On My Radar - Rising Inflation, Bankruptcies, and Unemployment

August 22, 2025

By Steve Blumenthal

“Stocks are expensive to fundamentals, or what you might call reality. There hasn’t been a serious correction in 16 years, so people get out of the habit of thinking about market corrections…

The single biggest mistake investors make is that they conclude that the way things are today is the way they will always be, and the things that have been happening will always continue to happen. Whereas, reversion to the mean is much more likely.”

— Howard Marks, Oaktree Capital Co-Chairman, Bloomberg TV August 21, 2025

We’re in a rough patch, and the numbers don’t lie: inflation is creeping back, bankruptcies are surging, and unemployment, especially among youth and small-business workers, is starting to rise. These aren’t isolated blips. They’re threading together into what feels a lot like stagflation: slowing growth, rising prices, and a struggling labor market. It’s uncomfortable, it’s stubborn, and it’s not going away overnight.

At 10 AM EST this morning, Jay Powell spoke from the annual Jackson Hole Fed gathering. What is clear from his speech is that he has decided to cut interest rates in September. He said, “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Peter Boockvar bottom-lined it this way: He said today’s speech could not be clearer - Powell is ready to cut rates on September 17th. He added that the market is now fully priced for it and is expecting a second cut by year-end.

Grab your coffee and settle into your favorite chair. You will find data on inflation, bankruptcies, and unemployment, as well as Peter’s full post. Thanks for reading, and have a great week!

On My Radar:

Inflation, Bankruptcies, and Unemployment

Peter Boockvar - Fed Chairman Jerome Powell, Jackson Hole

Trade Signals: Update - August 21, 2025

Personal Note: One Team, One Heart, One Love, One Family

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

Inflation, Bankruptcies, and Unemployment

Here’s what I’m watching - and why it matters for your portfolio… Presented to you in my typical bullet point format (please know this is not a recommendation for you to buy or sell - for discussion purposes only):

1. Bankruptcies are Quietly Climbing Toward a Bubble

According to @KobeissiLetter, 2025 has already seen 446 large corporate bankruptcy filings, up roughly 12% above pandemic levels in 2020. July alone accounted for 71 filings - the highest single-month total since July 2020. Altogether, 371 filings in the first half of 2025 tie us with levels last seen in 2010. Sources: Facebook, S&P Global

Broader data from the U.S. Courts backs this up: in the year ending June 30, total bankruptcy filings, personal and business, are up 11.5%, with business filings rising 4.5%. Source: United States Courts

Reuters notes that business bankruptcies rose 33.5% in the 12 months ending September 2024. The hardest-hit industries include retail, casual dining, automotive, and healthcare. @KovessiLetter flagged several examples (Forever 21, Joann’s, Party City, Claire’s, etc.) Source: Reuters

Why it matters: Higher interest rates (yes, still elevated), combined with the rising cost of refinancing and margin pressure, are pushing marginal businesses over the edge. It’s a sign of broader stress, especially in consumer-facing and industrial sectors.

2. Inflation: Not Gone, Just Hiding in Plain Sight

Headline inflation remains moderate at +2.7% year-over-year in July, but the more telling figure - core CPI (strip out food and energy) - is now at 3.1%, its highest since early in the year. That’s above what the Fed usually tolerates. Sources: BLS, Reuters

Wholesale prices are even stickier: PPI spiked 3.3% year-over-year in July, with strong gains in goods like steel, aluminum, electronics, and food items. Tariffs appear to be feeding through at the producer level faster than at retail. Sources: BLS, Reuters

As a quick aside, I just learned that the health insurance I pay for my employees and myself increased by ~ 10%. That is a significant number for a small business (and large ones too). It goes into effect on October 1. I’m angered and speechless. Source: CMG’s health care provider - Blue Cross Blue Shield Personal Choice

Why it matters: Inflation isn't gone, and companies will need to make decisions. Consumers too. Tariffs and supply chain pressures are now showing up upstream and in services, making it harder for the Fed to justify rate cuts. However, unemployment is rising, making it harder for the Fed to justify not cutting rates.

3. Unemployment & Business Distress: Signs Are Flashing Yellow

On the ground, 11% of small businesses say poor sales are their biggest problem. Poor sales lead to layoffs and wage pressures. Source: Facebook

Youth unemployment (ages 20–24) is averaging 8.1% in recent months, matching levels seen in 2008. Outlook? Expect more use of automation and AI at entry levels as firms cut costs. Source: Facebook

Why it matters: Small businesses and younger workers are often the first to feel the pinch. These early warning signs suggest broader labor strain. I think Powell and team are seeing this.

4. What Comes Next? The Fed, Markets, and What to Watch

Despite stubborn inflation, markets are pricing in a 25 bp Fed rate cut in September and potentially more by year-end. This is mainly based on expectations that rising unemployment will finally open the door for easing. Sources: Kiplinger, MarketWatch

But keep in mind that cutting rates while inflation and bankruptcies are still rising risks a reflation shock moving into 2026. I’ve been saying that inflation Wave #1 is behind us and Wave #2 will follow.

It is clear to me that Wave #2 has begun.

What to watch:

Rate policy: The Fed is in a pickle. Will the Fed lean on weakening labor data to justify cutting rates? I vote yes. Could that spark a comeback in inflation? Also, yes.

Corporate debt markets: Refinancing at elevated rates remains a major risk for levered firms. Keep your eye on bankruptcies. Keep your eye on the junk bond market.

Sector divergence: Industrials and discretionary retail are bleeding; look to energy, high-dividend-paying, and high-free-cash-flow businesses, utilities, and consumer staples as potential safe havens.

Policy shifts: Tariff negotiations or relief could tilt the inflation dynamic — or make it worse.

Government deficits and new money creation: Keep an eye on the money supply and new money creation. Printing money is what causes inflation. Watch the pace of government debt growth (currently $37 trillion) and the size of spending deficits. I track this in Trade Signals each week along with Scott Bessent’s 3-3-3 plan—no visible change in course.

Investment positioning:

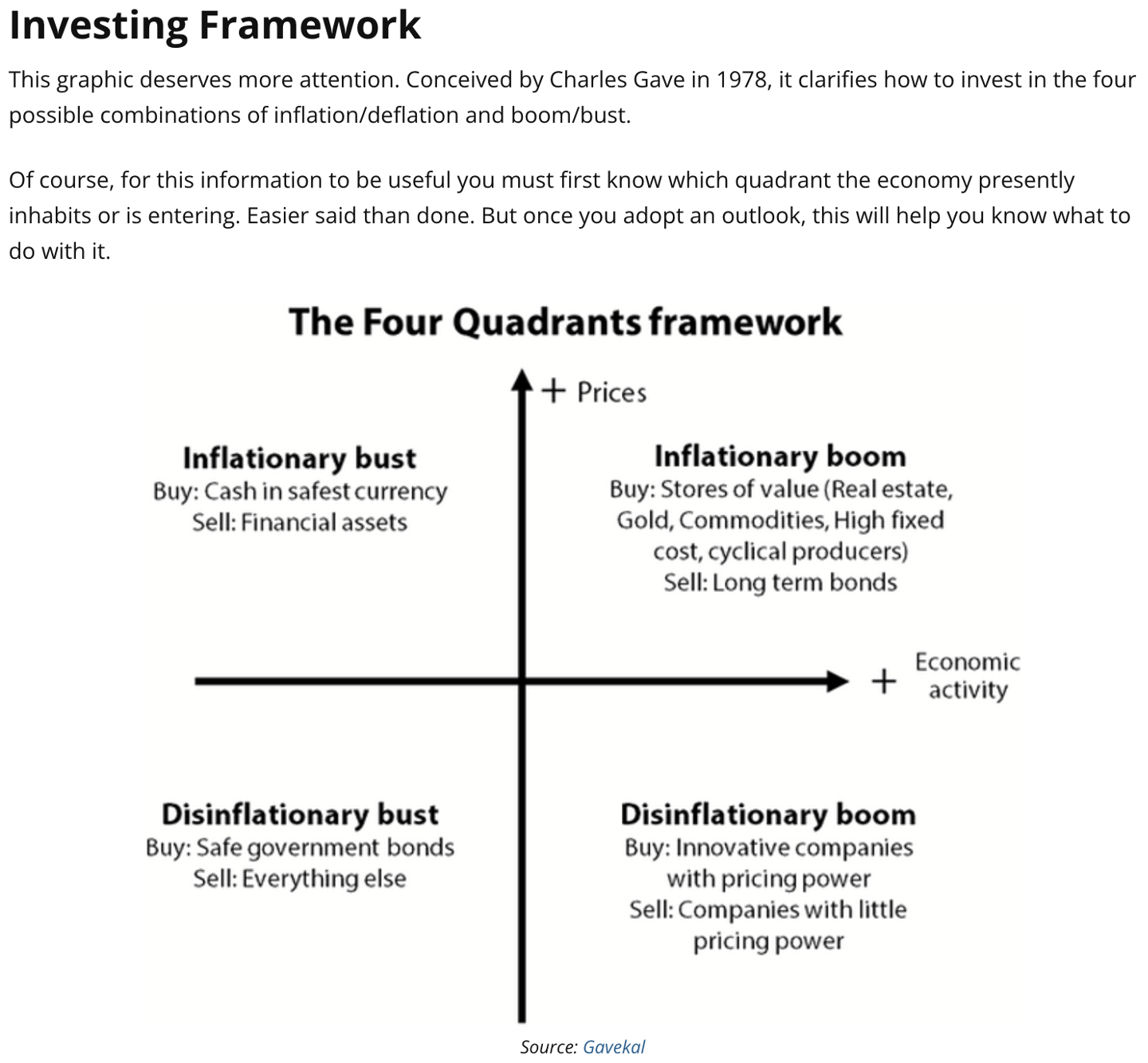

The following are a couple of charts I keep on my desk. The first is from a Louis Vincent Gave of GaveKal presentation many years ago. It’s a good time for a re-look.

The following graphic is from Apollo. Circled is our current state. Not a promising outlook for buy-and-hold stock and bond investors.

When inflation sticks and growth slows, not all sectors move together. Some businesses thrive on resilience and pricing power, while others struggle under debt and shrinking demand. The above chart shows where the pressure is building and where opportunities may lie. It’s a reminder that this isn’t the time to own “the market,” but rather to be selective and thoughtful about positioning.

In stagflation, it’s about selectivity, not broad market exposure.

Favor essential goods, quality balance sheets, income streams, high free cash flow businesses paying high dividends to shareholders and real assets.

Avoid over-levered and speculative plays. Be cautious of high-yield plays - companies that are exposed to refinancing.

This is an active manager’s market, not a buy-and-hold index market. If you must own bonds, focus on high quality and shorten your maturities to two years or less. Cash (MM funds) is not a bad option in terms of investment optionality. Have dry powder to buy when the next major market correction presents.

Here’s what Vanguard recommends:

Vanguard's most recent investor allocation recommendation, based on their time-varying asset allocation (TVAA) model, suggests a portfolio of 30% stocks, 70% bonds, and 0% cash for the next decade. This is a shift from the traditional 60/40 stock-to-bond portfolio, reflecting Vanguard's view that bonds are currently more attractive than U.S. stocks due to high stock valuations and expected lower equity returns (3.3%–5.3% annually) compared to bonds (4%–5% annually) over the next 10 years. They noted that this is not a one-size-fits-all recommendation and should be tailored to individual goals, risk tolerance, and tax situations.

Source: Vanguard

We’ll take a look at the most recent valuation metrics in early September. I do think Vanguard is in the right direction. However, I don’t like fixed-rate bonds in a rising inflation, rising interest rate cycle.

Bottom Line

We’re not out of the woods yet, or even close. Inflation hasn’t gone away; bankruptcies are spiking, especially in the vulnerable corners of the economy, and layoffs are on the horizon.

In a word, stagflation.

And keep your eyes locked on the Fed; how quickly rates come down, and the impact that will have on inflation.

This is not a recommendation for you to buy or sell any security. Speak with your advisors. All investing involves risk of loss.

Peter Boockvar - Fed Chairman Jerome Powell, Jackson Hole

I spoke to Peter last Saturday morning on my way to Stonewall. His public presence is everywhere, and like all good friends, I told him how proud I am of him and the importance of his always clear messaging about all things macro.

We’ll do a podcast soon. In the meantime, I asked him about his current thoughts on the markets. He quickly summed it up, “we are flying too close to the sun.”

I looked up from writing this morning around 11 AM EST to see what Jerome Powell had to say, concluding meetings in Jackson Hole. I went straight to my inbox to see what Peter had to say. With permission, I share Peter’s report:

This was all Jay Powell needed to say to clinch a September rate cut, “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” This was just a few sentences after saying this in his, ”In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate.”

And why is he shifting more to the softer labor side vs the tariff risks on inflation? “Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

And on tariffs and their influence on inflation, “The effects of tariffs on consumer prices are now clearly visible.” And, “A reasonable base case is that the effects will be relatively short lived - a one-time shift in the price level.” With the caveat, though, that “Of course, "one-time does not mean "all at once." It will continue to take time for tariff increases to work their way through supply chains and distribution networks. Moreover, tariff rates continue to evolve, potentially prolonging the adjustment process.”

And with this risk too, “It is also possible, however, that the upward pressure on prices from tariffs could spur a more lasting inflation dynamic, and that is a risk to be assessed and managed. One possibility is that workers, who see their real incomes decline because of higher prices, demand and get higher wages from employers, setting off adverse wage–price dynamics.”

But, “Given that the labor market is not particularly tight and faces increasing downside risks, that outcome does not seem likely.”

And after all that said, “Of course, we cannot take the stability of inflation expectations for granted. Come what may, we will not allow a one-time increase in the price level to become an ongoing inflation problem.”

Bottom line, today’s speech could not be more clear that Powell is ready to cut rates on September 17th and the market is now fully priced for it and for a 2nd one by year end. As for one cut at each of the following three meetings. The market is not there yet but at least has priced in a small chance of 12%.

The 2 yr yield fell 8 bps in response to the dovish speech while the 10 yr yield is lower by 5 bps and the 30 yr yield by a more modest 3 bps.

You can subscribe to Peter’s Boock Report on Substack here.

Peter Boockvar is an independent economist and market strategist. The Boock Report is independently produced by Peter Boockvar. Peter Boockvar is also the Chief Investment Officer of One Point BFG Wealth Partners a Registered Investment Adviser. The Boock Report and One Point BFG Wealth Partners are separate entities. Content contained in The Boock Report newsletters should not be construed as investment advice offered by One Point BFG Wealth Partners or Peter Boockvar. This market commentary is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. The views expressed in this commentary should not be taken as advice to buy, sell or hold any security. To the extent any of the content published as part of this commentary may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. No chart, graph, or other figure provided should be used to determine which securities to buy or sell. Consult your advisor about what is best for you.

Trade Signals: Update - August 21, 2025

“Stay on top of the current market trends with Trade Signals.”

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.”

– Charlie Munger

Trade Signals is Organized in the Following Sections:

Market Commentary and Notable Changes

The S&P 500 Index (Stocks) and The 10-year Treasury Yield (Bonds)

Trade Signals - Dashboard of Indicators

Market Valuations and Subsequent 10-year Returns

Supporting Charts with Explanations

Technicals, Fundamentals, Macroeconomics, and Investor Behavior

*Trade Signals basics: The Market Commentary section summarizes notable changes in the core key indicators: Investor sentiment, market breadth, stocks, treasury yields, the dollar, and gold. The Dashboard of Indicators provides a detailed view of all Trade Signals indicators.

Market Commentary - Howard Marks

Notable Changes This Week:

The Weekly MACD for the S&P 500 Index remained bullish. The Daily MACD moved to a bear trend signal yesterday (Aug 20, 2025). Despite the extreme overvaluation of the S&P 500, the collective trend evidence remains bullish on equities.

The Weekly MACD trend in the 10-year Treasury yield continued to point towards declining yields - a bullish signal for bonds. The collective trend evidence for bonds, including the CMG NDR Zweig Bond Model, remains bullish on bonds (signaling lower interest rates).

The Weekly MACD trend for the Dollar remained bullish. The Daily MACD for the Dollar turned bearish. The Monthly MACD trend remained bearish. Our fundamental view remains bearish on the Dollar.

The Weekly MACD for Gold remains in a bearish trend signal. The Daily MACD is in a bear trend signal as well. Gold continues to trade range-bound between 3450 (high) and 3250. I closed at 3350 yesterday, up 1% on the day. Our fundamental view remains bullish on Gold.

Key Macro Indicators - Investor Sentiment, Market Breadth, The S&P 500 Index (Stocks), The 10-year Treasury Yield (Bonds), and the Dollar:

The S&P 500 Index (Stock Market)

Investor Sentiment (looking for Extreme Optimism or Extreme Pessimism): The current reading is in the Extreme Optimism zone. Since we are in a secular bull market, we are looking for near-peak level Extreme Optimism for the sentiment signal to turn bearish. You’ll see in the charts section that we are not yet at peak extreme optimism.

Market Breadth (looking for direction): The current reading is bullish. The current signal is 69.79, which is down slightly from last week but remains bullish. Importantly, it remains above the bearish 50 level. You’ll find a detailed explanation in the CMG NDR Large Cap Index section below.

S&P 500 Index Weekly MACD: The current reading is bullish (green arrow, bottom right in the chart).

Trade Signals is a free service for CMG clients. Click on LOGIN below to go to the Dashboard of Indicators, Key Macro Indicators, Investor Sentiment, Market Breadth, the Dollar, and Charts.

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: One Team, One Heart, One Love, One Family

In the mid-1980s, one of the world's biggest rock bands, U2, was preparing for a concert. Their lead singer, Bono, had been receiving death threats from a white supremacist group. The threat was specific: if he sings their song "Pride," which honors Dr. Martin Luther King Jr., he will be killed.

The FBI investigated and confirmed. Security was heightened, yet the risk was high. Bono had a choice: stay safe and skip the song, or stand up for what's right.

As the concert reached its climax, Bono stepped to the microphone and announced they were going to sing "Pride." The crowd roared. Bono's heart pounded. Someone in that sea of faces might end his life.

He began, “In the name of love, one man in the name of love.” The powerful tribute to Dr. King. Bono’s iconic voice carried the weight of both the message and the moment. Emotionally, Bono closed his eyes and poured his heart into the performance, knowing each word could be his last.

When he finally opened his eyes, something had changed. There, directly in front of him, stood his bass guitar player, Adam Clayton. Without being asked, Adam had quietly moved from his usual position to stand between Bono and the crowd - a human shield protecting his teammate.

Adam didn't have superpowers. He couldn't stop a bullet. But in that moment, he was saying with his actions: "If something happens to you, it has to go through me first."

From Dublin, Ireland, the band grew up witnessing a country divided by religious and political violence. The troubles pitted Loyalists, Unionists, Republicans, and Nationalists against each other, creating ethnic and religious tensions that forced many to choose sides.

Growing up in an environment of division and violence forged key elements in U2's character. They learned early that brotherhood transcends religious and political differences. Adam Clayton was Protestant, while the others had Catholic backgrounds, yet they stood together. In a country where taking the wrong stand could make you a target, they learned the power of having someone watch your back.

U2’s willingness to sing about difficult topics, knowing it could make them targets, helps us better understand Bono's decision to sing "Pride" despite death threats and makes Adam's protective gesture during "Pride" even more meaningful. He came from a tradition where standing up for what's right and standing by your mates when they do, wasn't just admirable, it was survival. Irish culture runs deep through U2's sound, and that culture includes fierce loyalty to those who stand with you.

My favorite band, my favorite coach, and the beginning of a new season for many teams.

My wife, Susan (our Coach Sue), told the story about Adam Clayton to her high school boys’ soccer team this week. Tryouts are done, the season has started, and the team is growing.

The U2 Pride story isn't just about two rock stars. It's about building, creating, loving, and having each other’s backs.

When your teammate is getting beaten up by the opponent's best player, you step up and take some of that pressure. When someone makes a mistake and their confidence is shaken, you're the one who pulls them aside and says, "I've got your back, next play." When the coach is addressing a struggling player, you don't let them face it alone. Weak teams have selfish players (takers), great teams have givers, kindness, grit, and heart.

Adam didn't ask Bono if he needed protection. He saw his friend in danger and acted. On great teams, when you see a teammate struggling with schoolwork, being picked on, or dealing with problems at home, you don't wait for them to ask for help; you step up.

On the field, this might mean taking a hard tackle to make a crucial interception, or stepping between a teammate and an opponent who's getting too aggressive. It might mean being the one to tell a teammate they need to work harder, focus better, or pick up the pace, even if it's an uncomfortable conversation.

Adam didn't announce what he was doing, nor was he seeking recognition.

I remember my late soccer coach, Walter Bahr, saying, “focus on the little things.” Get the little things right and the big things will take care of themselves.

My take away from Coach Sue’s message is that the most powerful way you can protect your teammates is through small, everyday actions: checking on someone who seems down, including the quiet kid in your group, reaching out and greeting everyone with a smile and a high five, or if you’re teammate misses an open net, tell him “head up, next one.” Sport is a game with many mistakes. Don’t shame them, embrace them, grow, fix, and improve. Life is like that, too.

Her challenge to the players: Look around this locker room right now. These aren't just players on your team, they're your brothers. Support each other, stand up for each other, and protect each other. That's what champions do. That's what winning teams look like. That's what a successful life looks like.

Let’s huddle together, raise one arm high, clench your fist, then on the count of three: One team. One heart. One love. One Family!

Thanks for indulging me. If you can’t tell, I really dig my favorite Coach… Susan.

Two exhibition games yesterday. The Malvern Prep boys looked good. Game 1 next Thursday.

All the very best to you and your family!

With kind regards,

Steve

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201, Malvern, PA 19355

Private Wealth Client Website

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.