On My Radar: Big Cycle Stage 6

February 20, 2026

By Steve Blumenthal

“A house divided against itself cannot stand.”

- Abraham Lincoln

In June 1858, Abraham Lincoln rose to speak in Springfield, Illinois, and delivered a warning that sounded less like politics and more like prophecy. The nation was fracturing over slavery, institutions were losing legitimacy, and trust between North and South was collapsing. Lincoln didn’t offer a policy proposal; he offered a diagnosis:

“A house divided against itself cannot stand.”

He did not predict immediate collapse. In fact, he said the opposite: the house would not fall, but it would stop being divided. It would become “all one thing, or all the other.” Three years later, the Civil War began.

Ray Dalio developed his “Big Cycle” thesis by studying roughly 500 years of history. Long enough to watch societies move from order to disorder and back again. He often says the patterns become obvious only when you zoom out far enough to see multiple lifetimes at once, “like a movie” rather than a snapshot.

Each cycle typically spans 50 to 100 years. This week, Ray wrote that we have entered Stage 6, which he calls the period when the existing world order breaks down.

That’s a big statement.

In his framework, this phase is marked by rising internal conflict, realignment of power among nations, and a shift toward “might makes right” dynamics across trade, technology, capital flows, and geopolitics. In plain English, the rules that governed the post-World War II world order are no longer holding.

Ray is not predicting inevitability or catastrophe. Stage 6 is the most challenging phase, and history shows outcomes depend on leadership, policy choices, and whether societies can restore cohesion before disorder accelerates. He references statements from U.S. Secretary of State Marco Rubio, German Chancellor Friedrick Merz, and French President Emmanuel Macron from last week’s Munich Security Conference, the world’s leading annual forum for global security and geopolitical strategy. You and I see this, too: China, Russia, Iran, Venezuela, Europe/U.S., and the extreme internal division that currently exists within the United States between right and left.

Grab that coffee and find your favorite chair. You’ll find an interview Ray did with Tucker Carlson. Like Tucker or not, he asks questions that help illuminate Ray’s thinking and how this framework informs his approach to markets. Please know that regulations prohibit me from making specific recommendations in this letter. I can speak in general terms about asset classes, but not specific investments. If you’d like to learn more about how we are positioning client portfolios, simply reply to this email and someone from CMG will reach out.

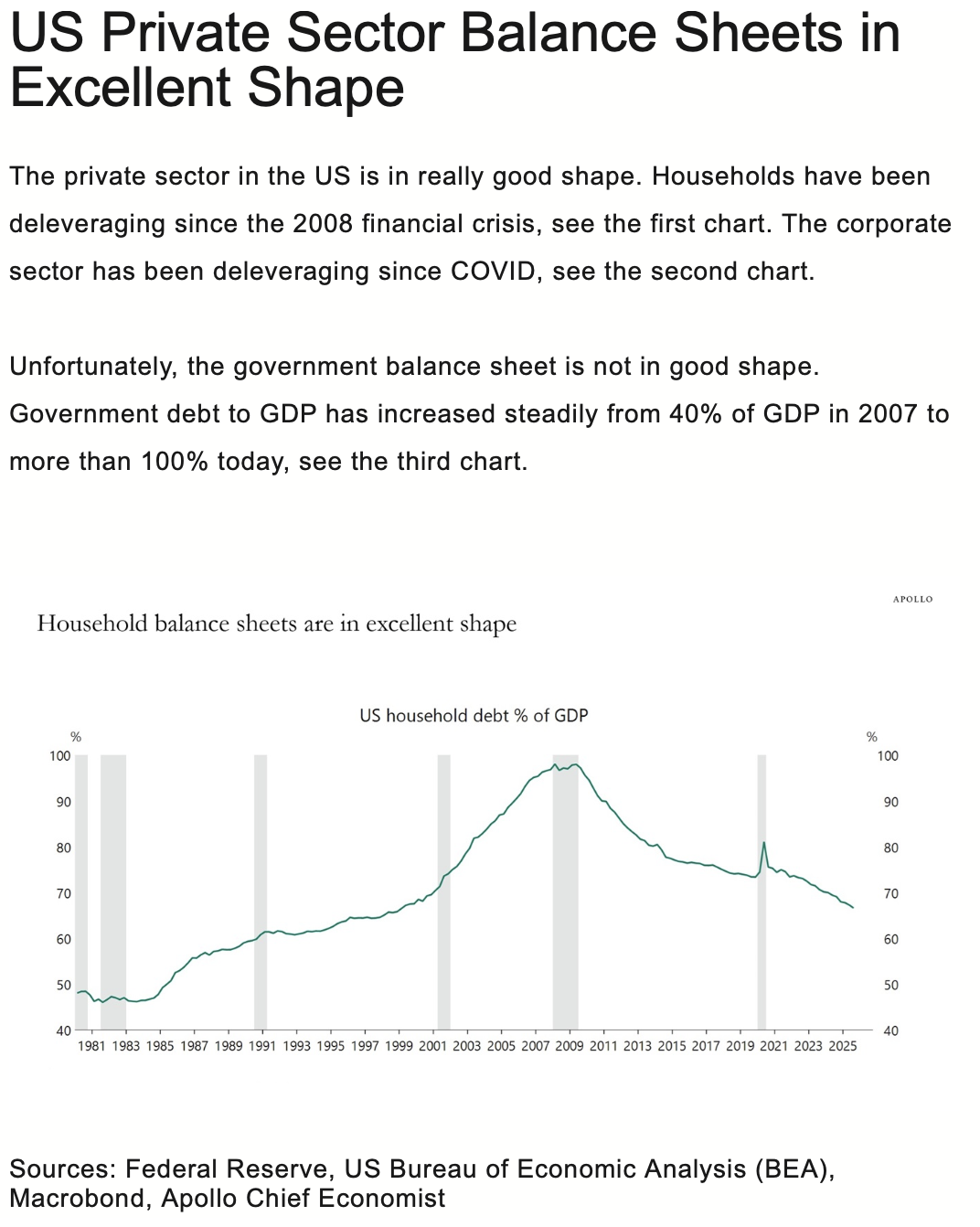

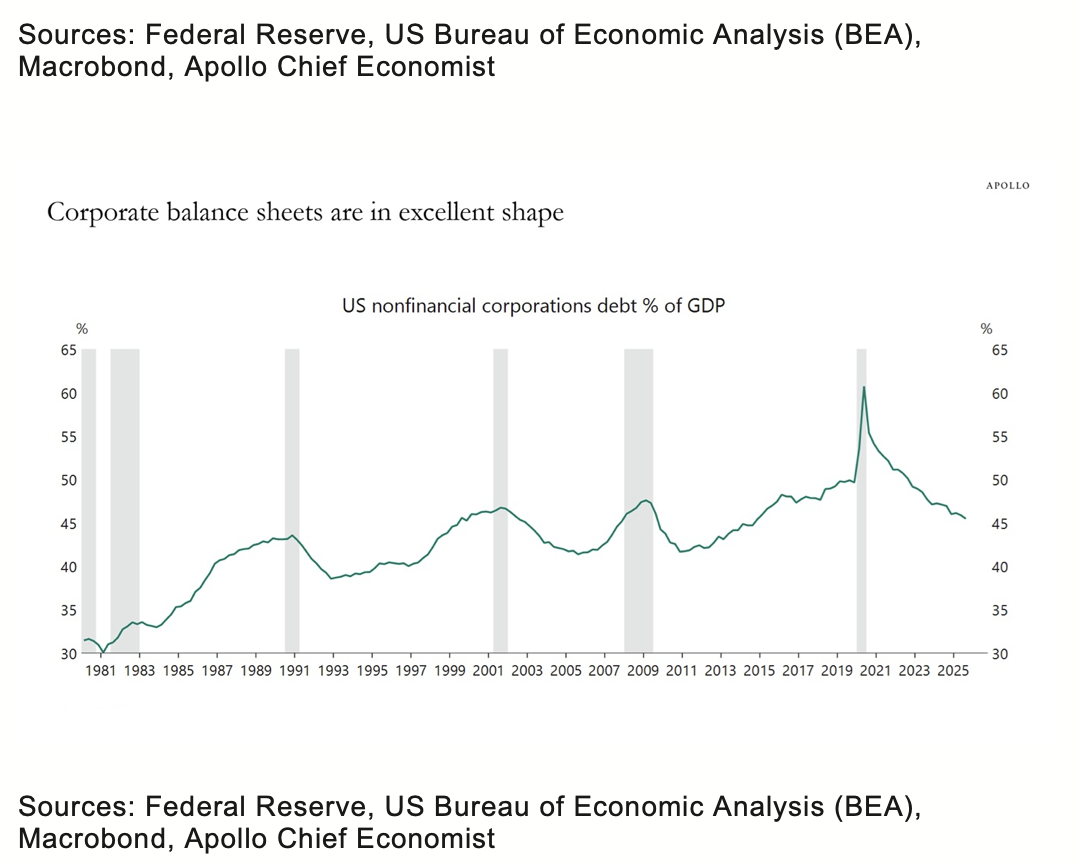

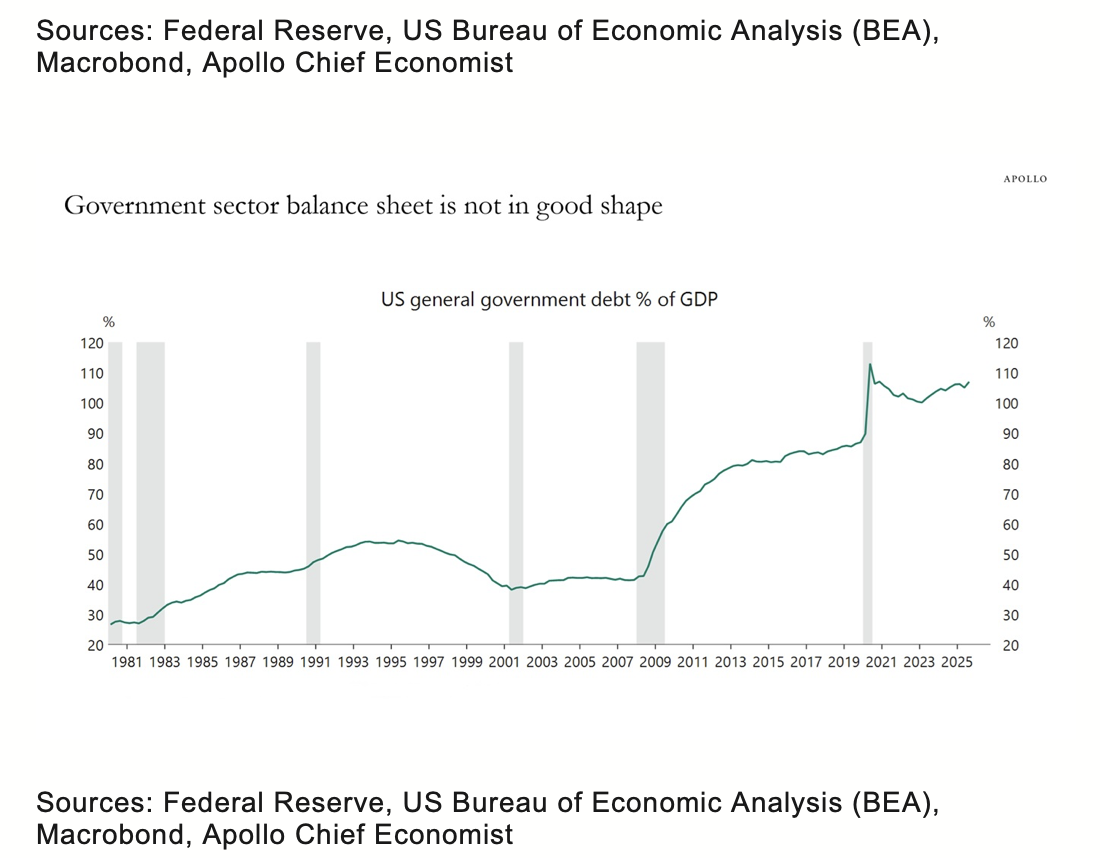

You’ll also find several important charts on private- and corporate-sector debt, plus insights from good friend Barry Habib and his team on the housing market (he’s bullish) and the near-term direction of interest rates.

Heat that coffee up. Let’s go.

On My Radar:

U.S. Private Sector and Corporate Balance Sheets Are in Good Shape

Barry Habib - “The Opportunity In Housing That So Many Can’t See”

Personal Note: The Wallach Beth Winter Symposium in Park City

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

Ray Dalio - Big Cycle Stage 6

Ray tweeted this week, “It’s official: The current world order has broken down. In my parlance, we are in the Stage 6 part of the Big Cycle in which there is great disorder arising from being in a period in which there are no rules, might is right, and there is a clash of great powers. How Stage 6 works is explained in detail in Chapter 6, “The Big Cycle of External Order and Disorder,” in my book Principles for Dealing with the Changing World Order. If you can, I think it would be worth your time to read.”

Ray Dalio, in his book Principles for Dealing with the Changing World Order (and related writings like LinkedIn posts and interviews), describes a recurring "Big Cycle" of rise and decline for nations/empires, spanning roughly 50–100+ years across generations. This includes the Big Cycle of Internal Order and Disorder, which unfolds through six archetypical stages: a timeless, cause-and-effect progression from internal order (peace/prosperity) to disorder (conflict/breakdown) and back again.

These stages explain how societies build strength, overextend, fracture due to wealth gaps/debt/conflicts, and eventually restructure through crisis. Following, I’m again providing a summary of the six stages based on Dalio's framework:

Stage 1: The new order begins after war/revolution. A new leadership consolidates power following a major conflict (e.g., civil war, revolution, and/or international war). Debts are restructured or monetized to reduce burdens, wealth gaps narrow, and conflicts ease as people unite around rebuilding. This marks the "birth" or rebirth of the system with fresh momentum.

Stage 2: Consolidation of power and building systems. Leadership further solidifies control and establishes effective resource allocation systems (institutions, governance, etc.). "Civil engineers" (practical builders like Deng Xiaoping or Lee Kuan Yew) thrive here, designing productive structures that improve education, competitiveness, and quality of life.

Stage 3: Peace and prosperity (the high point). The system works well: strong education, innovation, economic output, trade dominance, military strength, and often reserve currency status. There's broad productivity growth, favorable finances, and relative harmony. Examples include Victorian Britain, late-1800s Germany, or 1960s U.S.

Stage 4: Excess, decadence, and widening gaps. Overconfidence leads to overspending, excessive debt/credit bubbles, wealth/political polarization, and declining productivity relative to earlier gains. Hubris sets in, eroding competitiveness.

Stage 5: Very bad financial conditions and intense internal conflict (pre-breakdown). Large deficits, unsustainable debt, money printing, and eroding borrowing power. Wealth gaps fuel intense ideological/political fights; moderates lose ground. Conflict escalates (but the system for resolving disagreements still functions to some extent). Dalio has often placed the U.S. (and sometimes other powers) here in recent years, as a leading indicator of potential decline.

Stage 6: Civil war/revolution or major breakdown. The system runs out of money/credit; the mechanism for peaceful dispute resolution fails. This triggers violent conflict (revolution, civil war, or equivalent restructuring), often with "inspirational generals" leading. It destroys the old order, paving the way for a new one (looping back to Stage 1).

The cycle repeats as the painful resolution in Stage 6 creates conditions for renewal. Dalio emphasizes that these outcomes are not inevitable (reforms can avert the worst), but the patterns are historical and driven by debt, inequality, leadership qualities, and productivity dynamics. He has warned in recent writings (e.g., 2024–2026 comments) that aspects of global/U.S. conditions show progression toward or into Stage 6-like "great disorder," with weakening rules, clashing powers, and "might makes right" dynamics. Note that this applies to both internal (domestic) and external (geopolitical) orders. For more details, his book and the original LinkedIn series (especially the 2020 post "Delving into the Six Stages") provide full archetypal descriptions with historical examples.

In summary:

Every world power has its time in the sun, thanks to the uniqueness of its circumstances and the nature of its character and culture (e.g., it has the essential elements of a strong work ethic, smarts, discipline, education, etc.), but they all eventually decline. Some do so more gracefully than others, with less trauma, but they nevertheless decline. Traumatic declines can lead to some of the worst periods in history, when big fights over wealth and power prove extremely costly both economically and in human lives.

Still, the cycle needn’t transpire this way if countries in their rich and powerful stages stay productive, earn more than they spend, make the system work well for most of their populations, and figure out ways of creating and sustaining win-win relationships with their most significant rivals. A number of empires and dynasties have sustained themselves for hundreds of years, and the United States, at 245 years old, has proven itself to be one of the longest-lasting.” Source: @RayDalio, X, w CMG bold for emphasis

Click here to read Ray’s short post.

Click here or on the following X tweet for a detailed description of Stage 6 (Ray’s Feb 14 post).

The great Abraham Lincoln!

Source: X, @RayDalio

Ray Dalio on The Tucker Carlson Show

Here is the link to Ray Dalio on The Tucker Carlson Show, or click on the image to watch.

The Problem is Government Debt

Discussing the CBO’s 2026 U.S. budget report, David Friedberg clearly lays out the debt problem and shares his biggest concern: a government bailout of individual state(s) and local government pension funds (highlighting California). He suggests there needs to be a bankruptcy pathway for pensions and reminds listeners not to forget that the Social Security system is running out of money in 2032.

Following is the quick take from the discussion and a link for you to click through and listen as well:

There is no outlook for 3% debt-to-GDP. It is currenly 6%.

Most of the debt is short-term, modeled at 3.1% in the CBO report. But if rates rise to 5%, that’s another ~$650 billion in added interest expense, taking the total to almost $2 trillion, and that’s just on the existing debt.

Because we are running a spending deficit, the debt is rising at approximately $2 trillion per year, which will drive the government's interest expense even higher.

So the debt keeps rising, and the interest expense keeps rising. This is the “debt death spiral.”

Current interest expense is 3.5%; if rates rise to 5%, the interest cost goes to $2 trillion.

Social Security runs out in 2032. That will be financed with new debt. No one will get elected promising to cut Social Security benefits.

The bigger problem at foot is the state and local government obligations. The California public pension system is bankrupt. They have nearly $1 trillion in unfunded pension obligations to their public employees who have retired and will retire. He introduces the possibility that the Federal Government will have to step in to bail it out.

Friedberg suggests that if we get a Democratic president in 2028 and a Democratic-controlled House, we are likely to see federalization of those obligations. Meaning the federal government will step in to bail out the effectively bankrupt state and local government pensions. If not, there will be a massive economic hit.

The CBO report does not factor this in. Add it in, and this may “be not just the straw that breaks the camel’s back but the cement that breaks the camel’s back,” Friedberg said. This is what worries him the most.

David Sacks then jumps in, noting that we all agree with the debt and deficit problems, but that the growth assumptions in the CBO report are too low. He emphasises that we need strong economic growth to get out of the debt death spiral.

All In - Debt Death Spiral (click on the following link, then click on the 32.48 minute mark).

Next are three excellent charts that paint the picture.

US Corporate Balance Sheets in Excellent Shape

US Government Sector Not in Good Shape

Barry Habib - “The Opportunity In Housing That So Many Can’t See”

Some good news! You can find the link here.

Follow me on X @SBlumenthalCMG

The views are Steve Blumenthal’s and subject to change. Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. See important CMG disclosures below.

If you like what you are reading, click on the following link.

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: February 19, 2026 Update

Trade Signals Sections:

Market Commentary

The Indicators Dashboard - Stocks, Investor Sentiment, Bonds, Commodities, Currencies, and Gold

Valuations and Subsequent 10-year Returns

Supporting Charts with Explanations

Why Trend Following Matters

Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor. Important disclosures.Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor.

About Trade Signals - Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.” – Charlie Munger

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: The WallachBeth Winter Symposium, Park City, Utah

The WallachBeth Winter Symposium begins next week in beautiful (and freashly snow covered) Park City, Utah. Over 150 attendees, including S&P, Nasdaq, JPMorgan, VanEck, Invesco, AllianceBernstein, Cboe Global Markets, NYSE, SEI, State Street, Cambridge Associates, First Trust, Goldman Sachs, asset managers, investment advisors, and family offices.

My good friend Andy McOrmond MCs the conference, which he hosts with his excellent WallachBeth team.

Warm regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201,

Malvern, PA 19355

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.

See CMG Disclosures at the bottom of this page.

For more information about NDR, please visit at www.ndr.com.

NDR, Inc. (NDR), d.b.a. Ned Davis Research Group (NDRG), any NDRG affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDRG publication. The data and analysis contained herein are provided "as is." NDRG disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. NDRG's past recommendations and model results are not a guarantee of future results. This communication reflects our analysts' opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDRG or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. For NDRG's important additional disclaimers, refer to www.ndr.com/invest/public/copyright.html. Further distribution prohibited without prior permission. Copyright 2025 © NDR, Inc. All rights reserved.