On My Radar: Japan, the Yen, and the Carry Trade — What’s Really Happening

January 30, 2026

By Steve Blumenthal

“There are decades where nothing happens; and there are weeks where decades happen.”

- Author Unknown

When a currency falls as interest rates rise, it’s usually a warning, not an opportunity.

Japanese Prime Minister Sanae Takaichi vowed to act against speculative currency moves after the yen fell suddenly against the dollar, signaling concern about disorderly fluctuations but stopping short of confirming direct intervention (she emphasized steps against “very abnormal market moves”). Source: Reuters

Under normal circumstances, rising Japanese bond yields would make Japanese bonds more attractive, the yen would strengthen, and the pressure on the yen would ease.

That’s not what’s happening.

Instead, the yen continues to weaken, even as Japanese yields rise (charts below). That tells us something important.

This week, Japanese officials struck a careful tone. Prime Minister Takaichi and Finance Ministry leaders warned they are watching “speculative moves” closely and stand ready to act if currency swings become disorderly. However, they stopped short of confirming intervention. The messaging is intentional: calm the market without forcing its hand.

At the same time, U.S. Treasury Secretary Scott Bessent reiterated America’s “strong dollar policy” and flatly denied any U.S. involvement in supporting the yen. No intervention. No coordination. At least publicly.

Put the pieces together, and the picture becomes clearer.

Japan is trying to contain stress without triggering a disorderly unwind. The U.S. wants lower yields and a lower dollar. Both sides are trying to avoid the one outcome that matters: a violent reversal of the global carry trade. A very real risk.

Markets aren’t reacting to growth; they’re reacting to confidence. Investors don’t yet believe Japan can normalize policy without destabilizing its bond market, and they’re not ready to abandon dollar assets while U.S. yields remain structurally higher. The administration wants yields to be lower. Japan needs them higher to attract capital and drive the yen higher.

For now, the unwind is being managed, not forced. Japan and the U.S. share the concern.

Why This Matters

The yen carry trade is likely one of the largest, most leveraged, and most opaque trades in the global financial system.

The yen carry trade sits at the center of global liquidity. A disorderly reversal would push yields higher, tighten financial conditions, and an unwinding would ripple negatively through equities, credit, and currencies.

So far, policymakers are threading the needle, allowing pressure to release slowly rather than all at once.

But these kinds of stress cracks don’t disappear. They build quietly - until something breaks. And breaks happen quickly.

Grab that coffee, and find your favorite chair. This is one of many systemic risks. John Mauldin wrote a piece about “Late Summer Sandpile” many years ago. It was about fragile states. It may be the best piece he’s ever written.

I’m sure you remember building sandpiles on the beach as a kid. There was a great study to understand what causes them to collapse. You could never know which last grain of sand added to the pile would cause it to crash. Leverage in the system, be it government debt, corporate debt, margin debt, or synthetic debt on bank balance sheets. The current sandpile is one of the largest in history.

Think of the yen carry trade as a large grain of sand. This week, it was placed on top of the sandpile. I try my best today to explain this in a way many can better understand.

Decades where nothing happens, and weeks where decades happen. Gold, silver, uranium, copper, commodities, China, Russia, Iran, Venezuela, Greenland, right/left, internal conflicts, external conflicts, us/them.

Grains of sand, suddenly whipped up into a dust storm.

On My Radar: Japan, the Yen, and the Carry Trade — What’s Really Happening

Personal Note: Dreams Don’t End

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

The Yen, The Dollar, and The Carry Trade

How big is this yen carry trade?

There is no official number (that’s part of the risk), but various estimates put it anywhere from $1 trillion to over $4 trillion in effective exposure when you include hedge funds, macro funds, banks, insurance companies, corporate treasury hedging, synthetic currency (FX) exposure via derivatives, and structured products

The Bank for International Settlements (BIS) has repeatedly warned that yen-funded positions are deeply embedded in global leverage.

This isn’t one trade. The risk is systemically intertwined in all kinds of risk assets globally. It’s not just a yen problem; it is a global plumbing problem.

Normally, the higher Japanese Government Bond (JGBs) yields go, the higher the risk of collapse of the "carry trade" goes. The stress has been increasing with each tick higher in yields.

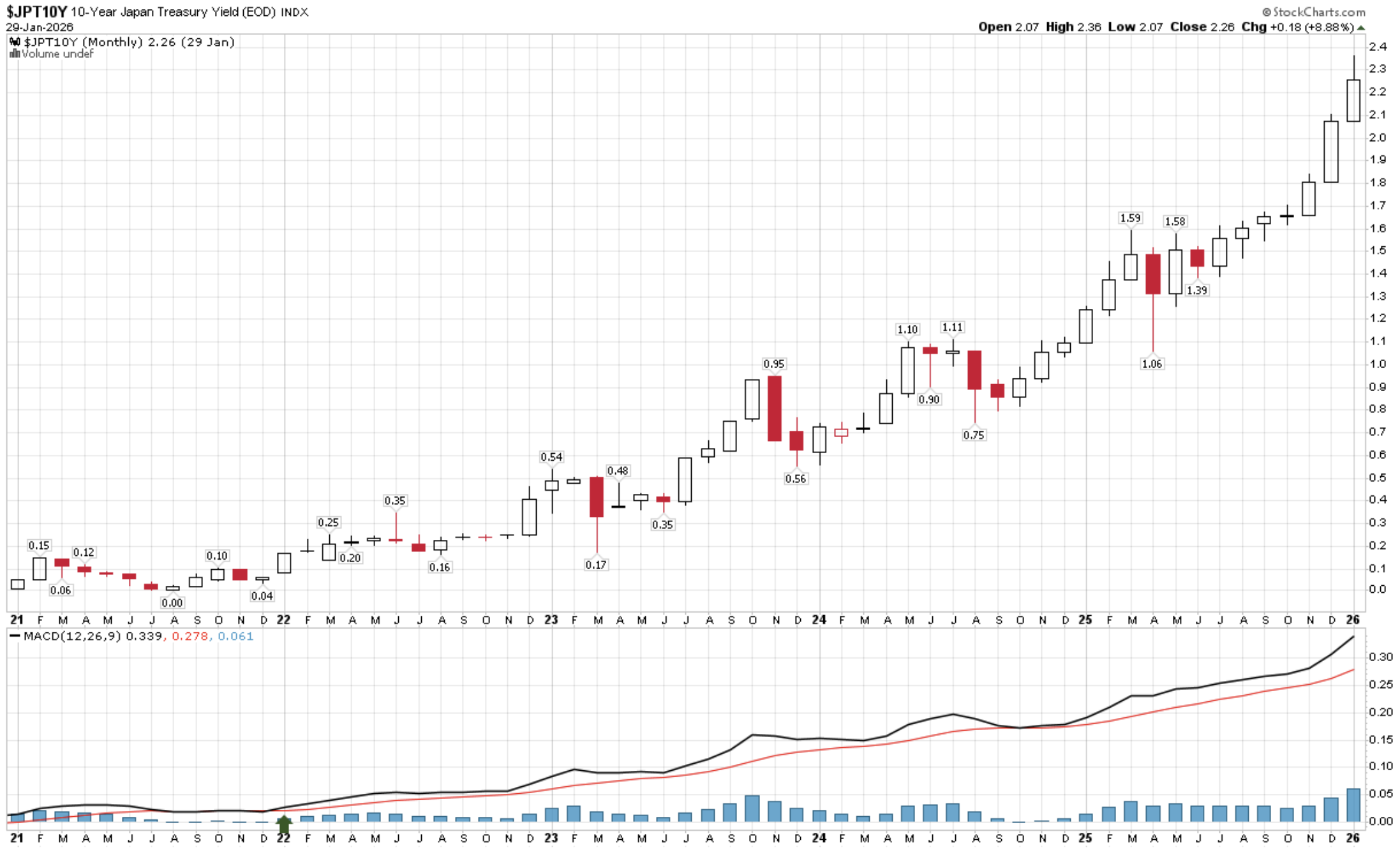

Following is a look at the 10-year Japanese Government bond yield. The yield has increased from 0.10% (basically free money) to 2.26% in the last three years.

Source: StockCharts.com, cmgprivatewealth.com

Think of the carry trade as a massive amount of leverage in the financial markets.

Investors were able to borrow yen at approximately 0% in 2023, convert them into dollars, and invest the money in U.S. Treasury notes at approximately 2%. They earn the spread. Leverage is used to enhance returns.

As yields rise in Japan, the attractiveness of the yen carry trade shrinks with the compressed spreads.

The unwinding of the trade would involve selling U.S. assets and dollars to convert the proceeds back into yen (sending the proceeds back to Japan to pay off the loan).

Under normal circumstances, when JGB yields rise, one would expect the yen to rise as the carry trade spread shrinks and Japanese bonds become more attractive. But that hasn’t been happening.

Thus, the concern that the overall size of the total debt is reaching a breaking point. End of long-term debt super cycle challenges.

While not the first shot across the bow, the behavior of the currencies and yields this week in Japan is another sign prompting panic on both sides of the Pacific to try to halt the yen’s decline.

One of Japan’s major issues is inflation, since it imports most of its energy needs (oil), and oil is priced in dollars. A lower yen means more yen is needed to buy the same amount of oil, which is very inflationary to the country's citizens.

The Japanese need a stronger yen and, ideally, a lower oil price per barrel. The U.S. administration appears to desire a lower dollar.

After sharp words from Japanese Prime Minister Sanae Takaichi and U.S. Treasury Secretary Scott Bessent, both the yen and the dollar are higher. I think it is temporary.

The root of the global mess lies in the size of outstanding debts. It’s become too big, as has the interest expense on the debts.

Let me try to summarize this in my bullet point form (my brain thinks this way. It helps me, and I hope it helps you too)

Why the Yen Is Falling Despite Higher Yields:

1. Japanese yields aren’t rising because Japan is strong. They’re rising because the BOJ is losing control of the bond market.

Investors aren’t saying, “Japan is attractive again.” They’re saying, “The BOJ may not be able to cap yields forever.”

That’s a confidence issue, not a growth signal.

2. The yield gap still massively favors the U.S.

Even with JGBs moving higher, there is still a *huge* carry differential.

Japan: ~2.25% and the U.S.: ~4.25%

For now, while Japan’s yields are rising, they’re not rising enough to offset: Higher U.S. yields, stronger U.S. growth, and better capital returns.

Bottom line: The math still favors staying in dollars.

3. The real issue: The currency risk is greater than the yield pickup. Here’s the key point I think most people miss:

Investors aren’t worried about yield anymore; they’re worried about currency instability.

If you’re a global investor and you believe:

The yen may weaken further

The Bank of Japan may be trapped

Japan may tolerate inflation to manage debt

Bottom line: Even rising yields won’t be enough to attract capital because currency losses can swamp yield gains. The risk is elevated, and leverage is sizable.

4. The carry trade hasn’t unwound; it’s being managed. This is critical because a disorderly unwind would:

Spike global yields, pressure U.S. Treasuries (higher yields on the long-end of the curve), and create volatility across all risk assets.

So instead, we’re getting the following from authorities:

Gradual repositioning, verbal intervention, and quiet coordination.

Bottom line:

When the yen falls while their yields rise, it is a warning signal that the market doesn’t trust Japan’s policy path. It is telling investors that higher yields aren't sustainable without currency pain.

For now, volatility is being suppressed. My major point is that this isn’t a normal rate move.

Japan is trying to normalize without breaking the system (needing a higher yen price), and

The U.S. is letting the dollar drift lower but not collapse.

Global markets are walking a tightrope between yield and stability. The systemic cancer in global markets is excessive Sovereign debt.

I believe that’s the story behind the headlines. They’re just trying to make sure it doesn’t happen all at once.

The unwind will eventually arrive. Watch the dollar, watch the yen, watch government bond yields.

Here is a look at the U.S. Dollar

The red arrow to the right points to the dollar reaction. Look at the spike lower and the new Weekly MACD sell signal. In trading today, the dollar is trying to hold on. Oh my.

Source: Stockcharts.com, CMG Investment Research

The views are Steve Blumenthal’s and subject to change. Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. See important CMG disclosures below.

If you like what you are reading, click on the following link.

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: January 29, 2026 Update

Trade Signals Sections:

Market Commentary

The Indicators Dashboard - Stocks, Investor Sentiment, Bonds, Commodities, Currencies, and Gold

Valuations and Subsequent 10-year Returns

Supporting Charts with Explanations

Why Trend Following Matters

Market Commentary - A plain-English snapshot of what changed this week, and what matters most beneath the surface.

The Indicators Dashboard - A consolidated view of key technical signals across equities, investor sentiment, bonds, commodities, currencies, and gold.

Valuations and Subsequent 10-Year Returns - Where current valuations stand historically, and what they may mean in terms of forward returns.

Supporting Charts with Explanations - The technical charts that anchor the signals, with concise commentary on what they’re indicating.

Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor. Important disclosures.Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor.

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

“Extreme patience combined with extreme decisiveness. You may call that our investment process.

Yes, it’s that simple.”

– Charlie Munger

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: Dreams Don’t End - An Olympic Comeback Story

The Winter Olympics begin in less than a week. I hope you enjoy this short story.

“Comeback stories like this are rare.

When the Olympics arrive, the name Deanna Stellato-Dudek will be everywhere. She is 42 and heading to her first Olympic Games, more than 15 years after she walked away from competitive figure skating. She skated in the U.S. system until 2001, then stopped after chronic hip injuries made continuing untenable. She moved on. Became an aesthetician. Built a life that had nothing to do with training schedules or podiums.

Years later, at a work retreat, she was asked a question that was meant to be hypothetical: What would you do if you knew you wouldn’t? Her answer was blunt and immediate: She would win a gold medal. She could tell as soon as she said it that her unfinished business was calling.

By then, she had spent more time away from skating than she ever had in it. Still, the idea stuck. At 32, she returned to the ice, switched disciplines to pairs, and eventually became a Canadian citizen to compete with a new partner. There was no rush to meet a neat Olympic timeline. Beijing in 2022 came and went. She kept going anyway. “I’m already too old to be doing this,” she said at the time. “So I can be too old in six years, too.”

As a kid, the Olympics she imagined were Turin 2006. Competing in Italy after all, but 20 years later, struck her as a funny outcome. In 2024, she won a world title, becoming the oldest woman to do so. This season, she made the Canadian Olympic team and is a favorite to win gold in Milan.

The point isn’t where she finishes. It’s that she came back at all, without insisting the return look a certain way or happen on schedule. The years away weren’t wasted time. They were simply part of the story.

There’s something steadying about the idea that ambition doesn’t evaporate just because it’s gone dormant. Skill and experience don’t expire the moment a path bends. Some goals don’t demand urgency. They ask for patience, stubbornness, and a willingness to look slightly out of step with everyone else.

Let’s ask ourselves:

What ambition has lingered quietly, even after life seemed to move on from it?

What parts of a past identity still feel unfinished?

What would change if experience were treated as leverage rather than baggage?

Not all unfinished things are failures. Some are future chapters.”

I don’t read The Daily Coach everyday but I should. The above post moved me, and I hope you find it motivating, too. Source in the link.

From ice to snow and Lindsley Vonn.

Lindsey Vonn’s career is a study in resilience, and her latest chapter may be the most remarkable of all. After multiple knee surgeries, fractures, and years of physical setbacks that would have ended most careers, she somehow found her way back. Not only back to racing, but back to winning. This season, at 41 years old, with a partially replaced knee, she did the unthinkable: she won a World Cup downhill and earned her place on the U.S. Olympic team. Let that sink in.

This wasn’t nostalgia or a ceremonial return; this was elite, world-class performance against skiers half her age. It’s a reminder that greatness isn’t about avoiding adversity; it’s about answering it.

Ages 42 and 41. Grit, belief, discipline, and love to compete.

The 2026 Winter Olympics Opening Ceremony is scheduled for Friday, February 6, 2026, at San Siro Stadium in Milan, Italy - marking the official start of the Milano-Cortina Olympic Winter Games.

Can’t wait!

Sad news, this just in. Just before hitting the send button, news broke that Lindsey Vonn crashed in a training run today. She was able to stand and was then airlifted to a hospital by helicopter. It appears to be serious. Send some prayers to Lindsey. Ever forward, indeed!

Warm regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201,

Malvern, PA 19355

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.

See CMG Disclosures at the bottom of this page.

For more information about NDR, please visit at www.ndr.com.

NDR, Inc. (NDR), d.b.a. Ned Davis Research Group (NDRG), any NDRG affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDRG publication. The data and analysis contained herein are provided "as is." NDRG disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. NDRG's past recommendations and model results are not a guarantee of future results. This communication reflects our analysts' opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDRG or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. For NDRG's important additional disclaimers, refer to www.ndr.com/invest/public/copyright.html. Further distribution prohibited without prior permission. Copyright 2025 © NDR, Inc. All rights reserved.