. Are the ingredients in place for a blowoff? It sure feels that way.

Grab that coffee, sit, and relax. It’s reading time, and I have a few interesting things to share with you today: the Fed, the yen, the 10-year yield, and a few ideas on inflation-regime asset classes. We finish with a story about a young Muhammad Ali and the gift of a red bike.

On My Radar:

The Yen, the 10-Year Treasury, and Several Other Interesting Charts

Personal Note: Muhammad Ali and his Red Bike

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

The Fed is Quietly Adding $20–$40 Billion Per Month

One of the important (and little discussed) developments right now is the quiet shift underway at the Federal Reserve. What’s happening? After years of attempting to shrink its balance sheet, it’s expanding again to keep the financial system from seizing up.

This isn’t a crisis response. It’s something more subtle. And likely more permanent.

There are no flashing red lights. Instead, the Fed is quietly adding roughly $20–$40 billion per month just to keep short-term rates from spiking and the banking system functioning.

Think of it like topping off the oil in a leaky engine. Not dramatic, but absolutely necessary to keep things running.

The Fed insists this isn’t stimulus. They call it reserve management: plumbing, not policy. I disagree. Whether you label it Quantitative Easing or balance-sheet maintenance, the result is the same: more new dollars created going into the system. Inflation remains the significant risk.

Temporary Fed behavior? I think not, it’s a pivot back to QE.

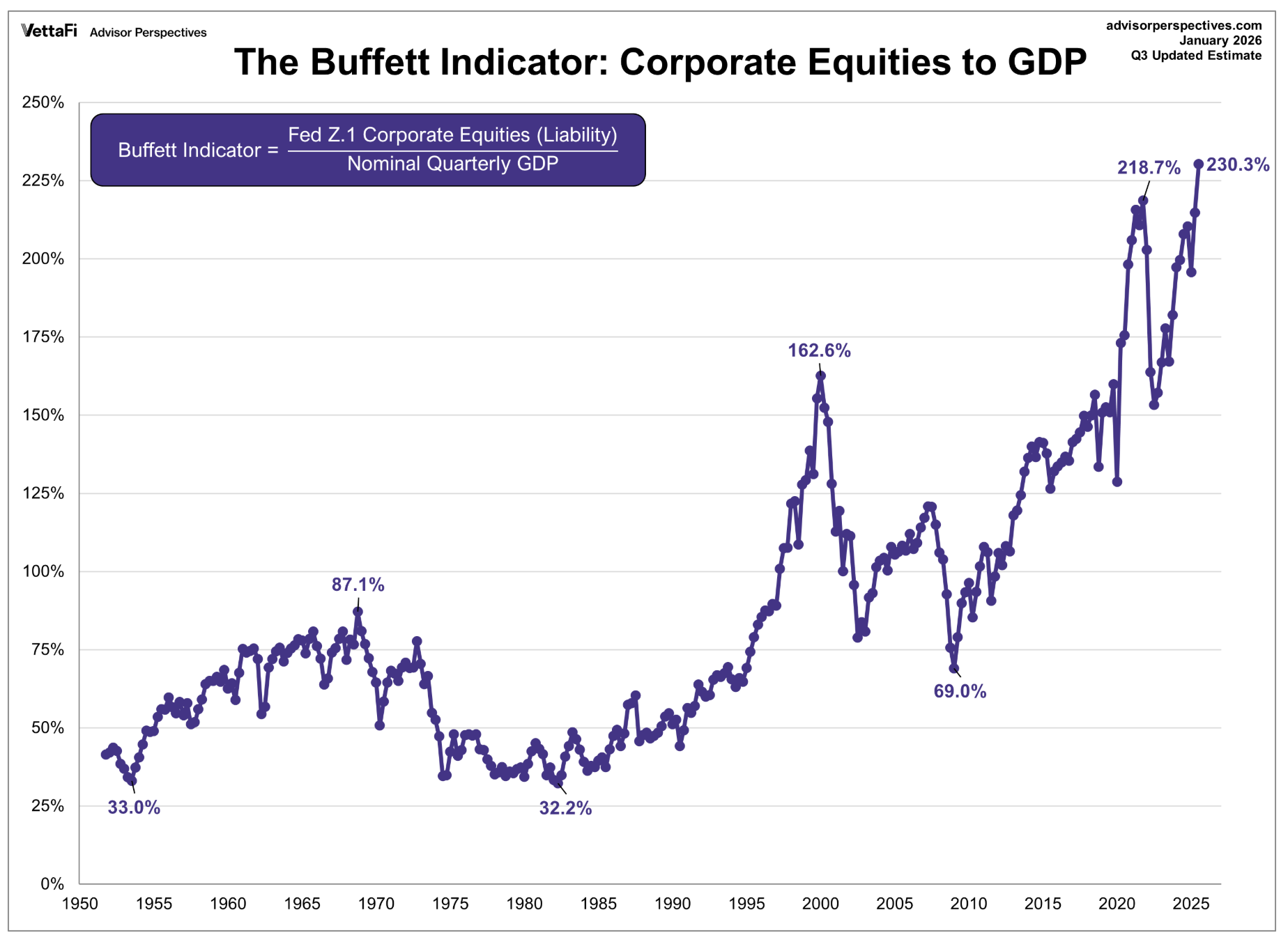

The Buffett Indicator and Paul Tudor Jones

The Buffett Indicator, total U.S. stock market value relative to GDP, now sits at 230.3% as of January 31, 2026. In plain English, the market is valued at more than twice the size of the U.S. economy.

To frame this, take a close look at the following chart (courtesy of AdvisorPerspectives). Compare vs. the 1960 secular bull market peak, the 2000 secular bull market peak, and the prior all-time high in 2021:

Source: AdvisorPerspectives

The ratio compares the value of all publicly traded U.S. stocks to annual economic output and is widely used as a broad valuation gauge. Historically, such extremes have coincided with periods of subdued long-term returns and heightened vulnerability to shocks.

Due to the aging population and the high concentration of wealth invested in US equities, the Fed, the Treasury, and current and future administrations can’t afford a major stock market dislocation. Instead of economic health driving asset prices, asset prices now drive economic behavior.

If markets fall:

Wealthy households pull back spending

Businesses slow hiring

Tax receipts fall

Deficits widen

And with deficits widening, the government borrows more, forcing the Fed to print more. The tail is now wagging the dog.

The uncomfortable truth is that turning off the printing press may not be possible without triggering a financial accident. The engine is old, clunky, and mired in too much debt. And what might that look like if the motor engine needs more than just topping off?

All of which leads me to share an excellent 4-minute CNBC discussion between Andrew Ross Sorkin and his guest, Paul Tudor Jones.

The Canary in the Coal Mine is Japan

Japan is living in the future that the rest of the developed world is approaching.

With debt levels that make interest-rate normalization impossible, Japan has two choices:

Let rates rise and blow up debt servicing

Print more yen and debase the currency

They’re choosing the second. The problem is that a declining yen means higher inflation for its citizens. This is because they import oil to fuel nearly 100% of their energy needs, and oil is priced in dollars. A lower yen-to-dollar exchange rate means oil costs more. The higher costs roll into higher manufacturing, transportation, and food costs, etc.

Japan can’t afford to let the yen decline, but printing more yen debases its currency (and causes it to decline). They want and need a higher yen to fight inflation. In short, they are in a major trap.

To defend the yen, Japan has been selling U.S. dollars and U.S. Treasuries to buy yen and Japanese bonds. That works temporarily but may have significant side effects.

For one, there is a large leveraged trade in play that risks unwinding. U.S. investors borrowed yen at near-0% interest rates, then used that money to buy dollars, which they used to buy higher-yielding U.S. assets.

Another is inflation. Printing money is what causes inflation. This is the long-term trap in which Japan, the U.S., and other developed countries find themselves.

There is debate over how large the “yen carry trade” is. I asked Grok AI to do some research, and this is what I found.

“As of early February 2026 (around the current date), recent estimates and discussions vary, but there's no single definitive "official" figure. Many sources note it's difficult to quantify exactly, with amounts described as "substantial" after proliferation in recent years, yet far smaller than some exaggerated claims of trillions.

Key recent estimates include:

One analysis from early January 2026 pegged the yen carry trade at around $261 billion, arguing fears are overblown, with gradual unwinding underway and no recent growth.

Other discussions reference roughly $500 billion tied up (or potentially at risk of unwind), sometimes in the context of broader Japanese overseas investments that could repatriate if the yen strengthens significantly.

Historical peaks were estimated higher (e.g., $1–1.5 trillion in 2021–2022 or even $1.5–2 trillion in 2024), but much of it unwound after BOJ rate hikes starting in 2024, reducing the outstanding size.

Broader warnings (e.g., from BCA Research in February 2026) call it a "ticking time bomb" due to vulnerability if the yen appreciates further or risk assets drop, but they explicitly say a precise size is hard to estimate.”

No country is an island in a high-debt world.

I remember writing in 2007-08 about what later became known as the Great Financial Crisis. My investment hero, Mark Finn, laid out what was going on with subprime mortgages. We thought the problem was a $400 billion problem. In the end, it turned out to be many times that number.

Subprime was the spark that lit the global financial fire. I think our guess around the size of the "subprime problem" itself was pretty good (a calculation based on the size of the then-outstanding subprime loans), but its defaults and related securities losses (hundreds of billions directly) triggered far larger systemic damage in the trillions.

It was not the largest single asset class, but its concentration in risky, leveraged positions made it explosive when the housing bubble burst. Then to now - this is why a potential unwinding of the yen carry trade has my warning lights turned on. It’s leverage that tends to always blow things up. Sources: Wikipedia, FDIC.gov

Precious metals appear to be reprising. I remain bullish on gold as I don’t see money printing going away. I think we are in the fourth inning of a 9-inning ball game. I believe gold will be part of the solution to reset the monetary system. Not the bargain gold was ten years ago or even a year ago, but an attractive asset class given the macro backdrop.

We now know a leadership change is coming at the Fed. President Trump has nominated Kevin Warsh to lead the Fed starting May 2026. Warsh favors a smaller Fed and tighter policy. His challenge is that he inherits a system constrained by mandatory spending, structural deficits, and an interest expense on the debt that is approaching $1.2 trillion annually.

The uncomfortable truth is that turning off the printing press may not be possible without triggering a financial accident.

Why This Matters is that the Fed has quietly become the buyer of last resort for U.S. debt. This doesn’t mean hyperinflation, but it does mean ongoing, systematic decline in purchasing power. Inflation.

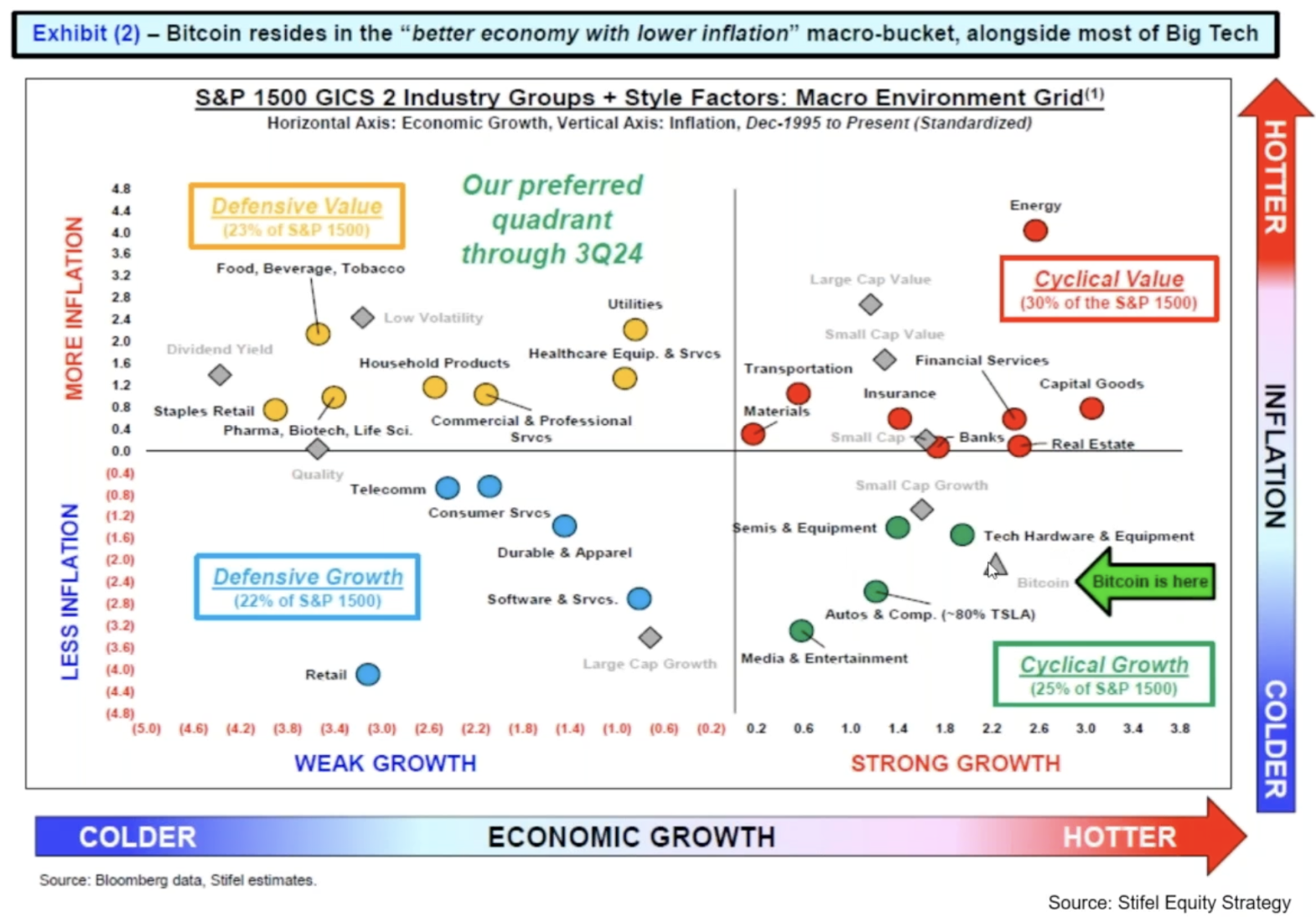

I shared the following chart with you in August 2024 (same message today):

Source: Bloomberg, Stifel Equity Strategy

The Yen, the 10-Year Treasury, and Several Other Interesting Charts

A few important charts to keep your eye on (update these weekly in Trade Signals):

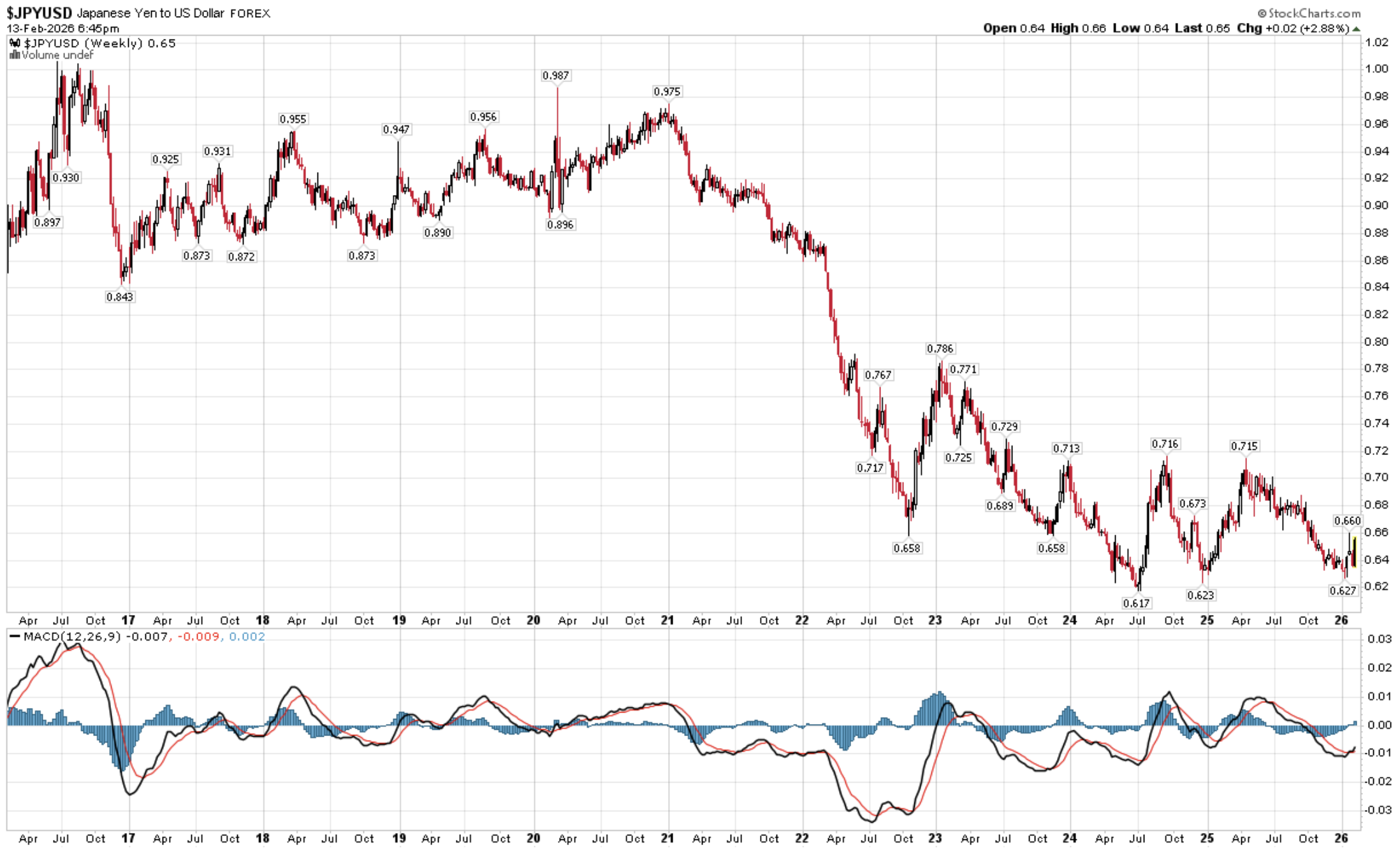

The Yen

A falling yen-to-dollar ratio is bullish for global liquidity. A rising yen is bearish. The current monthly trend is up. Monthly trends typically range from 8 months to 20 months.

Yen Weekly MACD

The Weekly MACD just signaled a rising yen. Think about the weekly signal as an intermediate signal, 8 weeks to 8 months. Also bearish for global liquidity.

Source: Stockcharts.com

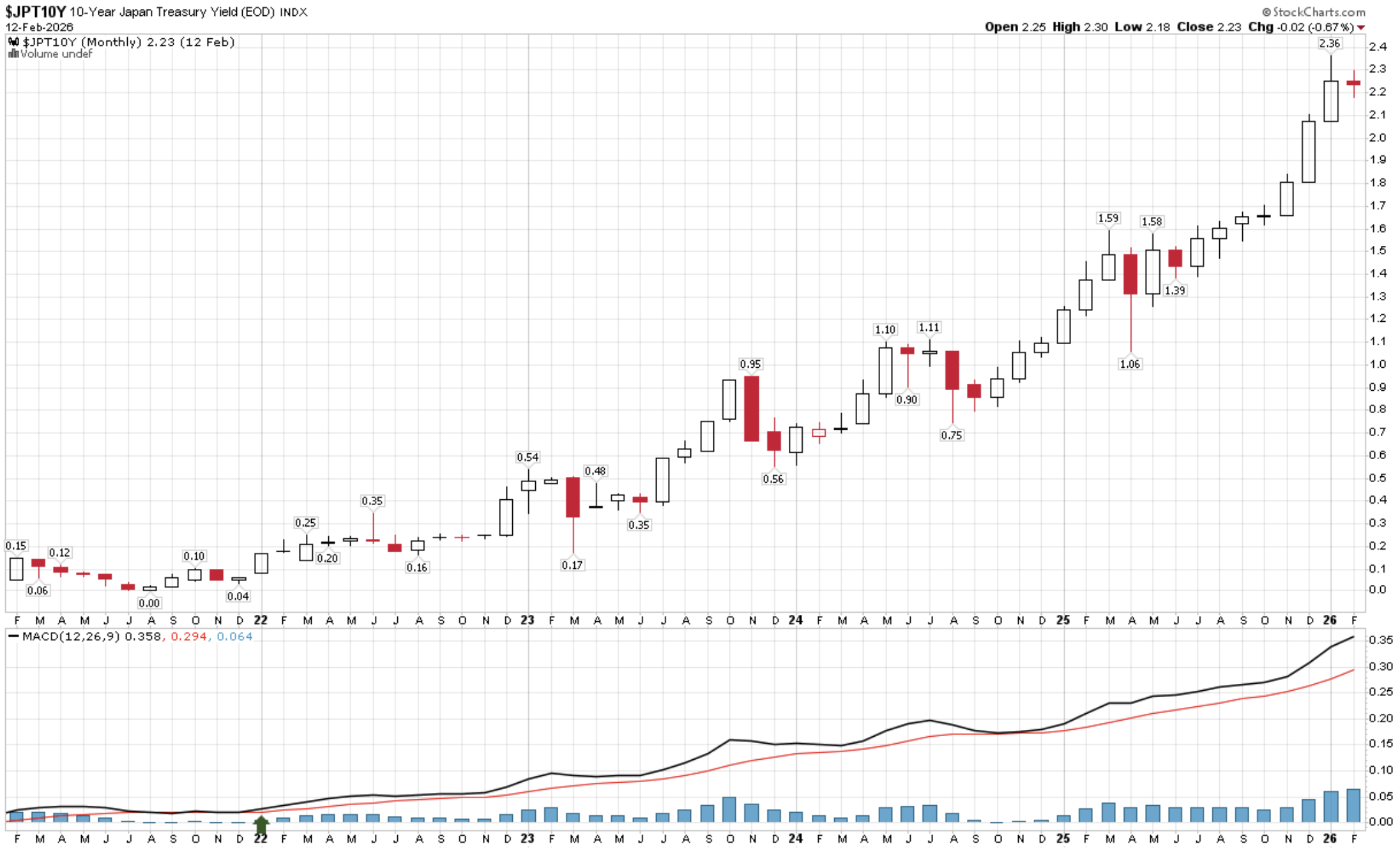

The Japanese 10-Year Treasury Yield

A high yield discourages the carry trade (borrow at a low interest rate and invest in another country at a higher one). It is the unwinding of the trade that could be problematic to global assets, U.S. long-term yields (bond selling drives them higher), and the dollar (lower due to selling to convert back to yen).

Source: Stockcharts.com, cmgprivatewealth.com

The 10-Year Treasury Yield

There is a lot going on in this chart as I look at it daily. The current yield is back down to 4.06%.

Source: Stockcharts.com

If you are not a Trade Signals subscriber and would like one of the charts updated, reach out to Amy from time to time, and we’ll send it to you.

Commercial Real Estate Challenges Remain

It’s been a while since we touched on the Commercial Office Space. The write-downs are getting real!

Warning, Will Rogers, Warning

Do you remember the TV series Lost in Space? It follows the Robinson family, pioneers traveling through the cosmos after their mission is thrown off course, forcing them to survive on strange worlds filled with danger and discovery. Their greatest ally is a mysterious Robot who forms a deep bond with young Will Robinson and repeatedly saves the family from peril. Whenever trouble looms, the Robot flails its arms and sounds the alarm — “Warning, Will Robinson, warning!” — a phrase that became one of television’s most iconic signals of approaching danger. I can picture that robot waiving its arm right now.

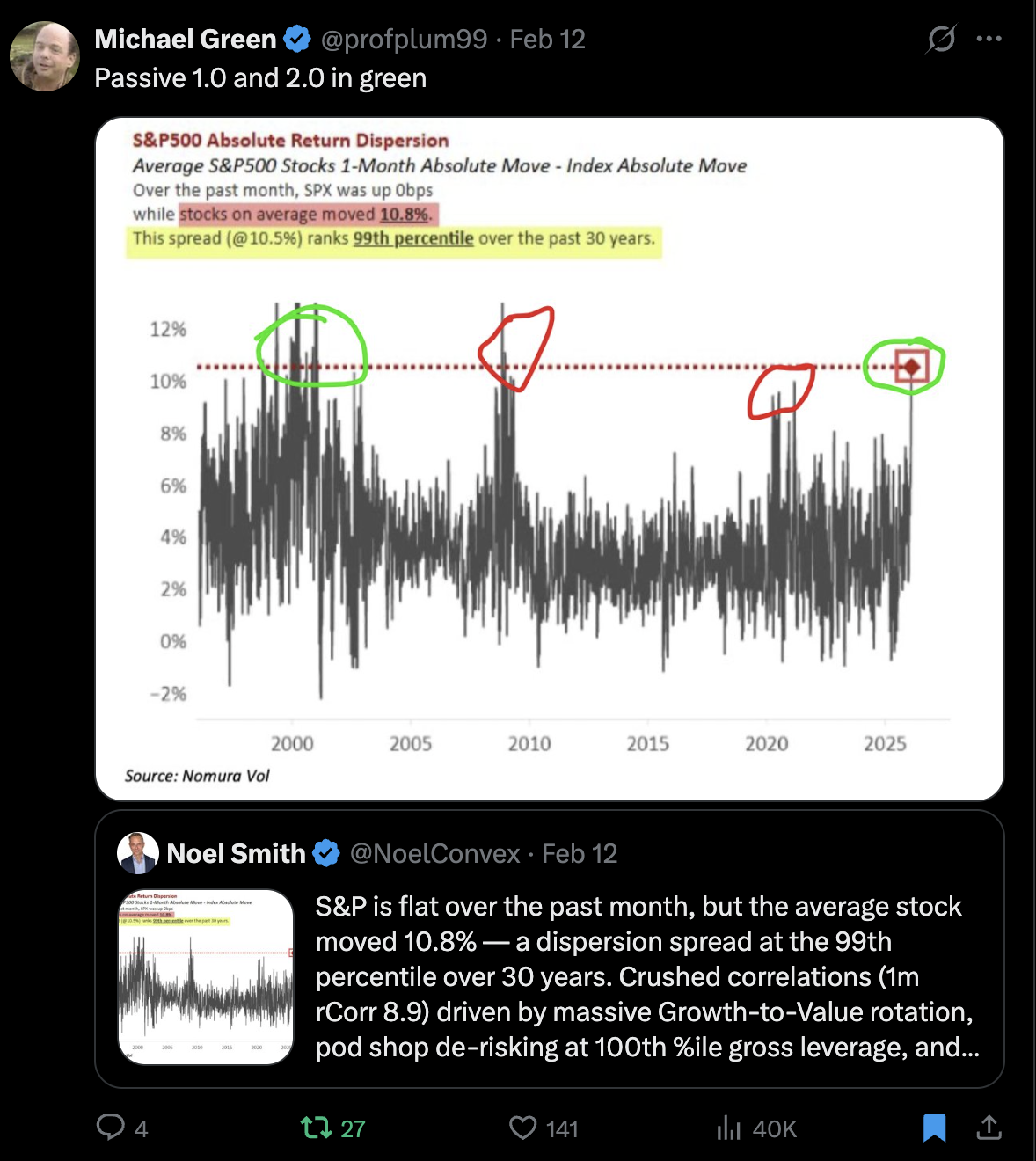

Source: @profplum99, @noelconvex, via X

SaaS-ageddon Follow-up

David Sachs, the government’s Crypto Zar, is more optimistic about the impact of AI than I was last week, in an OMR post titled "Saas-ageddon." And he has valid points.

Like the advent of the automobile or the internet, we have no idea what the extent of new innovation (new businesses to be invented) will be. As I mentioned last week, this is not the end of SaaS. It’s the end of easy SaaS, and it could trigger a market reversal to more attractive valuations.

Regardless, the software sector has been SaaS-attacked, with current valuations almost half of what they were a few months ago.

Follow me on X @SBlumenthalCMG

The views are Steve Blumenthal’s and subject to change. Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. See important CMG disclosures below.

If you like what you are reading, click on the following link.

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: February 12, 2026 Update

Trade Signals Sections:

Market Commentary

The Indicators Dashboard - Stocks, Investor Sentiment, Bonds, Commodities, Currencies, and Gold

Valuations and Subsequent 10-year Returns

Supporting Charts with Explanations

Why Trend Following Matters

Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor. Important disclosures.Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor.

About Trade Signals - Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.” – Charlie Munger

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: Muhammad Ali and his Red Bike

Sometimes our greatest gifts don’t look like gifts in the moment they come to us. I reflected on a story my good friend Bob Fouty shared with me this week. You may know it, but it was new to me. This

Before the world knew him as Muhammad Ali, he was just Cassius Clay, a skinny kid in Louisville, Kentucky, with a brand-new red bicycle his parents had scraped together to buy.

One afternoon, young Cassius rode that bike to the store and did what kids do. He leaned it against the wall and went inside. When he came back out, it was gone.

Heartbroken and furious, he found a police officer and poured it out—how angry he was, how badly he wanted to beat up whoever stole his bike. The officer listened, nodded, and said something that changed history:

“You better learn how to fight.”

The officer, Joe Martin, also ran a local boxing gym. He invited Cassius to come by. Cassius did.

And the rest is woven into the fabric of sports and humanity. Olympic gold. World championships. Courage in the face of injustice.

Ali was a voice that rang louder than his punches. A life that proves greatness isn’t just measured by titles, but by heart, compassion, wisdom, and leadership.

All because of a red bike. Stolen. And a moment of anger that was guided in the right direction.

Sometimes what feels like our greatest losses may actually be our greatest gifts.

I’ll conclude by sharing a few great quotes from Muhammad Ali:

“Service to others is the rent you pay for your room here on earth.”

“I know where I’m going and I know the truth, and I don’t have to be what you want me to be.”

“He who is not courageous enough to take risks will accomplish nothing in life.”

“It’s the repetition of affirmations that leads to belief. And once that belief becomes a deep conviction, things begin to happen.”

“The man who has no imagination has no wings.”

“I wanted to use my fame to help people,” he once said.

The repetition of affirmations. Love it!

A red bike lost. And a gift to all of us for generations to come.

Heart, compassion, courage, and conviction are what made him great. Amen to that.

Glasses held high: Wishing you and those you love most a happy Valentine’s Day. My girl loves a good IPA. We’ll start with that.

Susan and I have dinner plans on Saturday night with my sister Amy and her husband. The Olympics and Pebble Beach are on TV this weekend, and a short business trip to West Palm Beach is up next. Yes, golf clubs too. :)

Warm regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201,

Malvern, PA 19355

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.

See CMG Disclosures at the bottom of this page.

For more information about NDR, please visit at www.ndr.com.

NDR, Inc. (NDR), d.b.a. Ned Davis Research Group (NDRG), any NDRG affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDRG publication. The data and analysis contained herein are provided "as is." NDRG disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. NDRG's past recommendations and model results are not a guarantee of future results. This communication reflects our analysts' opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDRG or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. For NDRG's important additional disclaimers, refer to www.ndr.com/invest/public/copyright.html. Further distribution prohibited without prior permission. Copyright 2025 © NDR, Inc. All rights reserved.