On My Radar - The Modern Day World Order is a Game of Thrones

August 15, 2025

By Steve Blumenthal

“If you follow the news, it’s probably clear to you that the current monetary order, domestic political order, and international geopolitical order are all on the brink of breaking down. We are headed for great conflicts and disruptive changes.”

— Ray Dalio, Founder Bridgewater Associates

I wrote last week that the world today looks a lot like Game of Thrones: shifting alliances, rival powers, and one rising challenger aiming for the throne. Planet Earth is our Seven Kingdoms. Noble houses maneuver, ally, and betray one another in their quest for the Iron Throne, while a darker threat looms from beyond the northern Wall.

The U.S. holds the throne, China and Russia want it, and everyone else is choosing sides.

Coffee, yes; chair, yes. There are several sections this week that fit into the main story. I hope you enjoy today’s OMR. This one is fun. My advice is to take a step back to view the global macro chessboard more broadly. Remove emotion and reflect on the geopolitical and economic happenings with an eye towards investment positioning. As in Game of Thrones, there will be winners and losers on the global stage, and companies that prosper and assets that suffer. Our job (yours and mine) is to transition from Winter to Spring with our family's wealth intact.

It’s been a lot of fun for me writing today’s missive. Following is my best shot at our modern-day Game of Thrones. I hope you enjoy the story. Thanks for reading. Let me know what you think.

On My Radar:

The Modern Day World Order is a Game of Thrones

Bessent’s 175 bps Rate Cut Push

Ray Dalio - The Big Cycle

Trade Signals: Update - August 14, 2025

Personal Note: Just Two Stocks, Golf and Soccer

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

The Modern Day World Order is A Game of Thrones

The world today resembles George R.R. Martin's Seven Kingdoms, a realm where shifting alliances, ancient grievances, and rising powers vie for supremacy while an economic winter approaches. As Ray Dalio's historical patterns suggest, we stand at that pivotal moment when the old order crumbles and new powers emerge from the chaos.

The Iron Throne: Global Economic Hegemony

In this modern Game of Thrones, the Iron Throne is global economic dominance. It is the power to control trade routes, set monetary policy, and dictate the terms of international commerce. For seventy-five years, the United States has sat upon this throne, wielding the dollar as its Valyrian steel sword. But, as Dalio warns, the throne has grown heavy with debt, and winter, in the form of economic reckoning, is coming. Like in The Game of Thrones, there are several Houses.

King Donald of House Trump: The Warrior King

Trump enters this drama as a warrior king, crude but effective, wielding tariffs like a battle axe. His 15% tariffs on most nations are his way of strengthening the realm's coffers, while his higher levies on China, Russia, Iran, and India represent targeted strikes against rival houses. This evening’s (August 15, 2025) summit with Putin in Alaska echoes those tense negotiations between rival kings. Will it be Ned Stark's honorable attempt at diplomacy, or will it mirror the Red Wedding's calculated betrayal?

House Trump hit Switzerland with an aggressive tariff on gold, only to be quickly reversed - revealing the delicate balance of power between policy, markets, and countries. The proposed tariff threatened to disrupt COMEX gold markets by blocking Switzerland's refined gold bars, potentially creating shortages and destabilizing the very foundation of gold futures trading. Like Aerys II's wildfire caches beneath King's Landing, disrupting COMEX markets could have triggered a chain reaction across global commodity markets.

Emperor Xi: The Dragon Across the Narrow Sea

Xi Jinping embodies Daenerys Targaryen, the exiled royal with a legitimate claim to power, building strength across the narrow sea. Many years prior, the Targaryens and their dragons ruled the Seven Kingdoms. China's Belt and Road Initiative mirrors Daenerys's liberation of Slaver's Bay: appearing benevolent while systematically building a power base. Just as Daenerys had her dragons, Xi has manufacturing dominance, rare earth monopolies, and growing military might.

The genius of Daenerys's campaign, and why it mirrors China's approach, is that her main goal is to free the slaves in Slaver's Bay and abolish all slavery. This "liberation" creates a power vacuum that only she can fill. The freed slaves became dependent on her protection and governance.

The upcoming meeting between Xi and Modi on August 31 feels like the crucial alliance-building that defined the later seasons of Game of Thrones. Can these two rising powers overcome their border disputes to challenge the Western order?

Tsar Vladimir: The Night King

Putin operates like the Night King. He’s patient, relentless, and willing to destroy the existing order entirely. His war in Ukraine serves multiple purposes: weakening Western unity, demonstrating resolve, and positioning Russia as a dominant player on the World stage. The Alaska meeting represents a rare moment when the Night King may agree to a peace deal. Have we reached a Reagan-Gorbachev-like moment? Within our current Seven Kingdoms story, given Tsar Vladimir’s alliance with Emperor Xi, sadly, the odds appear low.

Prime Minister Modi: The King in the North

Modi positions India as the Jon Snow of this tale, the reluctant king who never wanted the throne but finds himself thrust into leadership. India's growing economy and strategic position make it a target of interest from all sides. Will Modi bend the knee to China's growing power, or will he forge his own path, much like Jon Snow's ultimate rejection of both Daenerys and the Iron Throne?

The Great Houses and Their Alliances

The Western alliance, comprising the 32 NATO member countries, primarily in Western Europe and North America, also includes Southeast Asia and parts of the Middle East. Beyond NATO, the Western Alliance includes countries aligned with the U.S. through other treaties and shared ideologies (capitalism, anti-communism). Together, they function like the noble houses of Westeros.

Meanwhile, the Eastern powers, China, Russia, North Korea, and Iran, form their alliance of convenience, much like the temporary partnerships that emerged when survival was at stake. Their bond is more tactical than ideological, held together by shared opposition to Western dominance.

The Maesters: Ray Dalio, The King of History and Economic Wisdom (Maesters is an order of scholars, healers, messengers, and scientists in the Seven Kingdoms)

Ray Dalio serves as this era's Grand Maester, studying the great cycles of history and warning of patterns that repeat across centuries. His analysis of debt cycles reads like the prophecies in Game of Thrones, ancient wisdom that everyone acknowledges but few heed until crisis strikes.

When he writes that "the bias to create more ups in economies and markets through credit stimulation leads to long-term uptrends in debt," he's describing the same hubris that brought down Vaes Dothrak, Old Valyria, and countless other civilizations in The Game of Thrones world. The US, spending an increasing portion of its borrowing just to service existing debt, mirrors the decadent late-stage empires that thought their dominance would last forever.

Winter is Coming: The Debt Crisis

In Game of Thrones, "Winter is Coming" served as both a warning and an inevitability. In our world, the coming winter is the debt crisis that Dalio describes. It’s a mathematical certainty that exponential debt growth eventually becomes unsustainable. When a nation's borrowing increasingly goes to service existing debt rather than productive investment, the realm begins its decline. The decline has started.

The signs are everywhere: currency debasement, asset bubbles, growing inequality, and the rise of populist movements that promise simple solutions to complex problems. These are the same conditions that preceded the fall of previous global empires.

The White Walkers

The White Walkers in Game of Thrones are an ancient, supernatural race from the far north beyond the Wall. They command the dead, turning them into an army, and their mission is to move south to bring eternal winter to the living. They’re a silent, relentless force that adds an existential threat from a non-political player.

Inflation is the White Walker in our modern-day story.

The Game Continues

What makes this geopolitical drama particularly compelling is that, unlike Martin's finished novel, we don't yet know how it ends. Will Trump's warrior-king approach preserve American dominance, or will it accelerate the realm's fragmentation? Can Xi build a new order, or will China's own debt problems create their version of the Mad King's downfall? Will Putin's Night King strategy ultimately succeed in reshaping the world order, or will it lead to mutually assured destruction?

The Alaska summit, Modi's upcoming meeting with Xi, and the ongoing tariff wars are all chapters in this unfolding epic. A debt crisis is bringing it all front and center.

As in Game of Thrones, the true test isn't who wins individual battles, but who can adapt when winter arrives.

In geopolitics as in Westeros, the game never ends; it just finds new players. And as any reader of Martin knows, those who think they're destined to win are often the first to fall. The question isn't whether winter is coming; it's who will still be standing when spring returns.

Risks abound. When I watched, I very much enjoyed the series. I feared the White Walkers the most. Financially speaking, inflation and slow growth remain the probable outcome as we approach Winter. For now, I fear inflation the most.

Spring will follow, spring will follow.

The realm is watching, and the game of thrones goes on. Best success to you and yours in navigating the period ahead. It’s doable.

Bessent’s 175 bps Rate Cut Push

Bloomberg’s John Authers puts out a daily email. It’s one of hundreds that hit my inbox every day. It is one of the few that consistently catches my eye. John sent this on August 14, 2025.

Treasury Secretary Scott Bessent is pushing for the Fed Funds rate, currently at 4.25%, to be lowered by at least 1.75%.

Here is our current state:

The market is at a record high

Inflation is back above 3%

The money supply is at a record high

The budget deficit remains on course to hit $2 trillion

The interest expense on government debt is still at ~ 7% of GDP

Gold is at a record high, and

The Buffett indicator is at an all-time valuation high.

The argument to cut rates depends on what you want to look at and who you want to listen to.

Some of my smart economics friends think Fed Chairman Jerome Powell is late in cutting rates: Dr. Lacy Hunt, David Rosenberg, Danielle DiMartino Booth included. My friend Jim Bianco, President of Bianco Research, continues to express skepticism about the Federal Reserve cutting interest rates prematurely, arguing that such actions could exacerbate inflation and destabilize financial markets. He believes the U.S. economy is performing strongly, cites growth rates around 2.5–3% and low unemployment claims, which he sees as evidence that rate cuts are not currently justified. Bianco has warned that cutting rates in an environment of persistent 3–4% inflation, coupled with potential inflationary pressures from policies like tariffs or deregulation under the Trump administration, could lead to higher long-term bond yields.

It’s hard to bet against Lacy and Rosey, but they’ve been on the wrong side of the bond trade for the last few years. Bianco has been spot on. But does that make him right going forward?

My view is to follow the Weekly 10-year Treasury Yield MACD trend indicator and trade the bond market, rather than buy and hold. A 4.3% 10-year Treasury yield is unattractive to me in what is likely a rising inflation, rising interest rate world. We may see 3.5% on our way to 5%, 6% and 7%. I favor trading the trends. Not a recommendation for you to do anything. Just my two cents, especially if I am correct that all the roads I see ahead are leading us to inflation. Hope I’m wrong. Fear, I’m right. One can invest in a way that may prosper regardless.

Sharing the following with you, from John Authers. I came across it this week, and I believe he does a good job in shaping the interest rate cut debate.

From John Authers:

Today’s Points:

Bessent says “any model” suggests the fed funds rate should be 1.5% to 1.75% lower.

This isn’t the case, but markets like what they hear: bond yields down, stocks up.

Gold miners are having a great rally.

The invasion of Ukraine seems to have tipped haven investors toward gold.

AND: A Seventies Britcom star gets recognized by the Kennedy Center.

Looking at All the Models

Scott Bessent, the US Treasury secretary, made big news on Blooomberg Surveillance. He told the televised audience that “if you look at any model” for the fed funds rate, it suggests that “we should probably be 150, 175 basis points lower.”

This is breathtaking. With the current effective fed funds rate at 4.33%, he is suggesting that it should be about 2.6%. Over the last 70 years, the rate has never been that low with inflation as high as it currently (with the core reading above 3%). So apparently “any” model now shows that US monetary policy has been misguided throughout that entire period and needs to be changed:

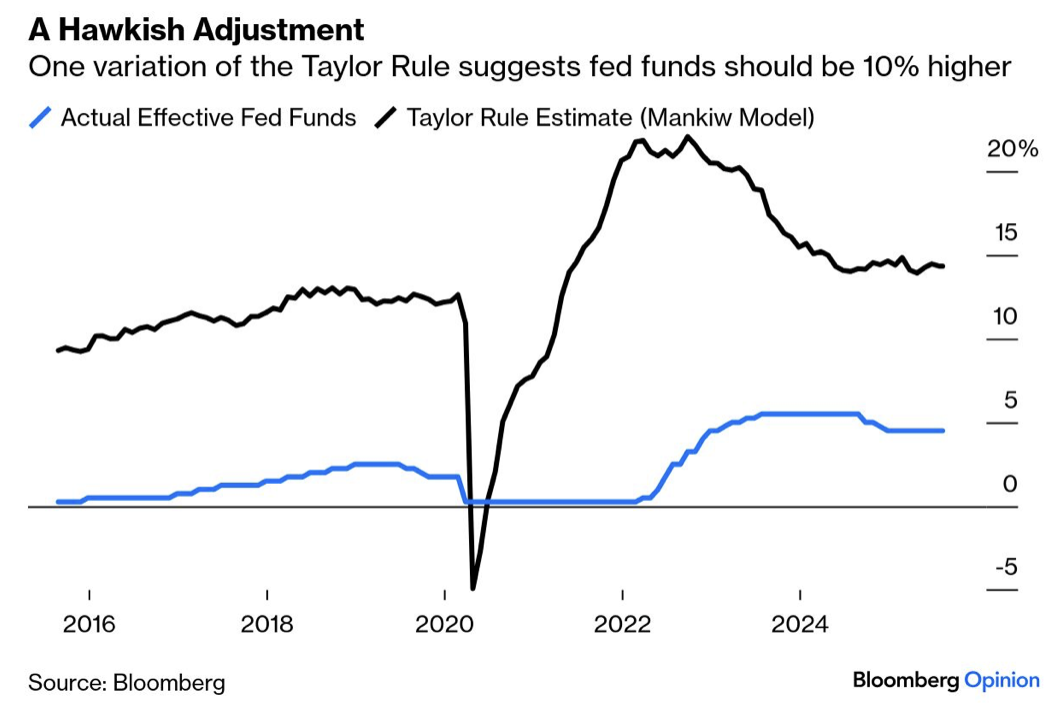

In fact, it's easy to find a model that says fed funds should be far higher than 4.33%. Arguably the most famous is the Taylor Rule, named for John Taylor, a Stanford economist and former senior Treasury official who was a candidate for the Federal Reserve chairmanship eight years ago. His formula suggests the next move should be up:

This is available on the Bloomberg terminal; it’s not exactly obscure. We also handily provide various different versions of the Taylor framework. This is the fed funds rate under the adaptation made by Gregory Mankiw, the Harvard economist who served as George W. Bush’s chairman of the Council of Economic Advisers:

The point is not that these models are necessarily right. They may well not be, and Bessent has a right to express his opinion. But it’s absurd to suggest that “any” model would call for fed funds to be so much lower, and alarming to hear it from the US Treasury secretary.

The bottom line we already knew from presidential social media accounts: Donald Trump wants lower interest rates, and more control over them. Fed independence has long been contested, and other presidents have kicked against it — but since the end of the gold standard in 1971, an independent Fed has been central to maintaining the dollar as the linchpin of the global economy. This is a dangerous game.

Further, the drawback of allowing the Treasury Department to control both fiscal and monetary policy is that it can then coordinate them to rhyme with the political cycle. In the UK, finance ministers set base rates until 1997, creating a pronounced “stop-go” effect as governments pumped up the economy ahead of an election, and put on the brakes once they’d been reelected. This is miserable economics, as the UK’s weak postwar growth demonstrates, but decent politics.

Even so, that implies that it’s madness for a government to behave like this six months into a four-year term. The likely outcome would be a short-term boom, and a pretty serious bust in time for the next election in 2028.

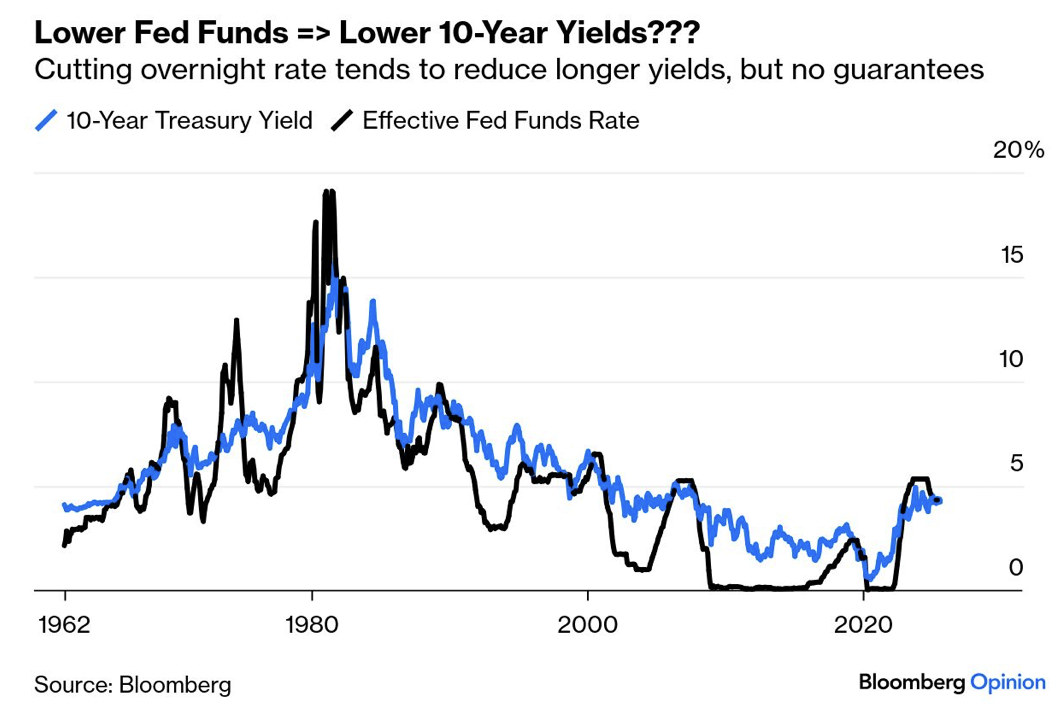

So why all the pressure? The most obvious answer is to bring down longer Treasury yields, which determine the cost of servicing the government’s debt. All else equal, lower overnight rates from the Fed mean lower longer-term yields. But the Fed doesn’t control the long end. Last September’s jumbo fed funds cut was greeted by a rise in the 10-year yield. There have been many other incidents when Treasuries refused to follow the lead that the Fed set for them:

The White House has also been clear that it wants a weaker dollar. The latest dose of pressure on the Fed appears to have achieved this, as the currency has fallen over the last few days. That’s helpful for many people, but particularly for the emerging markets, where stocks have at last taken out the high they made during excitement over China in early 2021:

For now, the impact is clear as investors are persuaded that there is no recourse but to continue buying US stocks. The latest Markets Pulse survey of Bloomberg terminal users found 59% believing that pressure to lower interest rates would boost US stocks compared to peers, even though some 70% expect tariffs to have had a negative effect by the end of the Trump 2.0 term. The great majority were uncomfortable with the premium that US shares currently command, but leaning on the Fed has convinced many that the rate environment will get more conducive from here.

Source: Bloomberg

To get John Authers’ newsletter delivered directly to your inbox, sign up here.

Not a recommendation to buy or sell any security. See CMG Disclosures at the bottom of this page.

Ray Dalio - The Big Cycle

Working my way through Ray’s new book. I recommend it to get a sense of how we humans have behaved historically. Ray’s done the work for us. Recently released, it is available at your favorite bookstore, book app, or on Amazon.

Click on the photo to watch the 6-minute video.

Opinions are those of Ray Dalio and are subject to change. This is not a recommendation for you to buy or sell any security. All investing involves risk of loss. It is the water in which we swim.

Trade Signals: Update - August 14, 2025

“Stay on top of the current market trends with Trade Signals.”

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.”

– Charlie Munger

Trade Signals basics:

Trade Signals basics: The Market Commentary section summarizes notable changes in the core key indicators: Investor sentiment, market breadth, stocks, treasury yields, the dollar, and gold. The Dashboard of Indicators provides a detailed view of all Trade Signals indicators.

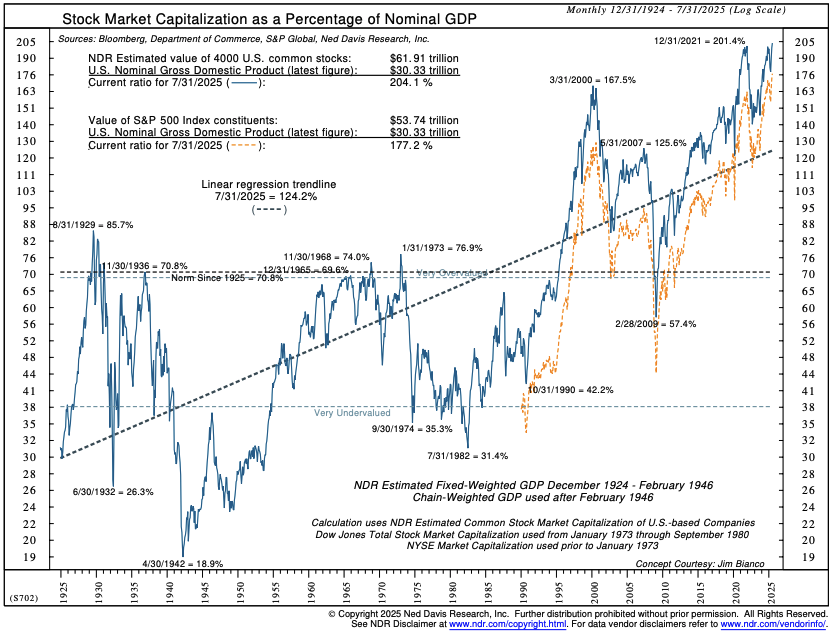

Market Commentary - Buffett Indicator at All-Time Record High and Inflation Hotter Than Expected

Historically, the ratio of the value of the US stock market to the country’s Gross Domestic Product ranged from ~ 70% to ~ 130%. It was 204.1% at the end of July and is over 205% today, a record high dating back to 1924.

The following chart should give any value-oriented investor pause.

On the inflation front, the Producer Price Index numbers came in hotter than expected - both headline and Core inflation were up 0.9% for the month. Year-over-year, headline inflation rose from 2.4% to 3.3% and Core inflation rose from 2.6% to 3.7%. Bond yields moved higher on the news.

Notable Changes This Week:

The Weekly MACD for the S&P 500 Index remained bullish. The Daily MACD turned bullish.

The Weekly MACD trend in the 10-year Treasury yield continued to point towards declining yields—a bullish signal for bonds.

The Weekly MACD trend for the Dollar remained bullish. The Daily MACD for the Dollar turned bearish. The Monthly MACD trend remained bearish.

The Weekly MACD for Gold remains bearish.

Trade Signals is a free service for CMG clients. Click on LOGIN below to go to the Dashboard of Indicators, Key Macro Indicators, Investor Sentiment, Market Breadth, the Dollar, and Charts.

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: Just Two Stocks, Golf and Soccer

Just a little more market data, as I find it, is blowing my mind.

Two stocks, Nvidia and Microsoft, make up 15.4% of the S&P 500 Index. 498 stocks make up the remaining 85%. Source and chart below.

Ten stocks make up 40% of the S&P 500 Index, and 490 stocks make up the remaining 60%. Source and chart below.

As of July 1, 2025, the total market capitalization of the U.S. stock market is ~ $62.8 trillion.

The total market capitalization of the S&P 500 index, as of August 12, 2025, is ~ $57.3 trillion.

91.24% of the money invested in the US stock market is in just 500 stocks.

36.53% or $22.92 trillion of all the money in the US stock market is in just 10 stocks.

15.4% of the entire US stock market is in just two stocks.

US money supply is at a record high. Source and chart below.

Warren Buffett is sitting on a record $347.7 BILLION in cash. Nearly 30% of Berkshire Hathaway’s assets are just cash and T-bills—the largest cash pile in U.S. corporate history. Source and chart below.

Ugh… and double ugh!

We could go higher and higher.

I need a cold IPA!

Son Kyle is coming home for the weekend, and we have a 9:30 am golf game with a good friend, Jack F, at Stonewall. And, Brianna is flying home next weekend. Yahoo is an understatement.

Soccer tryouts for Coach Sue’s Malvern Prep team begin on Monday. A scrimmage is scheduled for Thursday, which I hope to make. The first game is on August 28. If you’ve followed my stories over the last few years, I find myself moved by how much sports can teach us all about life. Especially, young people in preparation for life. Long-time readers know I live vicariously through my wife, Susan, and I am all around crazy about her.

My job is to have a notepad in hand and watch the opposition to understand their formations, areas of strength, weaknesses, and report my findings to Susan. I played soccer at Penn State from 1979 to 1983 under a legendary coach named Walter Bahr. We were top ten in the nation each year, finishing 3rd in 1979. But to be crystal clear, I know nothing compared to Susan. It’s fun to watch and learn from her.

The character of this year’s set of players is exceptional, and the team is showing promise. Hopes are high, fingers crossed. I’ll share a few stories with you as the season progresses.

Good luck to your young ones, children, and grandchildren in their upcoming seasons. Enjoy the ride. It goes by way too fast.

And of course, football season is here. Good luck to your favorite teams unless they are facing my Nittany Lions or Philadelphia Eagles.

With kind regards,

Steve

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201, Malvern, PA 19355

Private Wealth Client Website

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.