On My Radar - Trapped Like a Rolling Stone

September 19, 2025

By Steve Blumenthal

“There are no risk-free paths now.”

— Jerome Powell, Chairman of the Federal Reserve (press conference September 17, 2025)

Watching our Fed Chairman speak on Wednesday, following the 25 bps point rate cut, Elvis Presley’s “We’re caught in a trap, I can’t walk out,” softly crossed my mind.

“No risk-free paths now.” Edward Chancellor’s book, The Price of Time, reminds us that, across thousands of years of monetary history, governments have almost always printed money, devalued their currency, and inflated away the burden.

Powell also said the Fed expects to cut two more times this year, but added the Fed is continuing to sell off some of the bonds it owns on its balance sheet. Quantitative Easing (QE) is when the Fed buys bonds, essentially putting more money into the system. Quantitative Tightening (QT) is when the Fed sells bonds, which technically puts upward pressure on interest rates and withdraws money from the system.

Unemployment is rising, and inflation is rising. The Fed is caught in a trap. Powell concluded, “It is quite a difficult situation for policymakers.”

Ray Dalio wrote this week, “By most measures, the Big Debt Cycle is tracking the cycle he laid out in his book, How Countries Go Broke: The Big Cycle.” I highlight his note and provide a link - an essential read.

We are witnessing the same human behavior today. I argue in today’s piece that we are on the path to a new monetary system.

Grab your coffee, slow your mind, put on your game theory hat, and keep your eyes focused forward, looking out over the horizon.

On My Radar:

On Path to a New Monetary System

It All Has Happened Before for the Same Reasons, Ray Dalio

Trade Signals: Update - September 12, 2025

Personal Note: The Daily Coach

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

On Path to a New Monetary System

“How Does It Feel, to be on your own, with no direction home, like a complete unknown, like a rolling stone?”

— Bob Dylan

The Price of Time reminds us that throughout history, when debts became too large, governments almost always chose the same path: they printed money, devalued their currency, and inflated away the burden. Rarely did it end well.

I see echoes of that history now. We are watching it play out. Ray Dalio gives it three years before the monetary system resets. More from Ray immediately below.

Impossible to stop? No. Likely to happen"? Yes.

What is needed is strong legislative leadership and the ability to make hard decisions, but sadly, that seems unlikely. I believe it will take a crisis.

Governments almost always debase the currency. Each time, something more credible had come in to replace it. When trust is lost, a new system eventually emerges.

Here’s how I see the transition unfolding:

Stage 1: Erosion of Fiat Trust (already underway)

U.S. deficits remain high, and debt service crowds out the budget.

The Fed is forced to cut rates and monetize debt through QE (the Fed balance sheet explodes higher as it absorbs the debt).

Inflation waves persist (wave number two is underway, and inflation remains problematic) while headline CPI can be managed lower, real purchasing power erodes. Impacting everyone - devastating for more than half the population.

Foreign central banks diversify away from the dollar, led by record gold buying. (Ray Dalio hits this topic well below)

Stage 2: Rise of Digital Rails (next 3 to 5 years)

Central Bank Digital Currencies (CBDCs) gain traction worldwide. Nearly every major central bank is already piloting them.

U.S. banks integrate crypto rails, making it easier to transfer funds between fiat and digital currencies.

Private crypto adoption grows, particularly in emerging markets where fiat systems are weakest.

Alternative trade blocs (BRICS, Gulf states) experiment with commodity or currency-backed settlement outside the dollar system.

Stage 3: The Grand Reordering (3 to 7 years)

A new global settlement system emerges, likely a digital currency backed by tangible assets - gold, Treasuries, commodities, etc.

This hybrid model combines the efficiency of crypto rails with the credibility of hard collateral.

The fiat dollar system gives way to something that restores confidence by limiting governments’ ability to inflate away obligations.

Gold, commodities, and select sovereign bonds become the foundation of the new system.

Probability? I spend a lot of time thinking about this and give this transition a better than 60% chance within the next five years and a 75% chance within the next ten years (my personal estimate).

History shows us that when debt overwhelms fiat money, the system resets.

The difference this time is that technology makes a crypto-backed solution viable.

Investment implication: The “backing assets” of the future system are likely to be gold, commodities, and perhaps Bitcoin, serving as a bridge—a kind of monetary insurance policy against a reordering that appears to be unfolding before our eyes.

I sense that we are heading toward what has played out many times before in human history:

Rates pushed back toward 1%

A weaker U.S. dollar

More QE, with the Fed buying increasing amounts of long-term Treasury debt, and eventually the Fed, Treasury, and legislators turning to some form of yield curve control.

Add in elements of modern monetary theory, and pressure on the dollar could intensify, especially if U.S. banks step deeper into crypto, potentially sparking a run from dollars into gold.

Gold, of course, has always been the ultimate monetary barometer. But history shows it is not the only asset that can benefit when governments attempt to inflate away debt. Things to discuss with your advisors:

Hard assets like real estate, farmland, and commodities tend to hold value.

Energy, particularly oil and uranium, often outpaces inflation.

Equities tied to tangible assets, like resource producers, infrastructure, and logistics, may also perform relatively well, especially if they enjoy pricing power.

Not everything is overvalued - commodities may be on the verge of a new long-term bull cycle.

Not all equities are overvalued - such as high-free-cash-flow companies that pay high and growing dividends with low debt-to-leverage ratios.

Bitcoin and digital assets as alternative stores of value.

Avoid long-duration bonds: Trade bonds rather than buying and holding them. Favor short-duration credit, floating-rate debt, and selective exposure to TIPS (but keep in mind that Governments have a habit of underreporting official inflation).

Deficits are climbing, and while headline CPI can be managed lower, the real story will play out in market prices. Keep your eye on the dollar, the yen, gold, commodity prices, and the 10-year Treasury yield. If history is any guide, they may once again be the important Trade Signals.

A Summary of What to Watch for?

Please think of the following as key things for us to keep our eyes on (my current guess - not a guarantee):

Fed Funds Rate back toward 1% – Rising unemployment will eventually necessitate policy easing, even if inflation remains uncontrolled.

A weaker U.S. dollar – Debt monetization and lower rates put pressure on the dollar, particularly if global capital seeks alternatives.

Fed/Treasury/Executive Office/Legislators – Direct absorption of Treasuries would ease interest rate stress. Implementing some form of interest rate control. Fed risks its credibility. Disastrous for the dollar and inflation.

Fed restarting QE – Once deflationary pressures or a credit shock emerge, QE returns.

Yield Curve Control (YCC) – A more extreme measure, but not unthinkable if bond markets revolt against massive issuance.

MMT-style policies – Think Edward Chancellor's study of history. Already underway, but the government’s fiscal dominance could expand materially.

Gold accumulation by central banks - Happening now.

Central Bank Digital Currencies (CBDCs): Nearly every major central bank is developing one. The technology rails are being built.

Crypto rails in U.S. banking: The deeper U.S. banks integrate digital assets, the easier it becomes to shift into a new form of money when trust in fiat falters.

Crypto adoption - Still speculative, but worth monitoring as banks integrate digital pathways.

Flight to gold – As trust in fiat currencies erodes, history shows investors eventually turn to gold.

“We’re caught in a trap, I can’t walk out.” My revised lyrics, “We are on our own, like a rolling stone… It’s not a complete unknown. We can find our way home.” I know, I know, corny. I won’t quit my day job.

The game plan is to beat inflation. I hope I’m wrong. I fear I’m right. There are ways to position wealth regardless.

We just republished our CMG paper on “How We Think About Wealth.” Click on the following image to sign up to receive the paper.

Registration for the paper: Please note that if you are interested in learning more about the investments we utilize to address the period ahead, we can connect with you after 30 days. There are specific regulatory qualifying rules. Regulations require us to make sure you are qualified for certain investments. If you have already been in contact with us, the 30-day regulatory rule does not apply. Please leave us a short comment if you prefer not to be contacted.

It All Has Happened Before for the Same Reasons, Ray Dalio

“For me, watching the news feels like watching a contemporary version of a movie that I’ve seen many times before. While the details change—the specific leaders, clothes, technologies, and stories aren’t identical—the basic story that is now unfolding and the cause/effect relationships that are driving it are the same as what I’ve seen many times in history (most recently the 1930s) and are laid out in detail in my book and video, Principles for Dealing with the Changing World Order.

Because seeing things this way has brought me great benefits and because I’m now at a stage in my life where I want to pass along to others what I see that might help them, I am sharing how I see what’s going on through that lens.

What follows are all things I have recently seen in the news that I haven’t seen through most of my lifetime, but that I have seen many times before in my study of history. These events are all following my Big Cycle template that points toward breakdowns in monetary, political, and geopolitical orders.

So here is what I’ve watched in the news and how I saw it:

The passage by the central government of the world’s leading reserve currency country, which is heavily indebted, of a budget bill that will produce big deficits that will require large bond sales and big increases in debt service payments, which will most likely be dealt with by the central bank pushing real interest rates down and monetizing its debt—increasing the risk to fiat money and debt denominated in it.

The imposition of relatively large tariffs for both economic and geopolitical reasons in an attempt to make the country more competitive, bring in tax revenue, and use trade as a weapon against opposing countries.

Moves by the country’s leader to increase his control over the central bank.

Moves by the country’s leader to gain control over both the political system and his political opponents that he believes are ruining the country, leading to conflict between those of the hard right and those of the hard left.

Moves by both the rightist (Republican) and leftist (Democratic) sides in a democracy to influence the elections to come out in their favor via redistricting initiatives (by Republicans in Texas and Democrats in California) rather than through representative democracy.

The deployment of the National Guard in cities that have social disorder and political opposition to the leader’s policies.

The shooting, martyrizing, and eulogizing of a political figure (Charlie Kirk) in a country where there is a lot of gun violence and increasing political violence.

Leaders from a group of rival powers (China, Russia, India, North Korea, Iran) gathering in meetings and for a military parade to talk about and display their powers to challenge the leading world power and its world order.

The incursion (by Russian drones) into countries (Poland and then Romania) that are in an alliance with other major countries (NATO countries) requiring them to enter a war if an attacked member country triggers that action.

The attack of a country at war (Israel) on its enemies who were being housed in a neutral sovereign country that was trying to help negotiations between Israel and Hamas.

There are many more news items that I could cite that paint a picture that is inconsistent with what we have become used to in this world order since World War II but is very consistent with what has happened at other times in history, especially during prior breakdowns in monetary, political, and geopolitical orders (e.g., in the 1930s).

I have found that studying the cause/effect mechanics of history makes it possible to logically explain these cause/effect relationships because they are relatively clear. I have built my understandings of these relationships into tools and models/templates for seeing how history has transpired. Because the causes come before the effects, these models have worked well for me, and I can’t help but see things through that cause/effect lens. While I have other models that determine my day-by-day positioning in the markets, my Big Cycle template has been most important in determining my big, long-term positioning.

By the way, I agree with the idea that history rhymes rather than repeats exactly. That is because many situations are similar, but none are identical. I find that to understand the big things that are going on and where these big things are probably headed, it is most important to focus on the interactions of the big forces and not squint at the details or expect precision. I suggest that you do the same.”

Ray goes on to explain how the Big Cycle works. Always worth the read.

Click on the photo to go to the full post.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: Update - September 19, 2025

“Stay on top of the current market trends with Trade Signals.”

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.”

– Charlie Munger

Trade Signals is Organized in the Following Sections:

Market Commentary and Notables This Week

The S&P 500 Index (Stocks) and The 10-year Treasury Yield (Bonds)

Trade Signals - Dashboard of Indicators

Market Valuations and Subsequent 10-year Returns

Supporting Charts with Explanations

Technicals, Fundamentals, Macroeconomics, and Investor Behavior

*Trade Signals basics: The Market Commentary section summarizes notable changes in the core key indicators: Investor sentiment, market breadth, stocks, treasury yields, the dollar, and gold. The Dashboard of Indicators provides a detailed view of all Trade Signals indicators.

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: The Daily Coach

“Nothing in life is of any value unless it is shared with others.”

Source: The Daily Coach

I enjoy the frequent notes from “The Daily Coach” that hit my inbox. I’m addicted to sports, as you're probably aware by now.

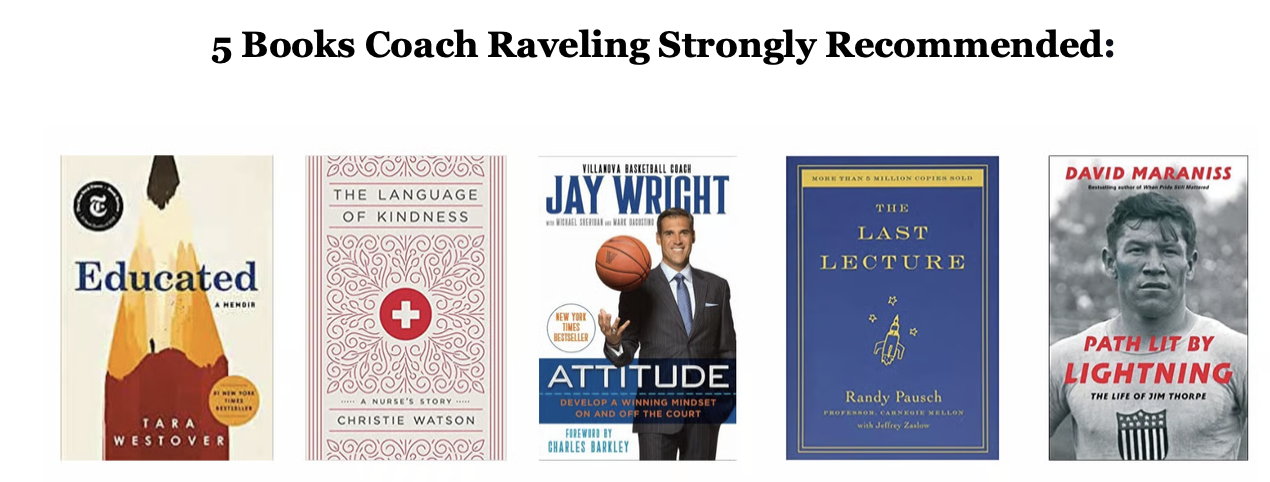

Early this month, Coach George Raveling passed away: a great man, coach/teacher, mentor, and friend to many. In tribute to Coach Raveling, the Daily Coach wrote this,

“In a world and society that didn’t see his humanity at birth, he spent decades upon decades seeing the humanity in others—pouring into people from all walks of life, never expecting anything in return. Because for Coach, the arenas of leadership and sports were never truly about the wins and losses. They were about the relationships, the lessons, the beauty of witnessing transformation in others, and the responsibility of equipping those who entrusted him to lead them for the ultimate game—the game of life.

Coach Raveling was more than a barrier-breaking basketball coach or visionary executive. He was gentle, thoughtful, compassionate, humble, kind, curious, authentic, and a beautiful soul. He cared deeply about people and about doing what was right, not just what was comfortable.“The essence of education is not to stuff you with facts but to help you discover your uniqueness, to teach you how to develop it, and then to show you how to give it away.”

I typed the Coach’s note (shown below) for easier reading. “The most important needs of all are what we need in ourselves - a need to be seen, a need to be known, a need to be recognized, a need for achievement, a need to enjoy our world, a need to see the continual wonder of life, a need to be able to see how wonderful it is to be alive. But we’ve forgotten how to look at each other anymore. We don’t look at each other; we don’t listen to each other, we don’t touch each other, heaven forbid.”

Many of us do listen to each other. We seek and encourage thoughtful debate. Maybe the best we can do is be true to who we are and show up every day trying to give it our best. Hopefully, our actions have a positive impact. Can’t fix stupid. Great coaches play a vital role in the ultimate game—the game of life. Thank you, Coach George. Welcome home.

Source: The Daily Coach, George Raveling

You can subscribe for free to The Daily Coach here.

I’ll be on the sideline next to my favorite coach, Coach Sue (my wife), by the time this note hits your inbox. Hopefully, discussing this afternoons MP Friars high soccer game. The boys are 5-2-0 on the season and are exciting to watch.

While soccer and striving for wins are essential, what I love most are the challenges that present that open the door to growth. I guess one doesn’t happen without the other. And I love great teachers.

The Game of Life!

If you are inclined, you can follow the MP soccer schedule and results here.

NYC, Tampa, Phoenix, and the Ryder Cup

I’m in NYC next Wednesday for a dinner with Jan van Eck and his team (big fan). Then, to Tampa, FL, early Thursday for a due diligence meeting with some golf mixed in at Old Memorial on Friday/Saturday. Phoenix follows in early October.

Speaking of golf, the Ryder Cup tees off next Thursday. Outside of the Masters, it is one of my favorite golf events. For those not familiar, the Ryder Cup is a biennial, three-day men's golf competition between the United States and Europe. The event pits the top professional players from the U.S. vs the best players from Europe. This year, it is being played at Bethpage Black in Farmingdale, NY.

Have a great week!

Kind regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201, Malvern, PA 19355

Private Wealth Client Website

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.