On My Radar - Tobin’s Q, Record High, and AI Humanoid Robots

October 3, 2025

By Steve Blumenthal

“Robotics isn’t about machines; it’s about creating companions that enhance human capabilities.”

– Raffaello D’Andrea, Swiss Engineer and Artist

The U.S. equity market is at a record high, valuations are at an all-time high, household ownership of equities is at a record high, and concentration in just a few names is also at an all-time high.

There are many indicators consistent with a bull market peak; however, the trend remains bullish.

Grab your coffee, find your favorite chair. You’ll find a few good charts and a fun short story about Rosie. Remember the cartoon show, The Jetsons? Rosie was their robot companion and housemaid. Quick trivia question: Do you remember the name of their dog? You’ll find it in the Personal Section. Let’s jump in.

On My Radar:

Tobin’s Q, Price-to-sales, Government Debt, and Proposed Stimulus Check

AI, Robots, and Quantum Computing

Trade Signals: October 2, 2025 Update

Personal Note: The Robots are Coming

OMR is for informational and educational purposes only. No consideration is given to your specific investment needs, objectives, or tolerances.

Please see the Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion and educational purposes only.

If you like what you are reading, you can subscribe for free.

Tobin’s Q, Price-to-sales, Government Debt, Concentration, and a Proposed Stimulus Check

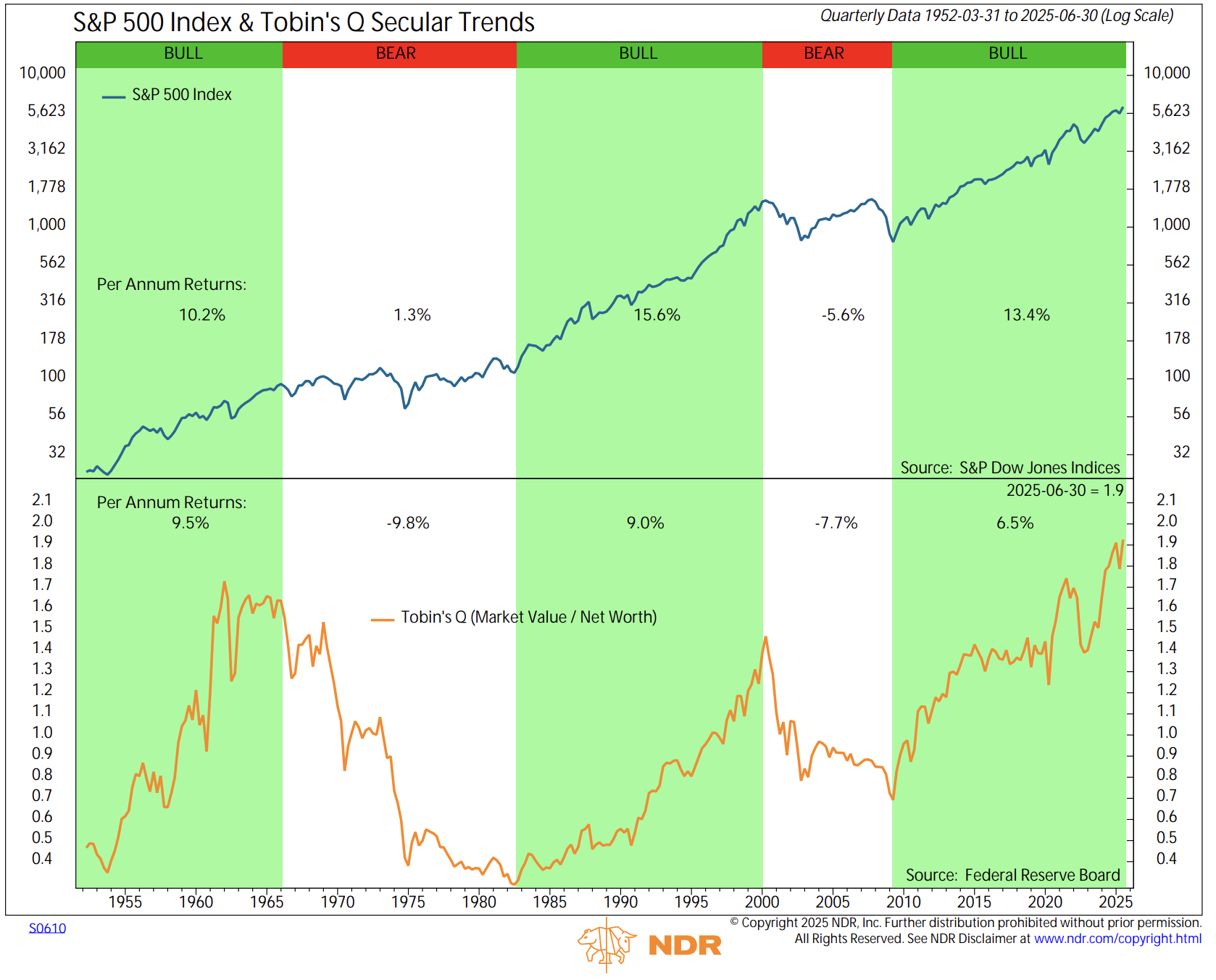

Tobin’s Q = (The Market Value of a Company’s Assets) ÷ (Replacement Cost of those Assets)

It’s mainly used to gauge whether firms, or markets overall, are overvalued or undervalued relative to their underlying assets.

With your first look at the following chart, zero in on the lower section (orange line) and note the secular bull market peaks in 1966 and 2000.

The green-shaded areas indicate the BULL secular (long-term) bull markets, and the white-shaded areas indicate the BEAR markets.

Several other data points:

I like how NDR shows the “Per Annum Returns” in both bull and bear periods (upper section).

Also, note that valuations were high at secular bull market peaks and low at the end of secular bear markets (in other words, bull market beginnings).

Source: NDR

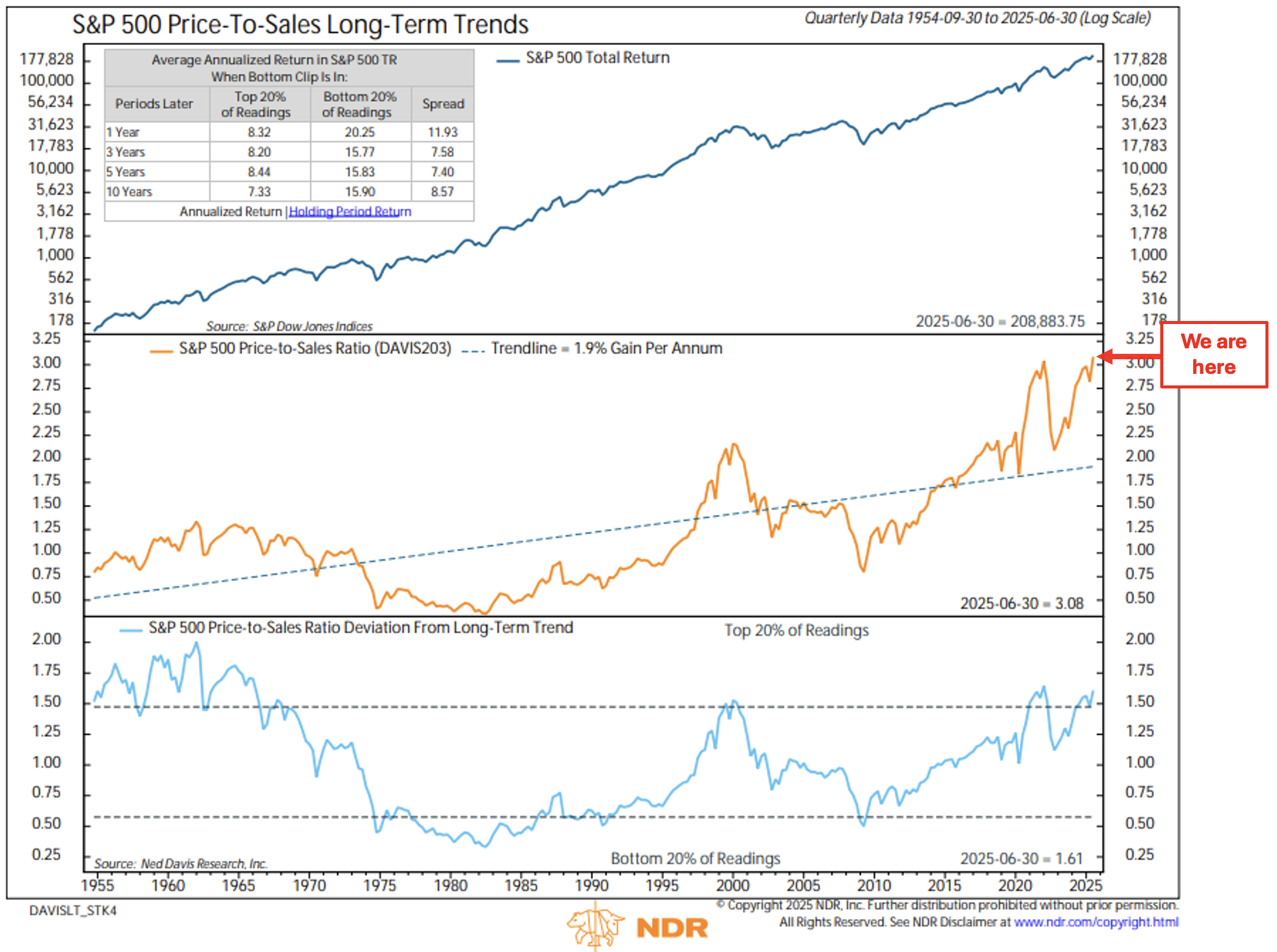

2) Price-to-Sales

The highest reading dating back to 1954.

Note the “We are here” red arrow

Also, look at the “Divation From Long-Term Trend” data in the lower section. It argues relative to an upward sloping 1.9% gain per annum, we are not quite at all-time highs, but high regardless.

Source: NDR with CMG annotations

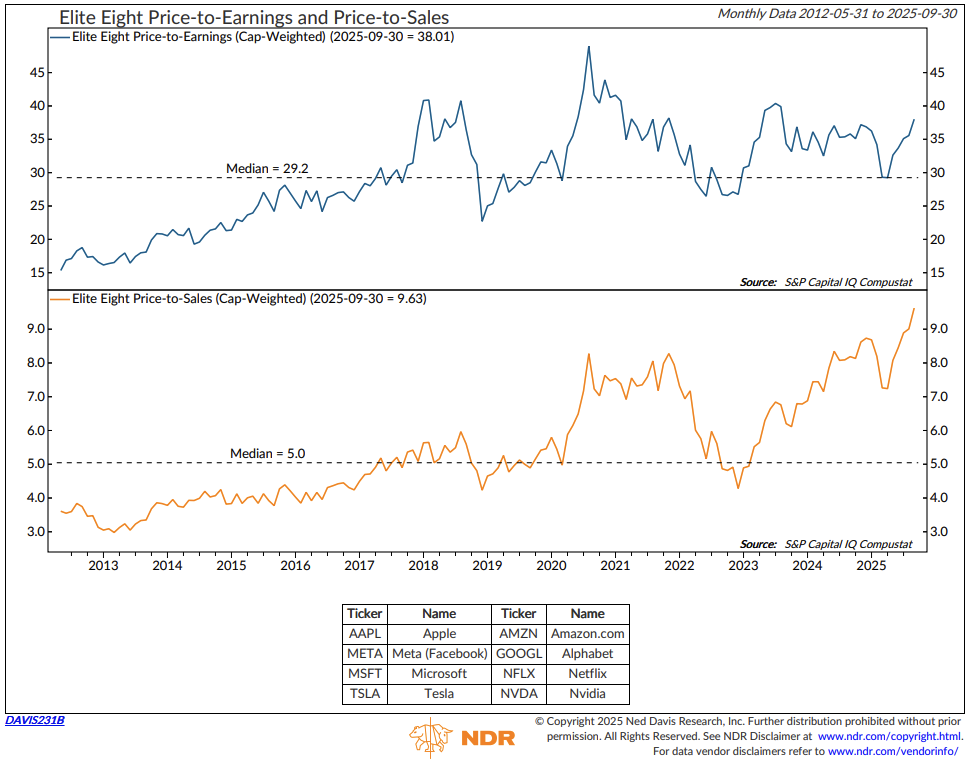

The following chart looks at the price-to-sales of the “Elite Eight” stocks. Take a look at the middle section, far right-hand side. Yikes!

Source: NDR

3) Government Debt

Up $1.7 trillion since the debt ceiling was raised (3 MONTHS AGO) !!!

Source: @CHARLIEBILELLO

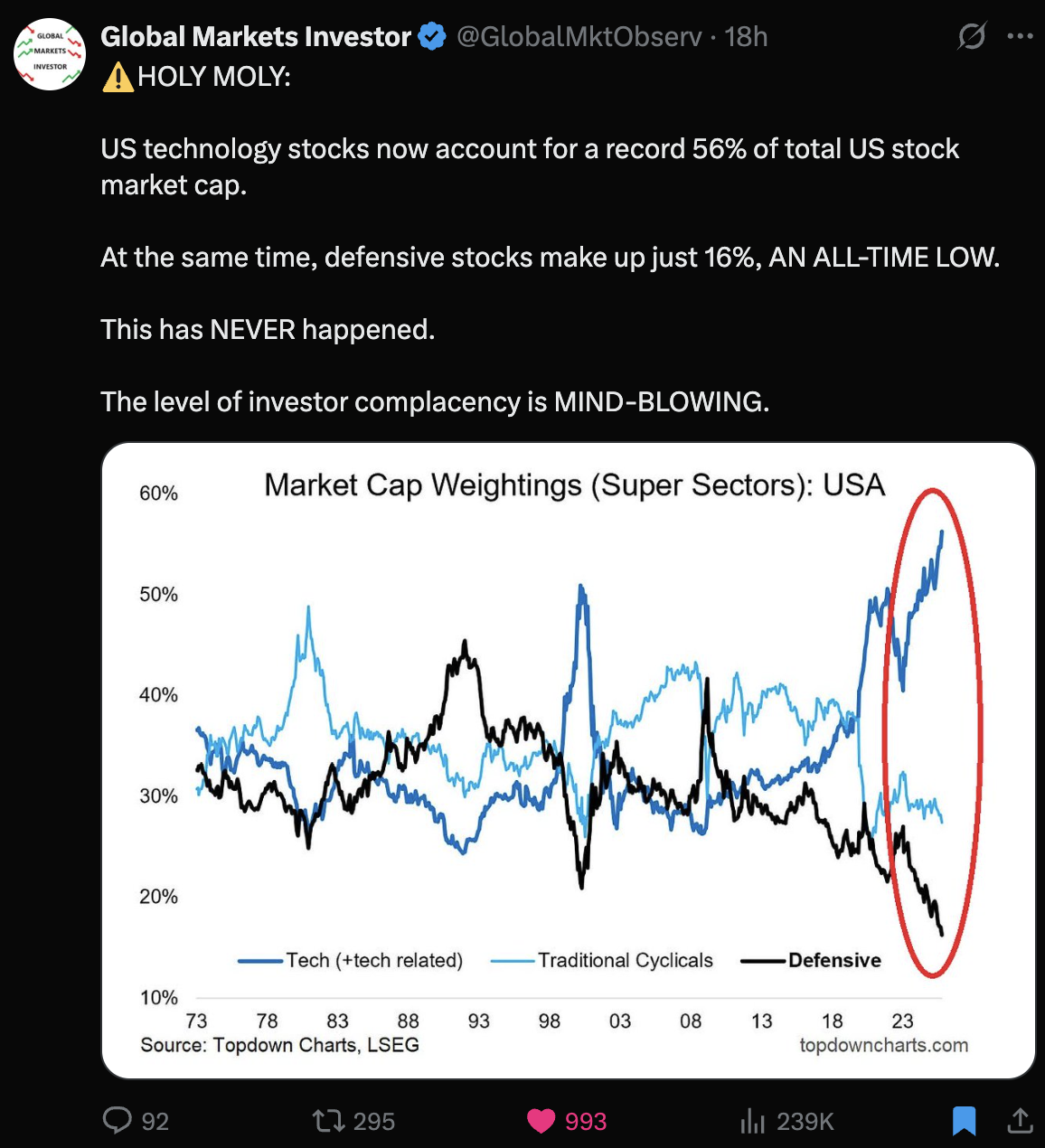

4) High Concentration

Holy Moly indeed!

56% of the total U.S. stock market cap (all-time allocation high).

No one wants defensive stocks (at an all-time allocation low).

Everyone wants technology stocks

Source: Topdowncharts.com

5) Proposed Stimulus Check

This just crossed my news feed - Apparently, President Trump is considering a $1,000 to $2,000 stimulus check for every taxpayer.

The funds would come from tariff collections.

EndGame Macro wrote, “Tarriffs are just to cover story, the real goal is to get cash flowing before the slowdown gets worse.”

Maybe - Regardless, this is concerning.

How about paying down some of the debt or using it to cover deficit spending?

Maddening if true. What in the world is going on?

Source: EndGame Macro

Diversification ideas - If you are interested in learning about the approach we follow at my firm, CORE and EXPLORE, we wrote a paper titled “How We Think About Wealth.”

Click on the following image to sign up to receive the paper.

Registration for the paper: Please note that if you are interested in learning more about the investments we utilize to address the period ahead, we can connect with you after 30 days. There are specific regulatory qualifying rules. Regulations require us to make sure you are qualified for certain investments. If you have already been in contact with us, the 30-day regulatory rule does not apply. Please leave us a short comment if you prefer not to be contacted.

AI Humanoid Robots

A lot of my day job feels a lot like Shark Tank. We trade ideas with close relationships that include other family offices. Each month, we review a handful of select opportunities, but only a select few make it through the approval process.

My team and I have spent the last few weeks studying a venture capital investment in an AI humanoid robotics company. This is an area we are really excited about.

I believe robotics is one of the most significant market opportunities in our lifetimes. A $30 trillion-plus addressable market.

Think labor 23 hours, 7 days a week:

Stocking shelves, cleaning warehouses, building cars (assembly lines), picking fruit, folding laundry, doing dishes, walking dogs, and even elder care.

Special forces - Iron Man robots, etc.

The firm we are investing in is currently one of the leaders. Will they win? We hope so, but these are early days, and big names dominate the space.

These are early innings. There will be a progression in growth.

Warehouse and logistics

Restocking tasks like stocking a grocery store

Safety must be excellent - around toddlers, infants, pets, and other people.

Robots in your home, do laundry and take care of us as we age.

AI powers the intelligent robot. Creating an effective hand/finger seems to be a significant challenge, but the leading players are making notable progress.

Imagine this: if you can afford it, you’ll likely have a robot in your home within ten years ($30,000 range). Think “Rosie” from the old cartoon show, The Jetsons.

There are five major players in the U.S. and others in China, but none in Europe. We believe this is a U.S. vs. China race, although more than one company will likely win, much like there are numerous car manufacturers worldwide.

One of the interesting aspects is that once one robot learns a task, all robots learn it as well. One of the significant risks is that it will require a substantial amount of capital to scale and manufacture.

Keep your eye wide open - the robots are coming!

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Trade Signals: Update - October 2, 2025

Trade Signals is Organized in the Following Sections:

*Trade Signals basics: The Market Commentary section summarizes notable changes in the core key indicators: Investor sentiment, market breadth, stocks, treasury yields, the dollar, and gold. The Dashboard of Indicators provides a detailed view of all Trade Signals indicators.

Market Commentary

The key technical market indicators follow. You’ll see that the S&P 500 Index Weekly MACD remains bullish, the 10-year Treasury yield Weekly MACD continues to signal lower interest rates, the U.S. Dollar Weekly MACD is bullish, and Gold continues to shine.

Notables This Week:

Oil down, natural gas up.

Oil prices declined sharply during the week. Natural gas prices rose from $2.75 to $3.40 per million British thermal units (MMBtu).

As of October 2, 2025, West Texas Intermediate (WTI) crude oil closed at $60.73 per barrel (down 1.7% from the previous day and about 8-10% over the past week), and Brent crude declined from $70 to $64.66 per barrel (down roughly 7-8% weekly). The Daily Oil MACD is bearish, the Weekly MACD is turning bearish, and the Monthly MACD remains bearish.

Key Reasons for the Decline

Several factors are driving this week's drop:

OPEC+ Production Increases: OPEC+ announced plans last week to raise output by an additional 137,000 barrels per day starting in November, following a similar increase in October. Market expectations see a higher supply.

Weakening Global Demand, Especially from China: Escalating U.S.-China trade tensions, fueled by new tariffs, have reduced economic growth prospects, particularly in China, the world's largest oil importer.

Broader Macroeconomic and Geopolitical Pressures: The dominant economic narrative is one of economic slowdown. Essential for us to keep our eye on. There is certainly geopolitical pressure to drive the price of oil lower, and Saudi Arabia and OPEC appear to be on board with the plan to pressure Russia by increasing oil output, thereby driving the price of oil lower.

Key Macro Indicators - Investor Sentiment, Market Breadth, The S&P 500 Index (Stocks), The 10-year Treasury Yield (Bonds), and the Dollar:About Trade Signals

Trade Signals is a paid subscription service that posts the daily, weekly, and monthly trends in the markets (and more). Free for CMG clients. Not a recommendation to buy or sell any security. For discussion purposes only.

“Extreme patience combined with extreme decisiveness. You may call that our investment process.

Yes, it’s that simple.”

– Charlie Munger

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only. Current viewpoints are subject to change. Please note that the information provided is not recommended for buying or selling any security and is provided for discussion purposes only.

Personal Note: The Robots Are Coming

As a kid, I loved watching The Jetsons. The flying cars and moving sidewalks were fun, but it was Rosie the robot maid that captured my imagination. Flying cars did, too. But Rosie had personality - she cracked jokes, kept the household in order, and even offered advice. Back then, Rosie felt like pure science fiction. A family having a robot assistant? That was something for Saturday morning cartoons, not real life.

Today, what once felt impossible is now within reach. Prototypes of humanoid robots are walking, lifting, talking, and learning. They’re not yet ready to fold the laundry or make dinner, but the trajectory is clear. Ten years from now, it’s entirely possible that a “Rosie” could be in our homes, helping us with daily life. That’s why I am leaning into this space. The robots are coming. Keep it on your radar.

By the time this note hits your inbox, today’s important matchup between the Malvern Prep Friars and the Haverford School should have concluded. It’s been a good week. The boys are now seven wins, two losses, and two ties.

Last Tuesday’s win was a strong one, ending 3-1. Today’s game will be the biggest test of the season. A cold IPA tastes so much better after a win, and the large smile on Susan’s face is priceless. I’ll be on the sidelines with her with a notebook in hand. Go Friars.

Here is a link to a short video - The Jetsons.

And the answer to the trivia question: The Jetsons dog’s name was Astro.

Congrats to the Yankees. Great win last night. October baseball - an exciting time of year. I’m a die-hard Phillies fan. Good luck to your favorite team.

Have a great week!

Warm regards,

Steve

CLICK HERE TO SUBSCRIBE TO ON MY RADAR - IT’S FREE

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

75 Valley Stream Parkway, Suite 201, Malvern, PA 19355

Private Wealth Client Website

CMG Customer Relationship Summary (Form CRS)

Metric-Financial, LLC Customer Relationship Summary (Form CRS)

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management. Author of Forbes Book: On My Radar, Navigating Stock Market Cycles.

Follow Steve on X @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.