On My Radar: AI, Seven Stocks, and Private Credit

November 14, 2025

By Steve Blumenthal

“A high work ethic and a good attitude put you in places where good luck can find you.”

– AllistairMcCaw, Mindset Coach and author of Champion Minded

Today, let’s take a look at AI and the Mag 7 stocks. You’ll find several excellent charts (“startling” comes to mind), we will dive a little deeper into the forward earnings potential, and what this might mean if earnings miss.

A topic made much more interesting this week by investor Michael Burry (do you remember the The Big Short movie?) detailed analysis posted on X accusing the major AI hyperscalers (like Meta, Oracle, Alphabet, Microsoft, and Amazon) of overstating earnings by extending the depreciation timelines on AI hardware (e.g., Nvidia chips and servers) from 2-3 years to 5-6 years or more, potentially understating depreciation by ~$176 billion from 2026-2028.

Put it on your radar - CNBC headlined: “‘Big Short’ investor Michael Burry accuses AI hyperscalers of artificially boosting earnings.” For more context, CNBC covered it here.

Grab that coffee and find your favorite chair. In addition to the AI charts and earnings data, you’ll find a summary of what is going on in the private credit space.

Tax Mitigation: You have less than two months to do some strategic tax planning for 2025. The U.S. tax landscape is not merely a set of restrictions; it is a catalog of incentives provided by Congress to encourage specific types of investment and economic activity. We wrote a paper on Tax Mitigation Strategies. You can find it here (it’s free).

On My Radar:

AI and The Seven Dwarfs

Howard Marks - Cockroaches in the Coal Mine

Bitcoin Explained

Trade Signals: November 13, 2025 Update

Personal Note: 3-0 Win, Ice Cream, and a Banquet

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

AI and The Seven Dwarfs

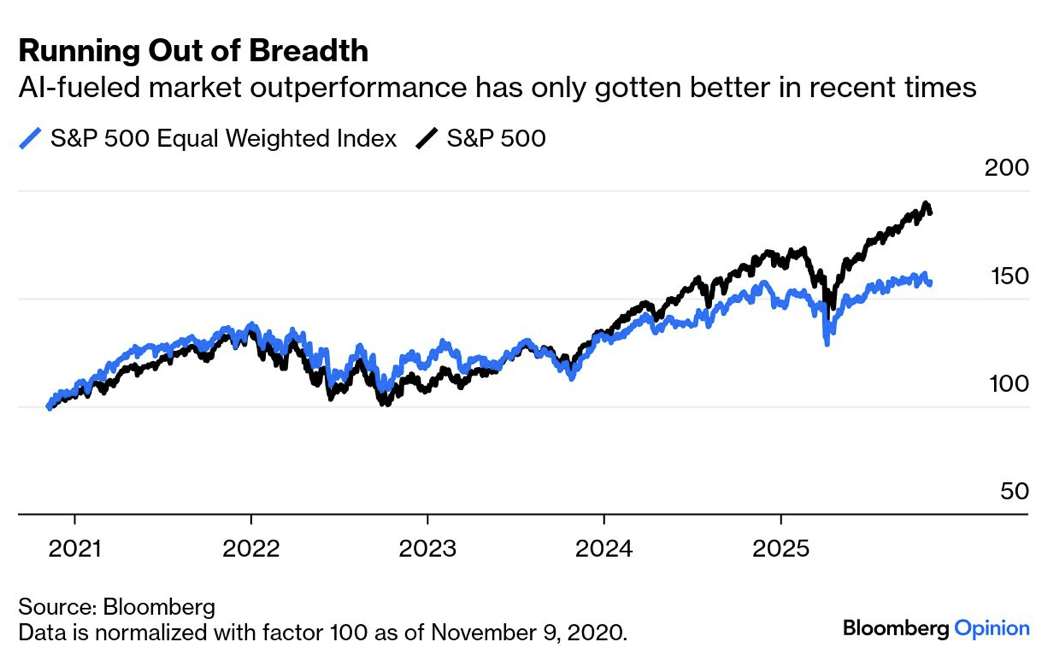

To gauge the impact of the Mag 7 on the market, the following chart illustrates that equity returns over the past five years are driven primarily by the Mag 7 (Apple, Amazon, Alphabet (Google), Nvidia, Microsoft, Tesla, and Meta (Facebook)).

Source: Bloomberg

“The third-quarter earnings season was surprisingly good, which is not surprising. Outperformance by mega caps since 2022 (the “Year of ChatGPT”) is almost a given and no longer exceptional — and chief financial officers continue to set a low-enough expectations bar in advance that they can get some positive headlines when they clear it. What matters now is whether the broad universe of stocks can contribute meaningfully to the market’s momentum.

Despite sporadic selloffs, stocks’ overall performance suggests a resilient economy. Artificial intelligence- and the huge capital expenditures to prepare for it- is papering over the cracks. Since the trough after April’s Liberation Day tariffs announcement, the equally weighted version of the S&P 500 has fallen further behind the main cap-weighted index, which is skewed by the tech behemoths:

Source: NDR, CMG Investment Research

If non-AI stocks had matched the performance of their AI-driven peers, Societe Generale’s Manish Kabra estimates that the index would be approaching 8,000; it closed last week at 6,728. Third-quarter earnings suggest this will continue.

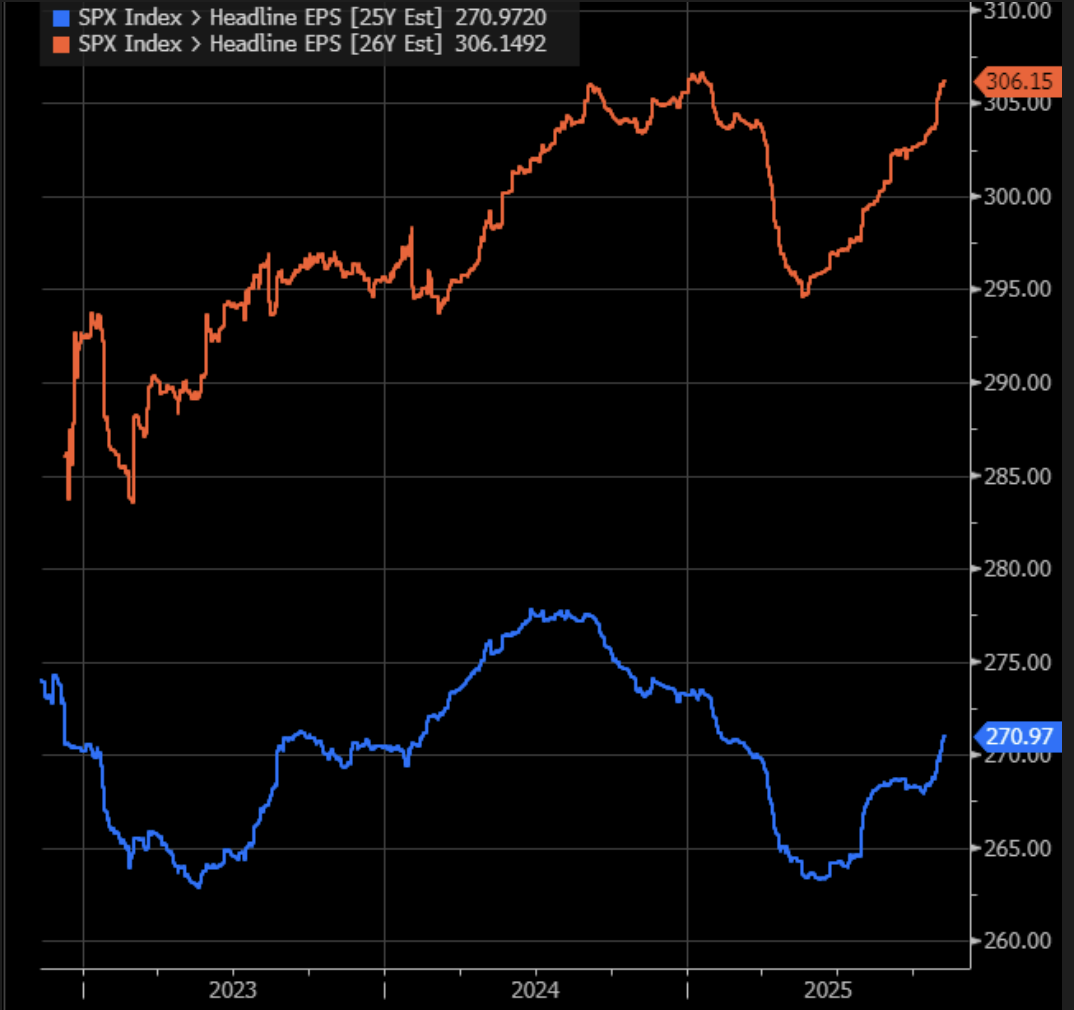

Viewed differently, this (next chart) is the gap between earnings expectations, as recorded by Bloomberg’s earnings expectations graph (EEG <GO> on the terminal) function, for the cap- and equal-weighted versions of the S&P 500. This is how 2025 and 2026 EPS expectations have moved for the cap-weighted version:

Source: Source: Bloomberg EEG

And this is the same exercise for the equal-weighted version:

Source: Source: Bloomberg EEG

The entire picture depends on the mega caps, with the tech-heavy Nasdaq 100 responsible for 82% of the S&P 500’s 12% EPS growth. The Institutional Brokers Estimate System consensus suggests that EPS growth outside the Nasdaq 100 will surge to 12.7% in the coming year, becoming the primary contributor to overall earnings expansion. Much depends on whether this is right.” Source: John Authers, Bloomberg

Market Trend:

Each week in Trade Signals, I post several market trend indicators, and for some time, despite the extreme overvaluation, the evidence has been bullish. “The trend is your friend,” the saying goes.

Market Breadth:

The general theory holds that when the majority of stocks are advancing, a healthy bull market is present. When fewer are gaining, the risk of a recession is higher, and stocks don’t do well in a recession. When the economy slows, businesses generate less revenue, which can affect their earnings.

Both “trend” and “market breadth” are essential technical indicators to monitor. The market trend appears to be okay right now, but market breadth is starting to weaken (more on that in the Trade signals section below).

Earnings Surprise, from Mauldin Economics Over My Shoulder publication, November 5, 2025:

“Being in a position where your costs are rising faster than your income is uncomfortable for any family, and for big companies, too. This table shows Wall Street analysts think that’s where the AI giants are going. The first column shows actual earnings per share (EPS) growth for the last four quarters, which was impressive. The next column shows estimated EPS growth for the next four quarters is sharply lower at four of the companies and down a smaller amount at the other (Microsoft).

Source: Jesse Felder

These estimates could be wrong, of course. The AI landscape is changing quickly. Wall Street’s earnings estimates also tend to start out low, which is why companies so frequently “beat” the target. We should also note that lower growth is still growth. No one predicts outright lower earnings at these companies (though Meta is close). But when expectations are so high, going from “a lot more profitable” to “a little more profitable” could still disappoint some investors. Stay tuned.”

As I mentioned above, this is a topic made much more interesting this week by investor Michael Burry (do you remember the The Big Short movie?) detailed analysis posted on X accusing the major AI hyperscalers (like Meta, Oracle, Alphabet, Microsoft, and Amazon) of overstating earnings by extending the depreciation timelines on AI hardware (e.g., Nvidia chips and servers) from 2-3 years to 5-6 years or more, potentially understating depreciation by ~$176 billion from 2026-2028.

Put it on your radar - CNBC headlined: “‘Big Short’ investor Michael Burry accuses AI hyperscalers of artificially boosting earnings.” For more context, CNBC covered it here.

Howard Marks - Cockroaches in the Coal Mine

I enjoy reading Howard Marks ’ memos.

Marks provides crucial context on the recent credit failures. Something JPMorgan’s Jamie Dimon called, cockroaches. He was referring to the bankruptcy filings from First Brands, an auto parts supplier, and Tricolor, a seller of and subprime lender against used cars.

The impression given by the “cockroaches” analogy is that there is systemic risk in the system. Emotionally, it evokes memories of the 2008 subprime mortgage crisis, which led to the collapse of Lehman Brothers, Bear Stearns, and AIG.

This is an important asset class in my view, especially if I’m correct that “all roads lead to inflation.” In a rising inflation, rising interest rate cycle, I prefer investing in debt that will pay a higher yield as interest rates rise.

For example, I could invest in a 4% yielding 10-year Treasury bond, but if rates rise to 7% and inflation stays at 3% or moves higher, I won't make money; in fact, the value of my investment will decrease. Who would want to buy my 4% yielding bond in a world where interest rates are 5%, 6%, or 7%?

My team and I have fielded numerous calls on the cockroach topic, as my firm is actively involved in the private lending space. I share the following with you and hope it helps you better understand this unique and valuable investment space.

To begin, we agree with Howard Marks that this is not a systemic issue that can bring down the financial system like subprime did in 2007-2009; a crisis I foresaw and wrote about before the collapse (although, honestly, I felt it was a $500 billion problem, not several trillion). However, there are some similarities today in something called Broadly Syndicated Loans. Let’s take a look.

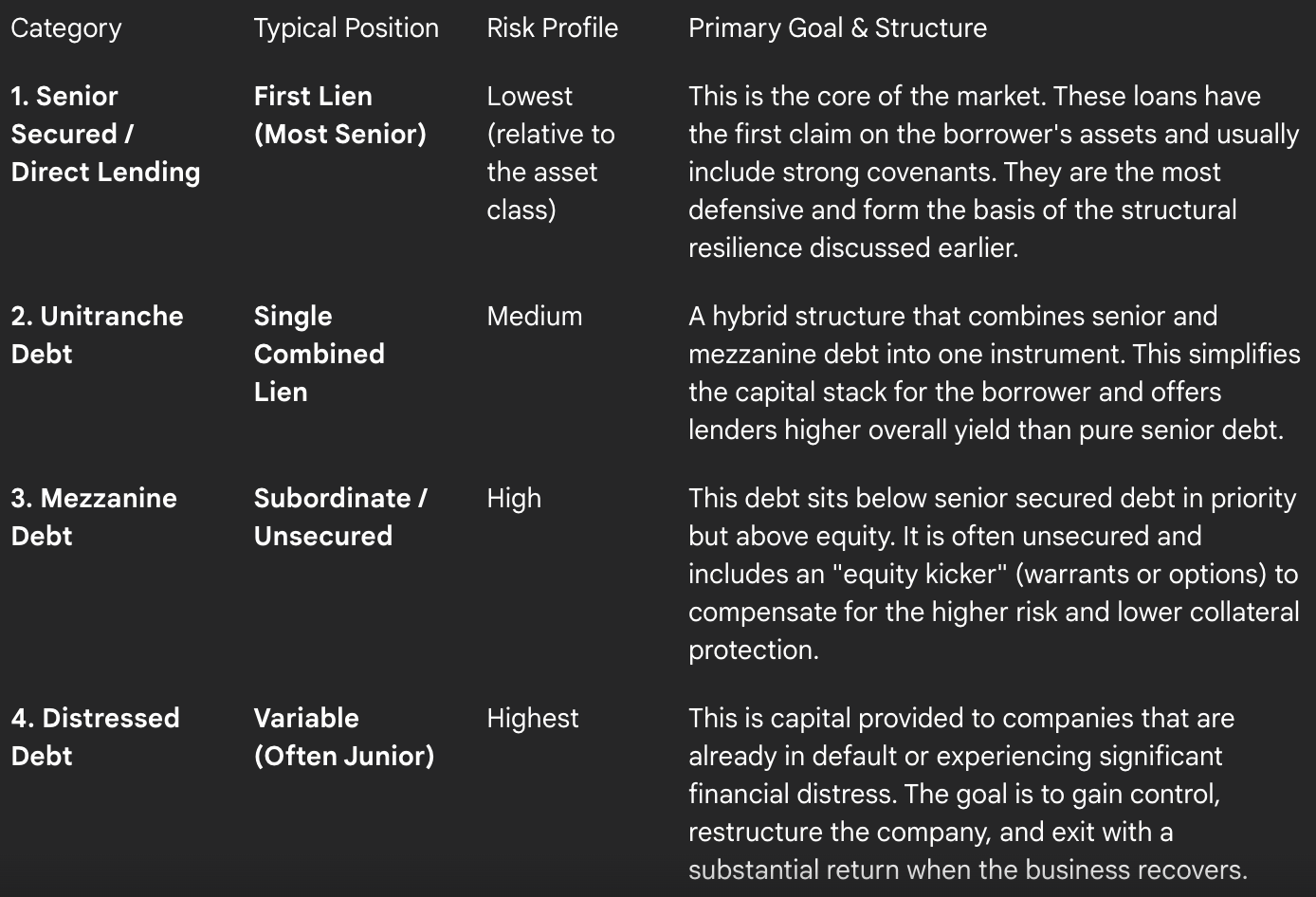

Private credit is a diverse ecosystem of debt instruments that sit outside traditional bank or public bond financing. The private credit market is typically segmented by the seniority of the loan and the risk/return profile. There are two prime categories:

Private Debt or direct private lending to businesses

Broadly Syndicated Loans (BSL)

The explosive growth of the Private Debt market, which had previously been a niche product, was primarily due to the Global Financial Crisis (GFC) and the subsequent regulatory crackdown on banks.

Basel III & Dodd-Frank: These regulations imposed stricter capital requirements and risk retention rules on commercial banks. This made it significantly more expensive and capital-intensive for banks to hold higher-risk assets, such as leveraged loans to middle-market companies, on their balance sheets.

The Shift: As banks consolidated and faced new reserve requirements, they pulled back from lending to the small and mid-sized corporate segment (the "middle market"). They shifted their focus to originating large, less risky loans or using the "underwrite and distribute" model (selling loans via syndication) to collect fees without holding the default risk.

The Vacuum: This regulatory-driven retrenchment created a massive financing vacuum for the middle market, which private credit funds, unburdened by the same banking regulations, were eager and able to fill.

The area to lean into for private credit is direct lending to businesses. The area to generally avoid, in our view, is the broadly syndicated loans (BLS). Our friends at Cliffwater put it this way:

Systemic risk is much less likely in private debt compared to the broadly syndicated (bank) loan market. Why?

Private debt lenders hold the loans they originate to maturity. Banks originate loans but then sell those loans through broad syndication, collecting fees but offloading default risk to investors. Banks lack incentives to “just say no” to bad loans.

Bank loans (aka broadly syndicated loans or “BSLs”) lack covenant protections against cockroaches that most private middle market loans possess.

Broadly syndicated loans are less likely to be private equity sponsored, making their debt more susceptible to weak management and fraud.

Broadly syndicated loans in workout are likely to see greater value destruction due to the potential use of subordination strategies by specialized distressed investors, in contrast to private middle-market loans, where private equity borrowers and private debt lenders are more likely to seek value-preserving loan restructuring.

Almost one-half of broadly syndicated loans become part of highly leveraged collateralized loan obligations (CLOs), where problem loans can put price pressure on other loans in an effort to de-lever.

The following grid is a further explanation. I added it before the Howard Marks summary notes and want to note that Marks is an opportunistic “Distressed Debt” investor. We like to focus on the Senior Secured / Direct Lending category, but also find the Distressed Debt category interesting.

Source: CMG Investment Research

Howard Marks

The following are my bullet-point summary notes for speed reading. You can read the entire “Cockroaches in the Coal Mine” Memo here. Views are Howard’s and subject to change.

1. The Recent Failures Are a "Cockroach," Not a Systemic Breakdown

Marks acknowledges the high-profile bankruptcies of First Brands (an auto parts supplier) and Tricolor (a subprime auto lender), noting that these, along with fraud allegations at two mid-sized banks, raised immediate concerns about widespread failure.

He argues the issues are not "systemic" (meaning there is nothing fundamentally wrong with the financial plumbing, like counterparty risk in 2008). Instead, they are "systematic," a regularly recurring behavioral phenomenon where imprudent loans and business frauds occur in clusters during good times.

Defaults and fraud are an inevitable part of sub-investment-grade lending. Marks says that the yield spreads exist precisely because credit risk is always present, even if it disappears from investors' consciousness during a boom.

2. The Private Credit Market Growth

Private credit grew rapidly after 2011 because banks retreated, allowing money managers (lenders) to initially demand high interest rates and stringent safety levels for loans, primarily to private equity sponsors.

Marks long-held view is that the sector benefited from a decade-plus of "mostly benign" economic conditions, meaning the market had never truly been tested by an economic downturn. The influx of nearly $2 trillion in capital may lead to more competition and relaxed lending standards.

3. Investor Psychology: The Cycle in Attitudes Toward Risk

The most important cycle is ‘the Cycle in Attitudes Toward Risk.’ When times are good, people become complacent, their risk tolerance grows, and they focus less on due diligence, leading to a lowering of lending standards. They prioritize not missing out (FOMO) over prudence.

Bad times expose the results of carelessness. Investments made without adequate investigation or a sufficient margin for error fail to hold up in a hostile environment. "The worst of loans are made in the best of times."

4. Fraud Is a Product of Good Times

Marks references John Kenneth Galbraith’s concept of the "bezzle" (fraudulently inflated wealth).

The inattentiveness that persists during good times creates the perfect conditions for fraudulent schemes. When people are trusting and money is plentiful, the rate of fraud discovery falls. Marks suggests the last sixteen years of uninterrupted growth are likely to have produced a "bumper crop of frauds" yet to be discovered.

5. Superior Credit Analysis

Superior credit analysis requires second-level thinking- assembling a mosaic of information and inferences, rather than relying on one obvious data point.

Howard Marks' Outlook (SB - Final notes):

The Immediate Future is "More Interesting" (Negative): Marks explicitly states that the coming period is likely to be "more interesting," which is Oaktree's polite way of saying the next few years will be challenging as the "errors that were made in those good times come to light." More frauds will be exposed, and more careless loans will default.

The Long-Term Outcome is Healthier (Positive): Marks concludes that the frauds and failures will likely have "chastened lenders and investors," forcing them to re-elevate their standards, perform better due diligence, and incorporate a higher level of prudence. This necessary return to discipline will create healthier investment conditions for those with capital and strong credit skills (like Oaktree) in the long run.

Bottom line: Marks believes that the current failures confirm the market is late in the cycle and discipline has been lacking. Still, these events are a necessary and systematic cleansing that will improve opportunities for shrewd credit investors going forward.

Please see the important CMG and NDR disclosures below.

Bitcoin Explained

Peter Van Valkenburgh, Coin Center’s Director of Research, gave one of the most straightforward explanations of Bitcoin during a U.S. Senate hearing, breaking down what it is, why it matters, and how it challenges traditional finance. Click on the image to watch.

Not a recommendation to buy or sell any security.

Tax Mitigation Strategies

This paper aims to provide a foundational understanding of sophisticated tax mitigation strategies. By exploring these strategies, we encourage investors to view the tax code as a powerful tool for wealth creation, not just a liability to be managed.

Click here or on the icon to sign up for the paper (it’s free):

Please note that CMG is not a qualified tax professional. Please consult with your tax advisor.

If you like what you are reading, click on the following link.

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: November 13, 2025 Update

Trade Signals is Organized in the Following Sections:

*Trade Signals basics: The Market Commentary section summarizes notable changes in the core key indicators: Investor sentiment, market breadth, stocks, treasury yields, the dollar, and gold. The Dashboard of Indicators provides a detailed view of all Trade Signals indicators.

Market Commentary - Market Breadth

Market breadth refers to the number of stocks participating in a market's movement, typically used to gauge the overall health of a market trend.

It measures the number of stocks advancing versus declining, or the volume of stocks rising versus falling.

Strong market breadth indicates broad participation (many stocks moving in the same direction), suggesting a robust trend.

In contrast, weak breadth (few stocks driving the trend) may signal potential fragility or reversal. Common indicators include the Advance-Decline Line or the Percentage of Stocks Above Moving Averages.

My personal favorite market breadth indicator is the CMG NDR Long/Flat Index. The most recent score is 69.10; it was 67.32 last week and 67.27 the week before. A drop below 50 will be a Bear Intermediate-term Trend Signal. Bottom line: We remain above the important 50-line.

You’ll find a detailed description of how it works below.

Key Macro Indicators - Investor Sentiment, Market Breadth, The S&P 500 Index (Stocks), The 10-year Treasury Yield (Bonds), and the Dollar

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

“Extreme patience combined with extreme decisiveness. You may call that our investment process.

Yes, it’s that simple.”

– Charlie Munger

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: 3-0 Win, Ice Cream, and a Banquet

"Focus on the little things and the big things will take care of themselves."

— Walter Bahr

Repeating the above quote shared last week. Last night was the season-ending banquet for the MP Friars, Susan’s boys' high school soccer team.

The final game ended in a 3-0 away game win. We celebrated with a stop at Handles Ice Cream on the way home. Align your incentives with the desired outcome. Ice cream seems to be an excellent motivator for teenage boys.

The banquet was last night. Fourteen seniors. Coach Sue reflected on each of them individually. It was wonderful/emotional.

From the age of 18 to 21, I had a legendary soccer coach named Walter Bahr, although it took me some time to realize just how legendary. Young and self-absorbed, I later learned he was the captain of the U.S. National team that beat England 1-0 in the 1950 World Cup. There is a movie called The Game of Their Lives" about that team. The coach of that team was William “Bill” Jeffrey.

Our home stadium was called Jeffrey Field. About halfway through my Sophomore year, one of my teammates told me about Walter and Jeffrey Field (that very same Bill Jeffrey). I was shocked.

I think about sports and life. Winning, losing, improving, failing, injuries, working with others - some you love, some maybe not as much. Regardless, one team, one vision, one dream. Creating together.

The Friars’ goal was to win the InterAc. But the real win was in the journey: the heart, the sweat, the ups and downs, the joy. The seniors are in good shape and better prepared for life. It will be fun watching what they create next.

Go get ‘em, young men! “A high work ethic and a good attitude put you in places where good luck can find you.”

Austin, Texas

Andy, Steve, Brian, Ryan, Joe and JD - Driftwood Golf Club and Ranch October 12, 2025

A big hat tip to Andy and Ryan. Thank you for hosting us. The course is spectacular. Disney Land for grown-ups. Indeed!

Have a great weekend. Every forward!

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201,

Malvern, PA 19355

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.

See CMG Disclosures at the bottom of this page.

For more information about NDR, please visit at www.ndr.com.

NDR, Inc. (NDR), d.b.a. Ned Davis Research Group (NDRG), any NDRG affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDRG publication. The data and analysis contained herein are provided "as is." NDRG disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. NDRG's past recommendations and model results are not a guarantee of future results. This communication reflects our analysts' opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDRG or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. For NDRG's important additional disclaimers, refer to www.ndr.com/invest/public/copyright.html. Further distribution prohibited without prior permission. Copyright 2025 © NDR, Inc. All rights reserved.