On My Radar: The SaaS-ageddon Attack

February 6, 2026

By Steve Blumenthal

“The viral moment for Anthropic’s models is the most important thing that’s happened in AI since ChatGPT’s launch.”

- Dean Ball

Senior fellow at the Foundation for American Innovation. Source: WSJ

It was a surprise attack no one saw coming. ClaudeAI fired a missile. It hit its mark. The Wall Street Journal summed it up: “The Week Anthropic Tanked the Market and Pulled Ahead of Its Rivals.”

Anthropic is the company behind the popular ClaudeAI tool. Analysts are calling it Saas-ageddon. This is exciting, way cool, and extremely disruptive.

Anthropic competes with ChatGPT and Grok and appears to have leapfrogged both, for now, in the race for AI supremacy. And the news upended the stock market this week.

From the WSJ,

“A simple set of industry-specific add-ons to its Claude product, including one that performed legal services, triggered a dayslong global stock selloff, from software to legal services, financial data and real estate. Then, Anthropic unveiled Super Bowl ads that taunt rival OpenAI.”

Grab that coffee, and find your favorite chair. “SaaS-ageddon” (a riff on Armageddon) is analyst shorthand for a prolonged shake-out in the Software-as-a-Service industry. It’s catchy and a little dramatic. But the concerns underneath it are real.

The focus for investors is the impact on earnings. This is a disruptive gut punch to the largest single sector in the U.S. stock market. Today, let’s take a look at why this matters.

On My Radar: ClaudeAI’s SaaS-Ageddon Attack

Personal Note: Super Bowl, Florida, and Park City

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

SaaS-ageddon and Market Valuations

Given near-record-high stock market valuations, it is important to consider the potential impact on tech’s overall earnings. Why?

This is material, since Information Technology accounts for ~36% of the S&P 500’s total market cap. Source: Stockcharts.com

If the technology sector's earnings decline, it would likely affect the S&P 500's overall earnings, making it harder to support current record-high valuations.

To give you a sense for how technology exposure has grown since 2010, a decade ago, tech’s share was substantially smaller, meaning its rise and earnings growth have been a major driver of index performance and concentration trends over the last ten years. The following is based on data from BlackRock:

Year-EndTech % of S&P 500 (approximates)

2010 ~14 to 15%

2011 ~15 to 16%

2012 ~16 to 17%

2013 ~18 to 19%

2014 ~20%

2015 ~21 to 22%

2016 ~22 to 23%

2017 ~23 to 24%

2018 ~22 to 23%

2019 ~25 to 26%

2020 ~27 to 28%

2021 ~30%

2022 ~30 to 32%

2023 ~30 to 33%

2024 ~31 to 34%

2025 *~34 to 36% (recent estimates ²Reuters)

* Data through late 2025 reflects the tech sector’s highest market-cap weighting in years.

Broader measures that include tech-oriented companies outside the pure tech sector (e.g., some in Communication Services and Consumer Discretionary that are tech-centric) imply a larger effective tech influence, often over ~40% of the S&P 500.

This is especially important because the S&P 500 accounts for roughly 70%–80% of the U.S. equity market. Because the S&P 500 comprises the bulk of U.S. stock market value, technology accounts for roughly 35-40% of total U.S. stock market capitalization. Source: Reuters

The point is that earnings growth in the tech sector materially affects the valuation of the S&P 500 index. Because the exposure is so large, a wobble in tech earnings impacts the market's performance and your 401(k).

The impact on the market since the January 30, 2026 announcement through February 5, 2026: the S&P 500 index is down 2.6%, while popular SaaS companies are down more:

Adobe -7.6%

Workday - 9.1%

Salesforce -11.3%

Intuit - 13.5%

The Wall Street Journal added,

“Anthropic’s tools, which include so-called agents that can act autonomously to carry out increasingly complex user requests for hours, have offered a preview of the threat sophisticated AI models pose to entire companies. The startup has fought its way to the forefront of the AI conversation with a novel strategy focused on safety, software engineering, and business customers.

The result: a broader business reckoning that has left corporate leaders asking what it will mean when an AI system can easily replicate expertise developed over a lifetime of coding or, in the case of companies, years of corporate development.

Tech titans such as Nvidia Chief Executive Officer Jensen Huang and others have warned that the correction is an overreaction, because many platforms are far more complex and intricate than spinning up simple websites and apps. Many companies also give priority to investing in their businesses rather than building internal software tools, analysts have said.

Still, tech giants including Microsoft, Amazon.com, Meta Platforms, Oracle and Alphabet’s Google are planning more than $600 billion in 2026 capital spending, an amount that approaches the 2026 spending budget of Japan and exceeds that of Germany and Mexico. Anthropic—and all the ways the world might use its tools—are crucial drivers of that spending.” Source: WSJ

All of a sudden, what looked like steady earnings growth for the largest segments in the S&P 500 Index, technology, is now in question. Think of this in light of near-record-high stock market valuations.

The salient point is that the Information Technology sector's current weighting has approached levels not seen since the dot-com era mania.

Following is a look at several popular valuation metrics I share with you frequently:

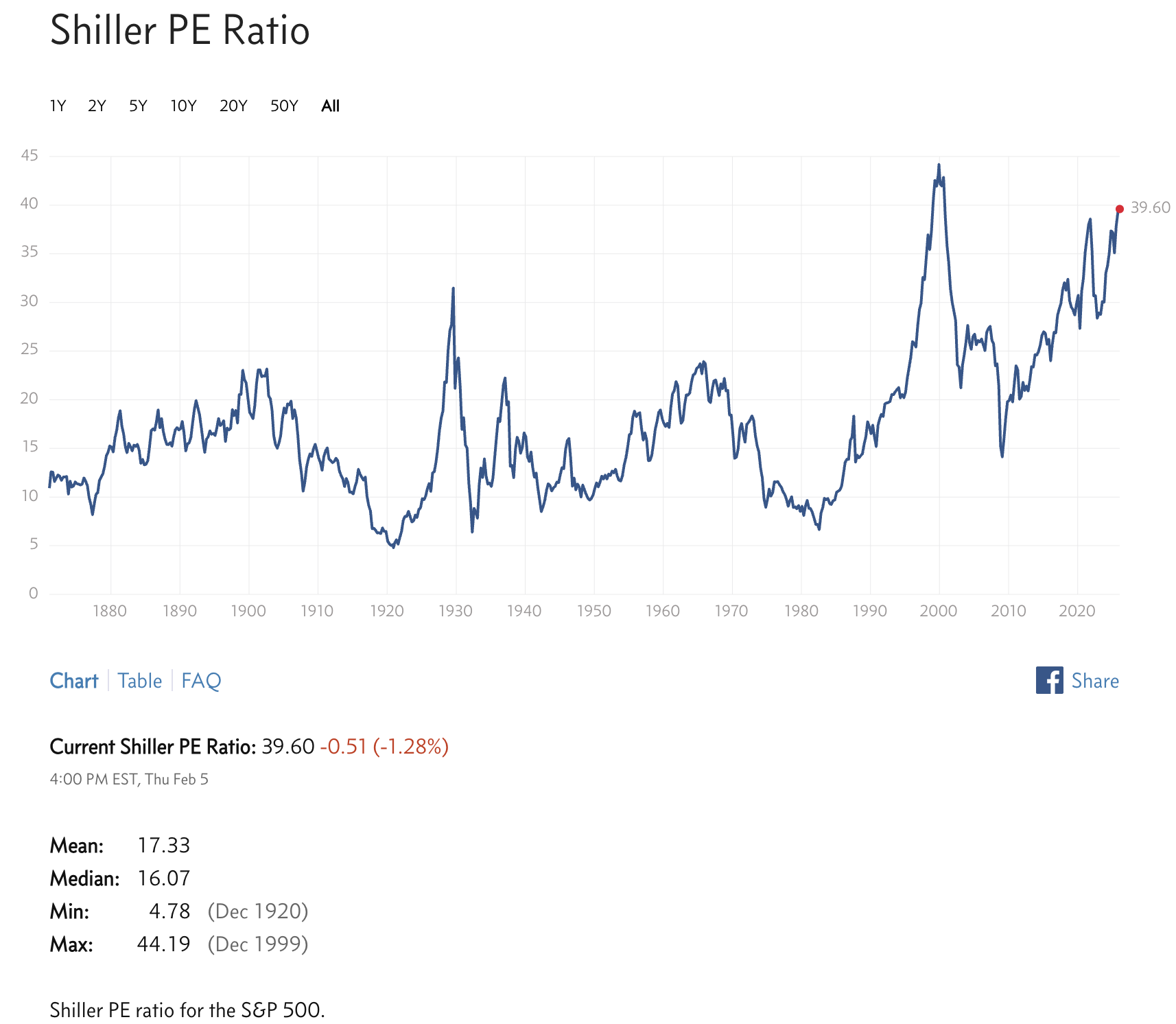

Chart 1: Shiller PE

Compare the red dot far right (today’s valuation) to the 2000 tech bubble top, the 1966, and the 1929 secular bull market peaks.

Source: ShillerPE, cmgprivatewealth.com

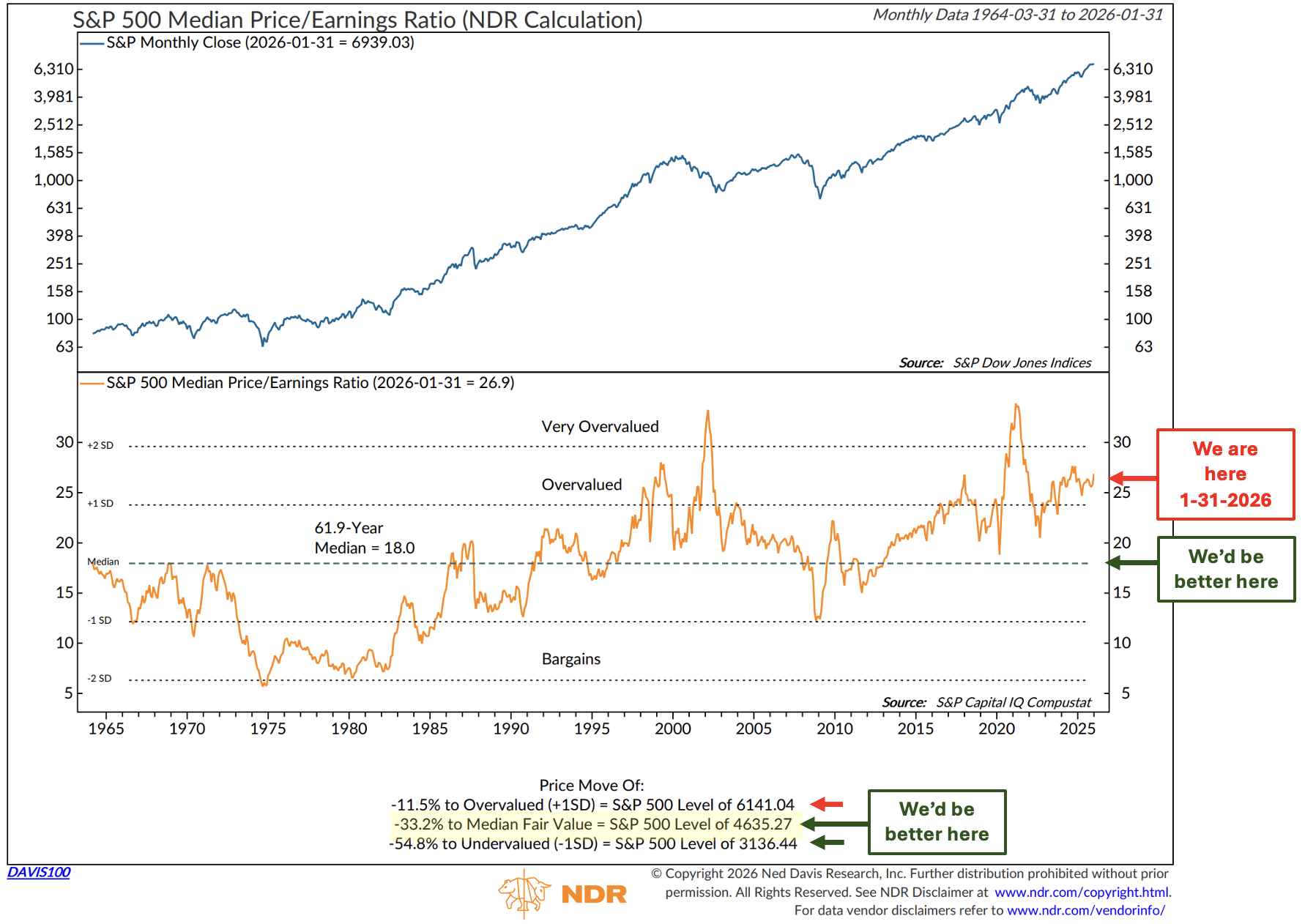

Chart 2: NDR’s Median PE

The median is the stock in the middle of the pack among the 500 stocks in the S&P 500 index. I like this measure for setting actual targets.

For example, as of January month-end, Median PE, based on nearly 62 years of monthly data, is 18, implying a Median Fair Value of ~4,635.27.

Median Fair Value is highlighted in yellow. It will take a 33.2% from the January 31, 2026, market close to get us there.

Note: This is not a cap-weighted valuation process. It does not weigh for Information Tech nor other sectors. It simply ranks all 500 stocks by PE and identifies the PE of the 250th-ranked company. The one in the middle.

Source: NDR, cmgprivatewealth.com

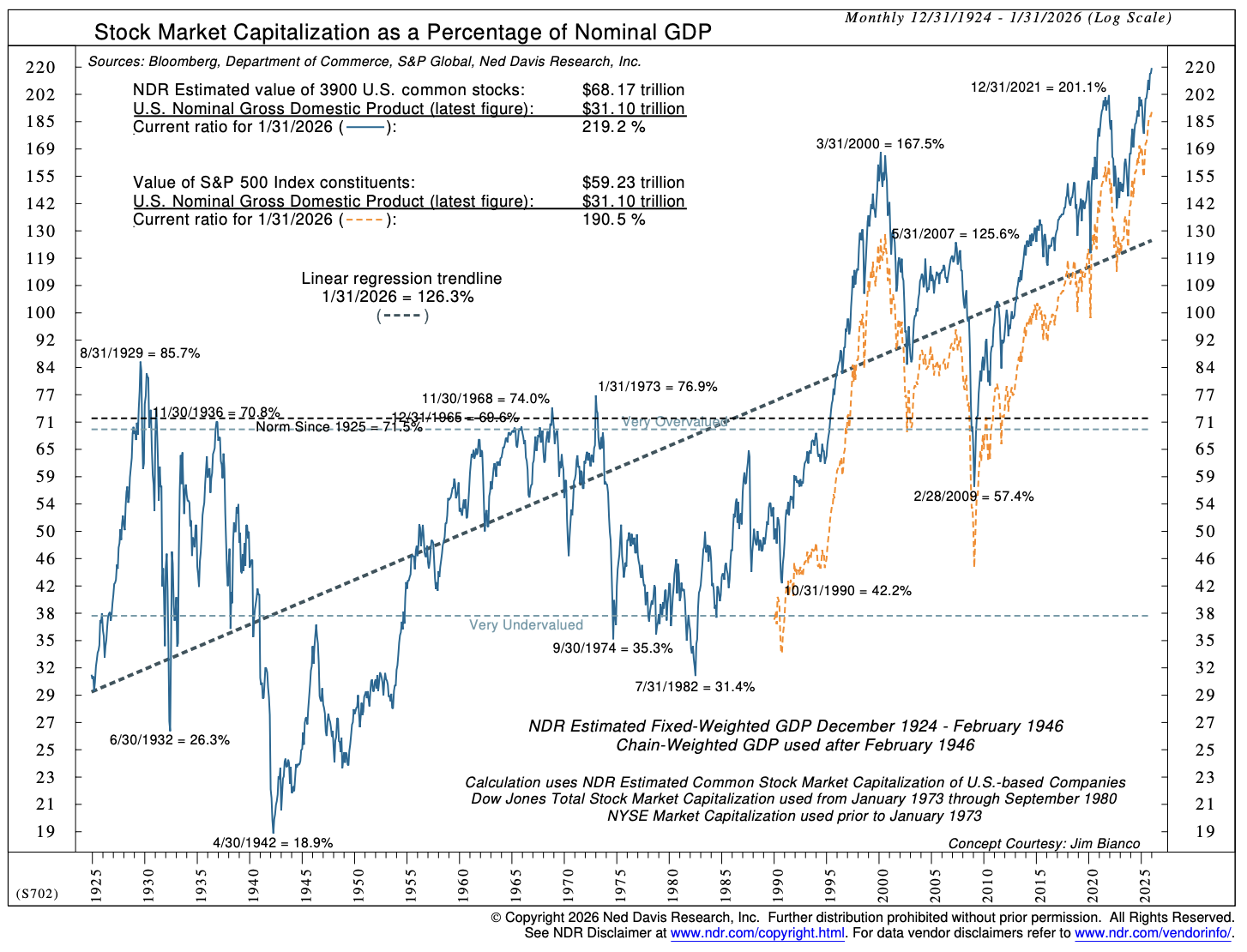

Chart 3: Total Market Cap to GDP

Blue line - upper right. A record 219.2%

Compare today’s number vs. 12-31-2021, 3-31-2000, 11-30-1968 and 8-31-1929

Source: NDR, cmgprivatewealth.com

Final thoughts: The story this week is about ClaudeAI’s new tool and how it is likely to affect the earnings potential of other Software-as-a-Service businesses and, more broadly, the technology sector’s overall earnings growth.

For example, my firm pays Salesforce over $65,000 per year for 15 licenses. Salesforce is a database we use for customer relationship management (CRM).

Imagine, to my delight, an advanced software tool that accomplishes much of what I need at a fraction of the cost. That is what ClaudeAI’s newest software promises. A disruptive technology that will impact the pricing power and earnings potential of current players. There will be winners and losers. The question for investors in light of the richly valued market is the impact on prices.

My two cents: This is not the end of SaaS. It’s the end of easy SaaS, and it could trigger a market reversal to more attractive valuations.

We’re likely moving from: “Grow fast, lose money, raise again” to“Grow reasonably, generate cash, prove durability.”

The views are Steve Blumenthal’s and subject to change. Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. See important CMG disclosures below.

If you like what you are reading, click on the following link.

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: February 5, 2026 Update

Trade Signals Sections:

Market Commentary

The Indicators Dashboard - Stocks, Investor Sentiment, Bonds, Commodities, Currencies, and Gold

Valuations and Subsequent 10-year Returns

Supporting Charts with Explanations

Why Trend Following Matters

Market Commentary - A plain-English snapshot of what changed this week, and what matters most beneath the surface.

The Indicators Dashboard - A consolidated view of key technical signals across equities, investor sentiment, bonds, commodities, currencies, and gold.

Valuations and Subsequent 10-Year Returns - Where current valuations stand historically, and what they may mean in terms of forward returns.

Supporting Charts with Explanations - The technical charts that anchor the signals, with concise commentary on what they’re indicating.

Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor. Important disclosures.Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor.

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

“Extreme patience combined with extreme decisiveness. You may call that our investment process.

Yes, it’s that simple.”

– Charlie Munger

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: Super Bowl, Florida, and Park City

As I hit the send button, I see the market has rallied nicely today. I see no major news. Investors buying the dip?

The NFL Super Bowl is this Sunday at 6:30 PM ET. Susan and I will be watching at home. I saw a funny retweet from Bloomberg's Tom Keene. I have friends in both places, so I’m rooting for a close and exciting game. Keep an eye out for the ClaudeAI commercial. Great fun!

Source: X, @tomkeene, @TheBsblr

Good luck to your favorite team on Sunday.

The opening ceremony for the 2026 Winter Olympics begins today. Some hopeful news on US downhill legend, Lindsley Vonn. Last week, she suffered a complete ACL rupture in her left knee during a crash at a World Cup downhill race on Jan. 30, just days before the Olympics. She also has bone bruising and possible meniscal damage.

Despite how serious a torn ACL normally is, she has reported minimal swelling and pain and has been working intensively on recovery. She completed at least one official downhill training run at the Olympics today, which makes her eligible to race in the women’s downhill event.

Her coach has expressed confidence that she will start the downhill event. She is scheduled for three events:

Women’s downhill (Feb. 8)

Team combined (Feb. 10)

Super-G (Feb. 12)

Fight, grit, and an unwavering will to win.

Meetings in Florida mid-month are up next (yes, a round of golf on the 16th), followed by the WallachBeth Annual Winter Symposium at the end of the month. By far, my favorite conference each year. Checking in, totally happy, and hope you have fun plans ahead as well.

Warm regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201,

Malvern, PA 19355

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.

See CMG Disclosures at the bottom of this page.

For more information about NDR, please visit at www.ndr.com.

NDR, Inc. (NDR), d.b.a. Ned Davis Research Group (NDRG), any NDRG affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDRG publication. The data and analysis contained herein are provided "as is." NDRG disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. NDRG's past recommendations and model results are not a guarantee of future results. This communication reflects our analysts' opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDRG or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. For NDRG's important additional disclaimers, refer to www.ndr.com/invest/public/copyright.html. Further distribution prohibited without prior permission. Copyright 2025 © NDR, Inc. All rights reserved.