On My Radar - Scales of Fed Justice

September 12, 2025

By Steve Blumenthal

“Looking ahead, the Fed must scale back the distortions it causes in the economy. Unconventional policies such as quantitative easing should be used only in true emergencies, in coordination with the rest of the federal government. There must also be an honest, independent, nonpartisan review of the entire institution, including monetary policy, regulation, communications, staffing and research.”

— Scott Bessent, Treasury Secretary

The Fed meets next week, and the market overwhelmingly expects a 25-basis-point cut. The odds of a 50-basis-point cut are low. Source: CME Group

If you were already losing confidence in government data, this past week added to your frustration. The BLS (Bureau of Labor Statistics) removed 911,000 jobs from previously reported numbers. The total removed is now 2 million over the last three years. It seems that the “L” should be removed from the acranum. BS data is what we’ve been getting.

Dr. Lacy Hunt said, "The repeatedly and loudly proclaimed resiliency in the labor markets was wrong. Many private and public decisions were made on this extremely erroneous data. Wage and salary compensation, total personal income, private saving, GDI, national saving, industrial production, and productivity will all be revised lower since the preliminary data of all these indicators use the monthly payroll jobs, which so massively over shot actual employment growth.”

He added, “The revisions provide strong additional evidence that monetary policy is inordinately restrictive. With the labor markets as weak as now indicated, is it reasonable to question whether the corporate profits are as robust as currently believed?"

You’re not the only one losing confidence in government data and the Fed. I appreciate how Bessent pulled no punches in pointing his finger aggressively at the Fed, regulators, legislators, and the Treasury, which he leads. Writing in the Wall Street Journal’s Opinion section last Friday, Bessent wrote an article titled, The Fed’s ‘Gain of Function’ Monetary Policy. Stating that “The central bank put its own independence at risk by straying from its narrow statutory mandate.” Well worth the read. Justice to come? We’ll see. You can find it here.

Grab your coffee and settle into your favorite chair. Today, let’s take a look at the current equity market valuations, the 10-year Treasury, and the global money supply. All are key metrics to watch. And yes, it is reasonable to question the robustness of corporate profits. We’ll keep our eyes glued on earnings as well.

On My Radar:

Valuations - Extremely High

More Good Charts

Bright Spots - Doctor AI

Trade Signals: Update - September 12, 2025

Personal Note: Champion Mindset

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

Valuations - Extremely High

“Just because it is inevitable, doesn’t mean it’s imminent.”

— Author unknown

A client reminded me of the above quote, thinking it came from Doug Casey, Casey Research, but I was unable to confirm. Regardless, a good point. But boy-o-boy, we must be close to a bear market correction.

The stock market remains “Extremely Overvalued.” That doesn’t mean that all stocks are overvalued. Just ask the value-oriented managers. Seven stocks are dominating price performance and carrying the cap-weighted indices higher with their price gains. Let’s take a look at the latest data.

1) A Quick Look at Everything

“Extremely Overvalued,” pretty much across the board. Red is bad, green is good.

Source: NDR

2) Median PE

Median Fair Value is 33.1% below the August month-end S&P 500 Index Close

Note the red and green arrows.

Median Fair Value is at 4,323.68 (that’s a good opportunity target to keep in mind).

“We’d be better off here,” points to the 61.5-year mean PE of 17.6.

Median PE as of 8-31-25 is 26.37.

Source: NDR, CMG annotations

3) S&P 500 Index vs Stock Market Capitalization as a Percentage of Gross Domestic Income

The middle section (orange line) plots month-by-month market cap as a percentage of nominal (before inflation factored in) gross domestic income. The dotted line is an upsloping regression trend line.

The lower section (blue line) plots how far above or below the orange line is vs the trendline. When the blue line is above the upper dotted line, it is in the “Top Quintile” of all readings dating back to 1925. When below the bottom dotted line, it is in the “Bottom Quintile” of all readings since 1925.

NDR then plots the “Averge % Change in the S&P 500” that occurred 1-, 3-,5-, 7-, 9-, and 11 years later when your starting point was in the “Top Quintile” and when your starting point was in the “Bottom Quintile.”

Bottom line: We are in the “Top Quintile” with the current extreme nearing the high in 2021 but below the tech bubble levels in the early 2,000. The return outlook for the cap-weighted S&P 500 Index over the next 1 to 11 years is flat to negative. This is not a buy-and-hold investment opportunity in a U.S. large company cap-weighted equity index. There are other ways to make money.

Estimated returns are highlighted in the bottom section (“We are here” red arrow).

Source: NDR, CMG annotations

4) Household Equity Percentage vs. Subsequent 10-year Rolling Returns

The yellow bar at the top shows where we are now vs other periods of high household equity ownership (most recent data 6-30-25).

The “We are here” arrow indicates an approximate -3% total return for the S&P 500 Index over the next 10 years.

Note the correlation between the blue line and the orange line. Not perfect (nothing is), but it reflects a high 0.79 correlation coefficient since 1951.

The dotted orange line stops 10 years ago, since that is the last known 10-year performance return result.

What patient investors are looking for is a correction from the record extreme household ownership of stocks (currently the highest on record, dating back to 1951. Higher than 2000 and 2021.

Source: NDR, CMG annotations

5) The Bubble – Contains the Collapse and Contains the Resurgence

John Hussman’s June post is out. Worth the read. You can find it here.

Let’s focus on what John says is his “most reliable valuation measure, based on correlation with actual subsequent S&P 500 10-12 year total returns in historical data spanning a century of market cycles.

The blue line shows the market capitalization of U.S. non-financial equities as a ratio to their gross value-added, including our estimate of foreign revenues.

MarketCap/GVA presently remains beyond the 1929, 2000, and even 2022 extremes.

Indeed, the current level is less than 1% from the most extreme level in U.S. history, which was set in February of this year.”

The arrow in the upper right points to the current level, which is higher than 1929, 1966, 2000, and 2021.

Source: HussmanFunds

More from Hussman, “Sustaining the bubble requires valuation multiples to increase forever, without any upper bound. The reason the current bubble feels so good to investors is that, up until the present moment, valuation multiples have done exactly that.

The chart below shows precisely what this looks like in real-world data. The blue line in the chart below shows the estimated 12-year S&P 500 total return that we project based on our most reliable valuation gauge – MarketCap/GVA. The red line shows actual subsequent 12-year S&P 500 average annual nominal returns across a century of market cycles.”

Bottom line: Hussman’s process is estimating an approximate -7% total annual return over the next 12 years. Source: Hussman Funds

Source: Hussman Funds

Yes, it is true: “Just because it is inevitable, doesn’t mean it’s imminent.”

Timing the top is impossible; however, valuation metrics can help you set a game plan.

If you are in your 50s or older and heavily invested in the S&P 500, my advice is don’t quit your day job.

My personal view is that there are many other safer ways to make money, such as high and growing dividend-paying stocks, first lien senior secure credit funds, and select companies. And importantly, there will be an exceptional opportunity to own the large-cap indices when the next bear market arrives.

With all this said, I actively follow various market indicators in Trade Signals, and again this week, there is mostly green on the dashboard. Green is bullish, red is bearish. I also shared, with permission, a post Ned Davis sent to NDR subscribers this week. He expects the market to consolidate (sell off) and then a continuation of the cyclical bull market. The technical market evidence supports this view. No guarantees.

Not a recommendation to buy or sell any security.

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

More Good Charts

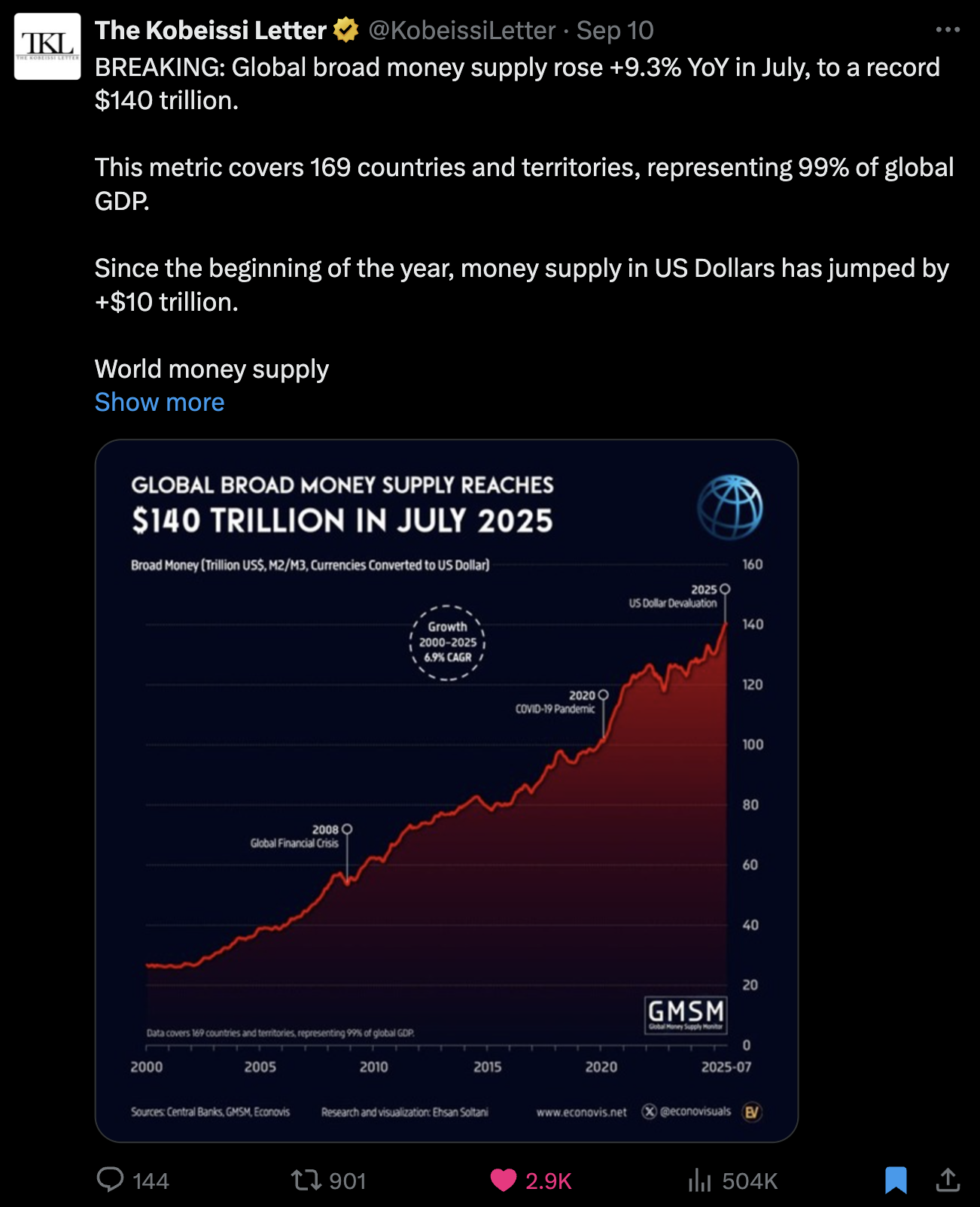

Chart 1: World Money Supply

This is insane! Inflation anyone? Click on the image for the source.

Chart 2: 2+ Standard Divations Above 50-Day MA

Source: @bespokeinvest

Chart 3: Inflation

Source: @charliebilello

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Bright Spots - Dr. GPT

The following article from Mauldin Economics’ Rational Optimist Society caught my eye, and I felt it was worth sharing with you. Please know that this is not something that will replace your doctor; I really like mine. It is something that will aid our doctors in helping us.

The article is titled, Your AI super doctor will see you now, by Stephen McBride, Aug 31, 2025. Here is a teaser, and you’ll find the link to the full post further below.

“Don’t Google your symptoms.”

WebMD.com is no substitute for a real doctor. AI is different. “Doctor GPT” is already much better than a human doctor in some important ways.

This is not hyperbole. ChatGPT aced the United States Medical Licensing Exam, the grueling, three-part marathon required to practice medicine.

And when Microsoft pitted its AI against a team of human specialists on the toughest mystery cases in the New England Journal of Medicine, the human experts got the diagnosis right 20% of the time.

The AI scored 85%.

How is it possible that AI beat human experts by 4X?

In part because the AI team created a virtual expert panel made up of different AI agents. These agents then debated diagnoses, challenged each other's assumptions, and even considered the cost of tests.

AI is almost perfectly suited to solving complex medical mysteries. Biology is staggeringly complicated. A single human genome contains three billion letters of code. The number of potential interactions between proteins in our bodies is infinite.

No human brain can even begin to grasp it all.

But AI can read every medical paper ever written and quickly spot patterns no human could.

You can find the full article here.

Hope to share more with you next week. Please let me know if you have anything super positive I can share with everyone.

Trade Signals: Update - September 11, 2025

“Stay on top of the current market trends with Trade Signals.”

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.”

– Charlie Munger

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: Champion Mindset

“You will have good days, bad days, overwhelming days, tired days, awesome days, I can’t go days, and every day you’ll keep showing up. This is the mindset of a champion.”

Source: @Bechampionminded (author unknown)

I read something a few months ago that I’ve been trying to keep in my daily routine. When I wake up, I spend a few minutes focusing on something that makes me feel happy - love of family, the feeling of skiing fresh powder snow, time with a good friend, a recent random act of kindness, etc. Then, I say to myself, “Something amazing is going to happen today.”

When I reflect at the end of each day, not every day is a win. But there were two “amazing’s” this week. One was a fantastic dinner event in NYC on Tuesday night with one of the EXPLORE (risk on) plays, and the other was an unexpected call presenting a new opportunity to us in a robotics company. How they play out, time will tell. But it was amazing to me and brightened my week.

In the face of far too many tragic events, I hope you found some amazing ones, too.

Ok, on to the fun stuff. The soccer season is off to an ok start. Coach Sue’s Malvern Prep Friars are five games in with three wins and two losses. Some good play, some missteps… fail-fix, fail-fix. It’s fun to watch the team take shape.

The early-season games are against non-conference opponents. For the boys and the school, it’s all about winning the Inter-Academic League, an interscholastic athletic conference consisting of several private high schools in the Philadelphia area. It’s a competitive league, founded in 1887, and serves as the country's oldest interscholastic athletic conference. The competitive juices run deep. The first InterAc game is at the end of the month. I believe this is Coach Sue’s strongest team in years. Hopes remain high.

I’m racing to hit the send button with hopes of getting to the 4:15 pm ET game at the Lawrenceville School near Princeton, NJ. Maybe “something amazing” will happen on the soccer pitch today! Champion mindset - Go Friars.

Visualizing a post-game Victory (Hop-devil) IPA with Coach Sue. Pun intended. An ice-cold beer always tastes better after a “W.”

Best of luck to your favorite teams this weekend, unless you are Villanova (playing Penn State) or Kansas City (playing Phila). We’ll be friends again next week. :)

Kind regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201, Malvern, PA 19355

Private Wealth Client Website

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.