On My Radar: Might vs. Right

January 16, 2026

By Steve Blumenthal

"First comes a High, a period of confident expansion. Next comes an Awakening, a time of spiritual exploration and rebellion. Then comes an Unraveling, in which individualism triumphs over crumbling institutions. Last comes a Crisis, the Fourth Turning - when society passes through a great and perilous gate in history.”

- Amazon description, The Fourth Turning by William Strauss and Neil Howe

We have entered a period of ‘rule of might’ over ‘the rule of law.’ The U.S. arresting Maduro and “running” Venezuela, its desire for Greenland, its seizure of five oil tankers associated with Venezuela oil transport, the seizure of a Russian oil tanker on January 7, and the developments in Iran evidence the current state. Developments at home in the U.S. pour fuel on the flames.

If you subscribe to the “Fourth Turning” thesis, it’s hard not to see that we are in its grips. The Fourth Turning, as described by historians William Strauss and Neil Howe (in their book of the same name), is the phase in history when long-standing systems finally crack under their own weight. This follows decades of excess, debt, complacency, and institutional drift. It is marked by confrontation, urgency, and uncomfortable change.

The First Turning is a rebuilding; the Second is an awakening; the Third is an unraveling; and the Fourth is a passing through a perilous gate. Each turning lasts approximately 20-years.

The Fourth Turning is when societies stop debating and start acting, when power replaces politeness, and when a new order is forged out of disorder. History suggests it’s messy, stressful, and transformative. And if you’ve felt that the world is heavier, sharper, and less forgiving lately, that’s what Strauss and Howe are describing. A generational pattern that occurs approximately every 80 years.

One of several geopolitical strategists I follow is George Friedman. In a January 9, 2026, Geopolitical Futures podcast, Friedman argues that the U.S. has publicly signaled a major pivot: de-prioritizing the “80-year adventure” of managing the Eastern Hemisphere and refocusing on securing the Western Hemisphere. Fourth Turning stuff? Hard not to see it.

George Friedman is the founder of Stratfor and is now the chairman of Geopolitical Futures. In a recent podcast, Friedman laid out what he believes is a major strategic shift underway: the United States is refocusing on the Western Hemisphere.

His argument is simple and very “Friedman-style esque.” For decades, U.S. attention has been pulled into Europe, the Middle East, and Asia. But geography always wins. And from a pure strategic standpoint, America’s true vital interest is what he calls “near abroad” - the Americas.

Friedman points to recent U.S. actions in Venezuela as evidence of this shift. He characterizes the removal of Maduro as a precise, efficient operation with no intention of long-term occupation. In his view, this wasn’t about ideology or nation-building. It was about clearing instability in the hemisphere.

He connects the dots to Cuba, noting that with Venezuela no longer able to prop it up as it once did, Cuba becomes more economically fragile and strategically exposed. That matters to Washington, not for moral reasons, but for balance-of-power reasons. He believes it’s about Cuba - The U.S. can’t have Russia and Iran in Cuba. Cutting off Venezuela's money lines to Cuba cuts off Cuba, Iran, and Russia, and risk of shutting down our shipping lanes. It certainly impacts China, as it gets ~15% to 20% of its oil from Venezuela.

And then there’s Greenland. Friedman frames Greenland not as a real estate curiosity, but as a strategic outpost in a changing Arctic world. His question is blunt: how far is the U.S. willing to push its allies when core strategic interests are at stake? His answer: probably farther than many in Europe would like. Source: GeopoliticalFutures

Classic Friedman: Geography over ideology. Power over politics. Strategy over sentiment.

Whether you agree with him or not, his message is: the U.S. appears to be consolidating influence closer to home, tightening its grip on the hemisphere, and doing so aggressively, not apologetically.

Fourth Turning history suggests this is how great powers behave when the world becomes more unstable.

And the world is certainly more unstable.

Pippa Malgren has been writing about “hot wars in cold places” and “cold wars in hot places.” She believes this is as much an internal war (Trump vs the Deep State) as it is a Russia/China/Iran external war. She’s out with her most recent piece this week and thought I’d share some highlights:

“It is impossible to understand current events without zooming out far enough to see what has been called “The Devil’s Chessboard”. That’s the title of a book about Allen Dulles, a founder of the OSS and then the CIA, who well understood that everything in the world of geopolitics must be a strategic move on the realpolitik chessboard. Everything is in play. Anything goes. All the spots on a Monopoly Board are potentially more valuable than others realize. As the nuclear superpowers – the US, China, and Russia - continue their efforts to resolve the gnarly problems of Ukraine, Gaza, and Taiwan, the smaller and older interstitial pieces of the puzzle, including Somalia and Greenland, are in play.

She gets me thinking in a different way. You can find Pippa’s recent post here. An interesting take from an intelligent, well-sourced individual. Pippa’s Wikipedia page here.

Might vs. Right? Depends on your viewpoint. It’s Fourth Turning behavior and is happening regardless. We are witnessing what global disorder looks like.

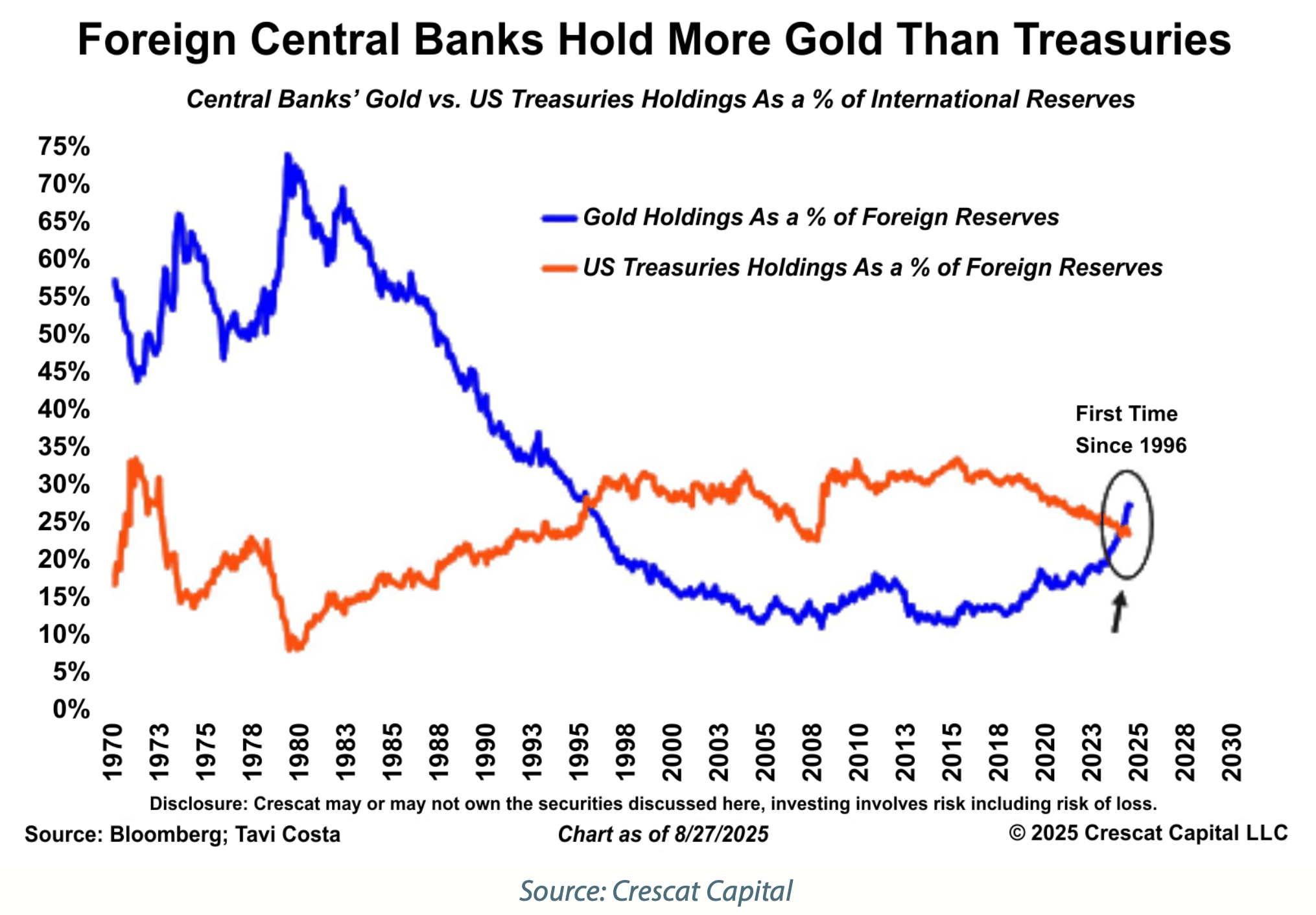

From an investment perspective, wars are inflationary. We are seeing it across gold, silver, copper, rare-earth minerals, and other commodities. I believe we are in the early innings of this trend.

Got gold? The following is indeed Forth Turning stuff.

Grab that coffee, and find your favorite chair. I had a fun conversation with Peter Boockvar this week. You’ll find the link to the full conversation below. And, I promised I’d follow up on the January 2, 2026, OMR piece I wrote about current valuations, noting a 28x trailing 12-month PE multiple, that set “Fair Value” entry target for the S&P 500 Index. I then stripped out the Magnificent 7 stocks to focus on PE for the remaining 493 stocks. I was surprised to find PE closer to 15x earnings. Yes, value-oriented stocks in general have been unloved, but I was surprised at the 15 multiple. Back of the napkin, think of a PE of 15 as “Fair Value.” Not so bad.

This week, you’ll also find some valuation analysis on high-dividend-paying stock indices. I personally find this useful for setting good value entry targets. Bottom line: Unlike the S&P 493, dividend payers are modestly overvalued relative to their historical norms. Not a recommendation to buy or sell anything. Simply, ideas to discuss with your advisor.

On My Radar: Why QE is Likely Coming Back

Personal Note: NY, Arizona, Utah, and Colorado

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

Peter Boockvar - Steve Blumenthal Podcast Discssion

Earlier this week, I had the chance to catch up with Peter Boockvar.

Peter Boockvar is a veteran macro strategist, investor, and market commentator with more than three decades of experience analyzing global markets, monetary policy, and economic cycles. He is the Chief Investment Officer at One Point BFG, overseeing asset allocation and investment strategy. Peter is also the editor of The Boock Report, a widely followed daily macro and market commentary read by institutional investors, advisors, and policymakers.

Previously, he served as Chief Market Analyst at The Lindsey Group and held senior roles at Miller Tabak and Omega Advisors (Leon Cooperman). Peter is a frequent guest on CNBC, Bloomberg, and Fox Business, and is known for his clear, independent thinking on inflation, central banks, government debt, commodities, and global macro risks.

Your favorite and mine, we begin with Peter’s top-down macro view. Hope you enjoy the short 33-minute discussion. Click on the photo.

Opinions are subject to change. Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. See important CMG disclosures below.

Valuation Analysis on High Dividend Payers

I conducted an AI analysis of the popular Vanguard Dividend Appreciation ETF (VIG), which tracks companies with a history of increasing dividends, focusing on quality dividend growers rather than high current yield.

My objective was to compare dividend-paying stocks, similar to my recent comparison of the S&P 500 Index trailing PE and the S&P 493 stocks, excluding the Mag 7 stocks. You can find the analysis here.

The portfolio's trailing 12-month P/E ratio (price-to-earnings) is in the mid-20s range based on recent data:

From Vanguard's official site: 25.7x (as of December 31, 2025).

From Yahoo Finance quote page: 26.73 (TTM/ trailing PE, recent data around early January 2026).

Other sources, like Investing.com, have cited around 21.08 in older snapshots, but more recent figures align closer to 25–27x.

Historical Context — Data from GuruFocus shows (with the latest holdings update) that over approximately the last decade:

10-Year P/E Range was: a low of ~18.5x to a high of ~68.9x

10-Year Median P/E was: ~22.9x

(Source’s historical range is based on aggregated ETF P/E history as available. Note: ETF P/E histories aren’t as widely published in a clean annual table as individual stocks, but this 10-year range and median give a reliable sense of the valuation context.)

I then asked AI to create some Valuation Bands (Based on Last ~10 Years)

Undervalued (cheap) < ~20x Below lower range of recent history

Fair Value (median) ~22.9x

Overvalued (rich) > ~27–30x

Bottom line: I was a bit surprised to find that the current ~25–26x sits above the historical median P/E. While it is below the high end of the range, VIG does sit in the upper half of its historical valuation spectrum. This overvaluation may be due to the popularity of the Vanguard VIG fund. Deeper analysis is required.

My objective was to see whether other value-oriented index-based ETFs, such as dividend payers, yielded a similar P/E to the S&P 493. I was surprised by the relatively rich valuations.

It is important to note that the yield is below 2%, which is lower than that of other dividend-paying index funds, due to VIG's tilt toward higher-quality, more stable, growth-oriented companies (often with premium valuations driven by consistent dividend growth and lower volatility).

I then asked AI to look at other popular dividend-paying ETFs and run similar comparisons. Here are a few (not a recommendation to buy or sell any security). The analysis is for discussion purposes only. To be clear, I am not recommending any of the ETFs in this report. This is a thought experiment aimed at identifying better valuation entry points.

Vanguard High Dividend Yield ETF (VYM)

Current 19–20x based on a weighted average of current holdings.

The 10-year historical P/E range has spanned from the low teens (12.8) to the 50s, with a median more like mid-teens (~15-17x), implying VYM’s current valuation is above its long-term median.

ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

Current ~21–22x

GuruFocus data suggests a typical 10-year median near ~21x, so NOBL’s valuation is roughly in line with its decade median - neither extremely cheap nor expensive historically.

Some takeaways:

If you are a value investor, there exists an opportunity in select dividend-paying equities, but dividend payers in general range from slightly overvalued (VYM and NOBL) to overvalued (VIG).

Think in terms of potential entry points. Back of the napkin, VYM needs its price to decline by ~15% to get the P/E to “Fair Value.” It could decline more in a bear market, but buying at a reasonable price is the goal.

NOBL is nearer to its “Fair Value.”

I also analyzed a handful of dividend-paying stocks with data going back as far as reliable trailing P/E history allowed (mostly from the early-2000s onward for these companies). I removed stocks with negative P/Es and extreme one-off spikes. The historical distribution for this looked like this:

The P/E average was ~ 19x.

25th percentile (or undervalued zone) was ~12.8x

Median (fair value) was ~15.0x

75th percentile (or overvalued richly priced zone) was ~17.6x

The point is that, in general, I found valuations for high and growing dividend payers to range from modestly overvalued to richly priced.

I’m a big fan of high and growing dividend-paying stocks and especially like strong companies with low outstanding debt. At some point, most likely during a recession, markets will correct, offering patient investors a better entry point. When? No sign of recession yet. But it’s good to have a game plan.

Note that ETF P/E can fluctuate with market conditions, changes in holdings, and earnings updates. For the absolute latest, check Vanguard's profile page directly (investor.vanguard.com/investment-products/etfs/profile/vig) or sites like Morningstar/Yahoo Finance, as values update frequently.

The views are those of Steve Blumenthal and are subject to change at any moment. Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. See important CMG disclosures below.

A Close Eye on Japan

I feel like a walking billboard advertisement for Peter Boockvar’s work. I read his daily notes (often 3 per day). If you want a pulse on the markets, you can subscribe to him here. He has a knack for hitting what matters most. The following hit my inbox this morning - it matters!

From this morning’s Boock Report post:

“ The Bank of Japan is not only in a rate hiking cycle, however glacial, and reducing their QE purchases, they are about to embark on selling its massive holdings of ETFs on Monday of which they own 83 trillion yen of at current market levels (about $500 billion). It will take though 251 years to fully liquidate at the pace they are doing so, 330 billion yen per year. Fortunately for the BoJ, their cost basis is about 37 trillion yen but I hope lessons are learned that the huge intrusion into the markets in order to generate higher inflation that many are so upset about should not be repeated.

The 10 yr JGB yield by the way is up another 2.7 bps to 2.19%, a fresh 27 year high. The big question for global flows is at what level of yield do the Japanese decide to bring their large amount of overseas money home, especially from the US Treasury market. I don’t know the answer and it’s likely higher than where we are now but we’re quickly heading to that decision time.

Japan did further add to its US Treasury holdings in November by $2.6b according to last night’s fresh TIC data to $1.2t, the most since 2022. China though continued to sell their holdings, by $6.1b and taking their holdings to $683b, the least since 2008.

Another day of verbal intervention threats also has the yen higher for the 2nd day in three. All something to watch this year.”

Generally, a rising Yen is negative for global liquidity, while a falling Yen is bullish for global liquidity. As you can see in the next chart, the Yen has been falling (note the “We are here” red arrow). What Peter is pointing out is the risk to Treasury holdings if Japan sells Treasuries to repatriate funds and buy Japanese bonds. The challenge for the US Treasury is making sure they find buyers for its expanding debt needs.

Source: Stockcharts.com, CMG Research (notations)

Ultimately, both Japan and the US, and much of the developed world, are at the end of a long-term debt accumulation cycle, and fractures are beginning to appear. How we get out of this mess remains to be seen.

I’m simply pointing to the signposts we are seeing in the markets. Too much sovereign debt and system-wide leverage remain the systemic risks. Risk remains elevated.

The views are those of Peter Boochvar and Steve Blumenthal and are subject to change at any moment. Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. See important CMG disclosures below.

If you like what you are reading, click on the following link.

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

Not a recommendation to buy or sell any security. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: January 15, 2025 Update

Trade Signals Sections:

Market Commentary

The Indicators Dashboard - Stocks, Investor Sentiment, Bonds, Commodities, Currencies, and Gold

Valuations and Subsequent 10-year Returns

Supporting Charts with Explanations

Why Trend Following Matters

Market Commentary - A plain-English snapshot of what changed this week, and what matters most beneath the surface.

The Indicators Dashboard - A consolidated view of key technical signals across equities, investor sentiment, bonds, commodities, currencies, and gold.

Valuations and Subsequent 10-Year Returns - Where current valuations stand historically, and what they may mean in terms of forward returns.

Supporting Charts with Explanations - The technical charts that anchor the signals, with concise commentary on what they’re indicating.

Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor. Important disclosures.Not a recommendation for you to buy or sell any security. For information purposes only. Outlook and viewpoints are subject to change at a moment's notice. This material is for discussion purposes and does not give you specific advice. Please discuss needs, goals, time horizons, and risk tolerances with your advisor.

About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

“Extreme patience combined with extreme decisiveness. You may call that our investment process.

Yes, it’s that simple.”

– Charlie Munger

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: NY, Arizona, Utah, and Colorado

Heading to NYC for a special dinner this coming Tuesday. Then flying to Phoenix for an industry conference at the end of January, followed by a few days of skiing at Snowbird, Utah, or Jackson Hole, Wyoming. It will be a game-day decision; whoever has the best snow wins. My fingers are crossed for fresh powder snow.

The mess in the world has upset both Susan and me. We talk all the time, and I imagine you may be having similar discussions with your friends and loved ones. Hold hands, send prayers, and hold a vision for a peaceful outcome. Light beats dark. Light will win.

As we move through this period, I sure hope you do some things that lift you up.

Speaking of uplifting, how can’t you love the Indiana Hoosiers? Sitting on no one's dance card at the start of the season, they are taking their undefeated record into Monday night's championship game.

The No. 1 seed Indiana Hoosiers are playing the No. 10 seed Miami Hurricanes on Monday night. I’m going to upset my Florida friends, but I’m pulling for Indiana.

Good friend and client Stephen H. asked me today if I had read the article about Indiana’s head coach, Curt Cignetti. I had not, but I sure do enjoy watching his intensity and facial expressions. I found the ESPN article and wanted to share a bit of what I read with you. Seems fitting - sports, human behavior, and life.

What a story!

Some highlights from ESPN: One of the most compelling stories in college football this season has been Indiana’s Curt Cignetti - not just for his team’s success on the field but for how he’s done it. Unlike most Division 1 coaches who chase star ratings, Cignetti has built his roster around production over potential, meticulously evaluating players for what they actually do and how they fit a culture of discipline and accountability.

ESPN noted, “Cignetti's player evaluation process is meticulous, multifaceted, and time-tested, and he is in the middle of every phase. Unlike most Division 1 programs, Indiana doesn't have a massive personnel department. At Big Ten media days in July, Cignetti declared, "I'm the GM and head coach." He makes the final call on players, as he has ever since leaving Nick Saban's side at Alabama to lead his first college program at Division II Indiana University of Pennsylvania.

Indiana players are not the highest-rated recruits or transfers. Cignetti's evaluation process has layers and starts by assessing what a prospect has done. "The first question is the stats: What were his junior-year stats? What were his senior-year stats? Why did he miss games? Why did he play in only eight games versus 12?" An assistant coach said, "Those are the biggest questions he asks.”

Cignetti puts a high premium on being a good teammate, well-mannered, and dependable, often factoring in how a recruit behaves and responds in meetings, how they shake a hand, how they carry themselves - details others might overlook. That ethos shows up in Indiana’s locker room: experienced players who play smart, show up prepared, and care about collective success over individual accolades.

What’s different about Cignetti is his relentless attention to culture and character, not just talent metrics. In a sport obsessed with measurables, he reminds us that who a player is off the field often matters as much as what they do on it. That’s a message not just for football, but for life and leadership.

Indiana University of Pennsylvania to the Big 10. Love that! Here is a link to the ESPN article.

With my Eagles out of the NFL playoff mix, I find myself pulling for Denver (a client’s son plays for them). Yet, I’m a big Josh Allen fan and would like to see him win a Super Bowl. That should be an excellent game. The 49ers, dealing with many injuries, bested my Birds. They will have their hands full against the Seattle Seahawks. A fun weekend ahead. Good luck to your favorite team.

Enjoy the games!

Warm regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201,

Malvern, PA 19355

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.

See CMG Disclosures at the bottom of this page.

For more information about NDR, please visit at www.ndr.com.

NDR, Inc. (NDR), d.b.a. Ned Davis Research Group (NDRG), any NDRG affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDRG publication. The data and analysis contained herein are provided "as is." NDRG disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. NDRG's past recommendations and model results are not a guarantee of future results. This communication reflects our analysts' opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDRG or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. For NDRG's important additional disclaimers, refer to www.ndr.com/invest/public/copyright.html. Further distribution prohibited without prior permission. Copyright 2025 © NDR, Inc. All rights reserved.